Daniel only had to undergo one night in the Lion's Den before King Darius removed him. For those masochistic enough to want to trade the S&P, every day and most nights provide advanced courses in unarmed combat as we struggle to disprove Random Walk Theory first outlined by Louis Bachelier in 1900 and developed by Alfred Cowles and others since with commensurate recognition by Nobel Prizes and the spin off for hugely successful books.

I guess it would be uncharitable of me to link this folly as a benchmark for some of the recent popularly known Nobel recipients so perhaps I won't!

The Danielcode, in complete opposition to Random Walk Theory, relies entirely on historic price movement on various time frames to fix future market turns. These range from multi decade to daily price levels.

Our aim always is to disprove Random Walk. If Bachlier is right most of us are out of a job!!

The Beginnings of Random Walk Theory

The Beginnings of Random Walk Theory

The year 2000 marked the centennial of the Random Walk Theory of stock market prices. Many scholars confirmed and refined the research of Louis Bachelier, the hapless unsung hero of financial economics. He wrote "The Theory Of Speculation" in 1900 and presented it as his doctoral thesis to the faculty of the Academy of Paris. Bachelier anticipated much of what was later to become standard fare in financial theory: the random walk of financial market prices. "There is no useful information contained in historical price movements of securities." source www.ifa.com

For a group of clients including some new traders, I have concentrated this week on the S&P index chart SPX to get them familiar with those numbers before exposing them to the undoubted joys of SPH8 the current front month futures contract.

The first SPX chart below was published to the Danielcode website on Monday afternoon in New Zealand, which is about 7:00PM Sunday, US ET. As the US and Europe finished off their weekend with hot rum toddies and baked dinners, Aussies and Kiwis were flocking to the beaches with barbecues, surf boards and cold beer as the long hot summer rolls on and Danielcode members plotted their strategy for the week.

Your correspondent has, with the ravages of time become a somewhat grizzled and ancient mariner without the mental capacity to make snap judgements on market squiggles, and strongly suspects there are others who suffer from this affliction to varying degree. I need an orderly, structured and simple approach to market analysis and trading. Most importantly I need a degree of certainty by seeing the key Daniel market points well in advance; preferably days in advance but certainly well before the markets open.

This is what members saw before daybreak on Monday:

SPX Daily

The important numbers were 1403, 1391 then 1374.

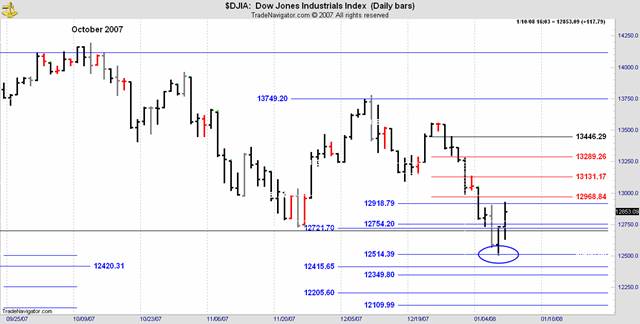

Members on Tuesday AM had the new Dow Jones Index chart below with Daniel numbers of12721 then 12514 to watch as likely points of market recognition or turning points.

As battle was joined on Monday, we had 1403.51 then 1374.50 as the near targets on SPX. Monday's low was 1403.45.

For Tuesday I expected an early rally and commented on the update posted 8 hours before the open "If up watch 1431.60 area". SPX obligingly rallied to 1430.28 then rolled over and was hard down later in the day for a nice 42 point range day.

For Wednesday our next target was 1374.59. SPX low for the day was 1378.70, being 4.11 points from our target. While others would claim this a good call, it is a bit outside the +- 3 points or so variance that is usual for this index. As we got the DJIA low neatly (12502 low against 12514 target is close enough in a daily range of 236 points) we should ask why SPX wasn't closer to our target. By this I don't mean we are always this accurate. Sometimes this market does things I can't explain at the time, but this wasn't one of them.

Here is the Dow after the turn. Close enough? Thursday's high was just 11 points through our first rally target.

The turn on Wednesday in the S&P came from the futures chart rather than the cash or index chart that usually controls this market. So far we were relying quite comfortably on the SPX chart but to be obsessively, compulsively accurate we need to be aware of the Daniel numbers on both charts as sometimes the futures leads the cash. Why does this happen? Take your pick of a stabilization effort by big options houses prior to next week's likely rally into options expiration on Friday 19th or help from the PPT? They are one and the same thing!

For me, the markets' knowledge of the hidden Daniel numbers is the best reason. Of interest to us is that markets lead the news so whatever caused the 1385.0 low on Wednesday, we should have a Daniel number to predict it. Here is the futures chart:

The 1385.0 low was exactly on the DC number and this ratio is equal to the 1374 number on the cash. Purely as a matter of interest (because we trade the market not our personal view), when the futures diverges from the cash like this it usually means that the cash number will come into play later.

From Thursday's update we had a first target for the rally of 1431.57 basis the SPX and my comment "Watch 1428ish". The SPX high was 1429.09 against its Daniel number and the futures daily high was 1436.0 against its Daniel target of 1435.35. Members got the lot! There are many more Daniel numbers to chart the way forward.

Member RD from Kansas City who is living the Daniel numbers said

"And talk about how these DC numbers can turn on a dime! It's almost scary how the market will use these numbers. It's uncanny how this works! It's like wearing shades when it's cloudy out… allows you to see only what's necessary."

Random Walk or the Daniel number sequence? The choice is yours.

Copyright © 2008 John Needham