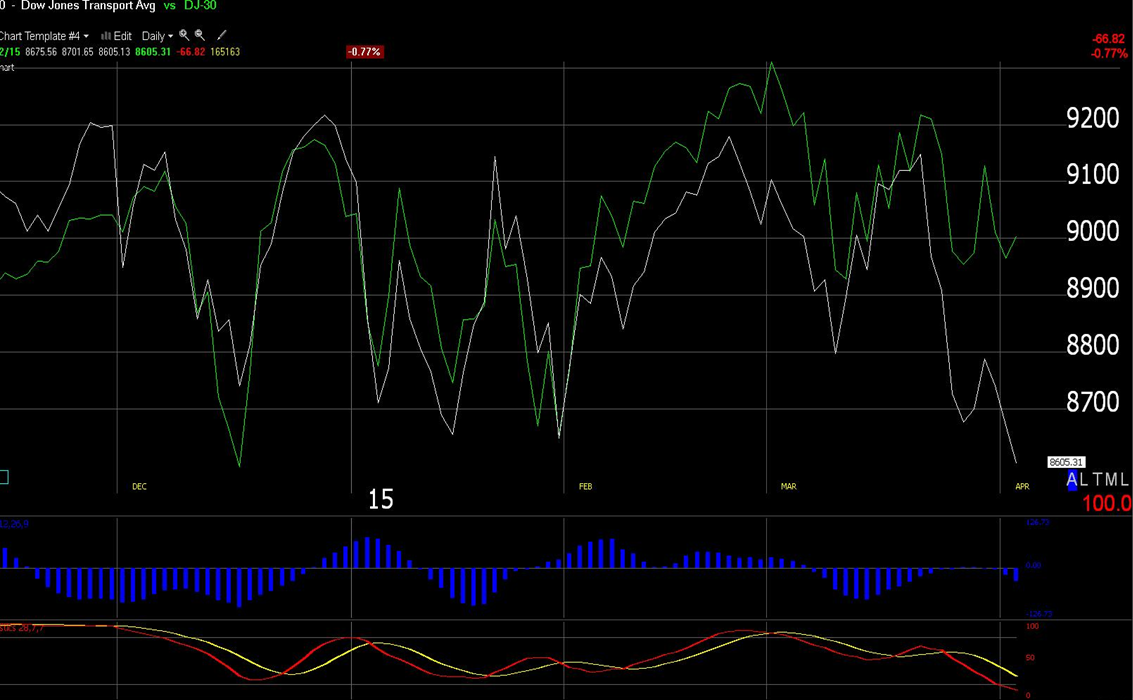

If ever you wanted an example of Dow Theory “Divergence” the Dow indices comparison chart below provides it.

A quick observation clearly shows that the Dow Transport Index (white line) is collapsing while the Dow Industrials (green line) is holding its own. Divergence is an indication of increased market risk and means that the future trend is in doubt and “in play”.

The question now is will the Dow Industrials pull up the Dow Transports or will the Trannies prevail and force down the Dow 30.

To help answer that question we need to look more closely at the Dow 20 Transport Index. The daily chart below indicates that the December 2014 low has been violated and that the 200 daily moving average has been broken. This is bearish. Thus on probability I see the Dow 30 being pulled down by the Dow 20.

Should this occur and the Dow 30 December low of 17068 be broken, the Dow Theory sell signal triggered in early January will have been confirmed.

Dow Theory Comparison Chart: Dow Industrials and Dow Transports

British General Election Brings Renewed Uncertainty To Euro Land

Just as everyone thought stability was returning to the Euro area it now appears this is not the case given that the British people will now be going to the polls May 7th.

Should the Conservative party win, David Cameron the outgoing Prime Minister has stated he will hold a referendum to decide whether he can bring England out of the European Union.

Currently his party is on track to win an overall majority.

This development has grave implications for Ireland as the UK is Ireland’s main trading partner. Accordingly, Enda Kenny the Prime Minister of Ireland has set up a special task force to deal with the matter. Here is what the Irish Times had to say about the issue last week:

“British prime minister David Cameron kicked off the British general election campaign this week, describing it as “the most important general election for a generation”. The election on May 7th will also have crucial ramifications for Britain’s relationship with the European Union.

While domestic political issues such as the economy and the National Health Service are likely to dominate the election campaign over the next six weeks, beneath the day-to-day campaigning lie deeper questions about Britain’s place in the wider world and the EU.

Cameron has committed to holding a referendum on EU membership by 2017 – a date that coincides, ironically, with Britain’s presidency of the Council of the European Union during the first half of 2017.

A referendum is almost certain should the Conservatives win a majority on May 7th. If not, the party would need the support of any coalition partners. The Tories’ current coalition partners, the traditionally pro-EU Liberal Democrats, have indicated they could be prepared to back an EU membership referendum in return for other concessions.

Officials in Brussels are watching developments in Westminster quietly from afar. With the configuration of the next British government unclear, the European Commission is under no pressure to formulate a position on the British question.

After the election, the question of a British renegotiation of EU membership is likely to become more pressing. Both European Council president Donald Tusk and European Commission chief Jean-Claude Juncker are understood to be open to working constructively with Britain, despite Cameron’s campaign against Juncker’s candidature for the EU’s top job last year. But the core issue remains how far Britain can secure changes within existing EU treaties.

Cameron’s pledge to hold a referendum two years ago was predicated in part by a belief that the EU treaties would be reopened anyway in the coming years to facilitate greater euro-zone integration, offering Britain the opportunity to demand its own changes. Now, the prospect of treaty change looks remote.

For Ireland, the costs of a British exit would be enormous, affecting everything from the fragile peace agreement in Northern Ireland to the huge trade in goods and services between the two islands.

Ireland would also lose a key ally around the EU negotiating table. Within the chorus of national positions that make up the 28-member EU, Britain and Ireland are aligned on a number of key issues, particularly in the area of the single market and commerce. This includes common positions on everything from the EU-US trade deal to new EU data protection rules and financial services regulation.

The establishment of a special unit within the Department of the Taoiseach (Ireland’s Prime Minister) to deal with a possible British exit shows the Government is taking the threat of “Brexit” seriously. Nonetheless, Ireland faces a delicate balancing act over the coming years in Brussels – demonstrating to its European partners that it remains committed to the European project, while working constructively with Britain on a reform agenda in which both countries share much common ground."

This renewed complexity in European affairs is bound to have a detrimental effect on the value of the Euro. It is highly likely it will add new energy to speculation whether the Euro can indeed survive a British withdrawal. When one takes into consideration the fact that the Greek debt crisis is in no way resolved it thus remains highly probable that the Dollar will continue to grow in strength vis-a-vis the Euro. This is not good news for US corporate earning going forward given their market footprint in Euroland. Should the European Union become even weaker as a result of the English referendum there is a distinct possibility that a sharp decline in European GDP figures will herald a significant pullback in the US stock market for where earnings go share prices are sure to follow.

Charts courtesy of Worden Bros.

News Source: Irish Times 2nd. April 2015