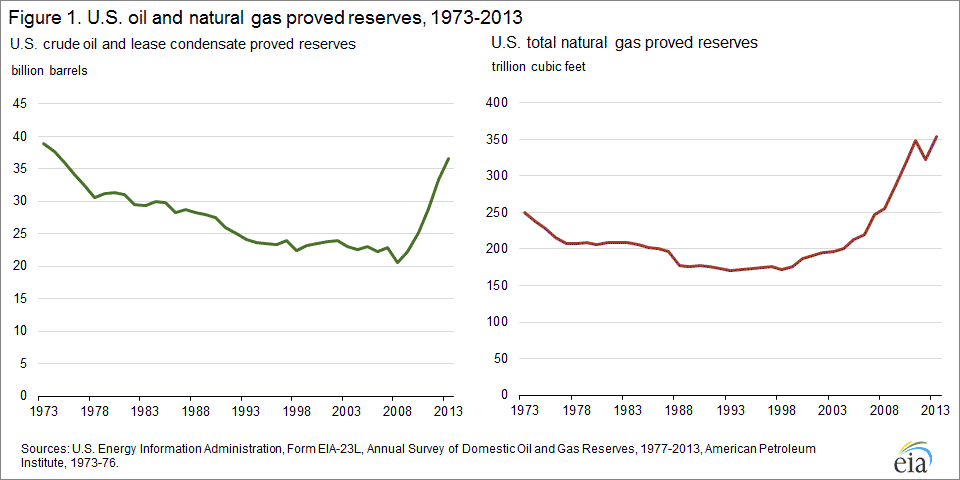

Last December the Energy Information Administration (EIA) released its latest estimate of U.S. Crude Oil and Natural Gas Proved Reserves. Although natural gas reserves rose, the real story was crude oil reserves. The EIA reported that U.S. proved reserves of crude oil and lease condensate had increased for the fifth year in a row, and had exceeded 36 billion barrels for the first time since 1975:

There are two reasons for this increase in proved reserves. The first is that despite >150 years of oil production in the U.S., new fields are still being discovered. In March 2015 the EIA released its update to the Top 100 U.S. Oil and Gas Fields as a supplement to the December report. This was the EIA’s first update on the Top 100 fields since 2009. The most significant addition to the list was the Eagleville field (in the Eagle Ford Shale), which was only discovered in 2009 but is now the top producing oil field in the U.S. In addition to the Eagleville, there were 4 other fields in the Top 100 that were only discovered in 2009. Several others in the Top 100 were discovered in 2007 and 2008.

But the largest additions to reserves weren’t via new discoveries at all. The largest reserves additions have been a result of rising oil prices, and this is a source of frequent misunderstanding on the topic on reserves.

An oil resource describes the total amount of oil in place, most of which typically can’t be technically or economically recovered. For example, it is estimated that the Bakken Shale centered under North Dakota may contain several hundred billion barrels of oil (the resource). However, what is technically and economically recoverable in the Bakken may be less than 10 billion barrels. The portion that is technically AND economically recoverable is the proved reserve. Because of the requirement that the oil be economically recoverable, proved reserves are a function of oil prices and available technology.

Thus, as oil prices rise, oil resources that may have been discovered decades ago can be shifted into the category of proved reserves. Venezuela provides a perfect case study of this phenomenon. Venezuela has an enormous heavy oil resource in the Orinoco region of the country. But this oil is very expensive to extract. In 2003, Venezuela’s proved oil reserves were only 77 billion barrels. At that time Saudi Arabia’s reserves were tops in the world at 263 billion barrels.

[Read: Don’t Expect an Oil Price Rebound This Side of 2017]

After the past decade saw oil prices rise to above 0/barrel, more of Venezuela’s heavy oil resource became economic to produce. Thus, by 2013 Venezuela’s proved reserves were estimated to be tops in the world — 289 billion barrels. Saudi Arabia has now slipped to second with 266 billion barrels.

But that economic argument cuts both ways. Oil and gas resources that became proved reserves as prices rose will be declassified as proved reserves should lower prices render them uneconomical to produce. This is often the reason that companies have to write down proved reserves. It’s not that a company believed there was oil or gas and found out later that there wasn’t (although that of course also happens), it’s generally because a period of depressed prices has rendered those proved reserves to be no longer economical. See the dip in gas reserves in 2012? That was caused by lower prices in 2012, which rebounded somewhat in 2013.

Proved reserves can be further subdivided into proved developed (PD) and proved undeveloped (PUD). PD means the resource can be produced with existing or minimal investment, while PUD may be booked as “proved reserves” if the development plan for those reserves provides for drilling within five years of being booked. If circumstances change and a company (or country) becomes unable to justify the five-year development then it may be required to reduce its reserves estimate.

Oil companies further confuse the issue by reporting to investors reserves numbers that are often many times higher than those that are reported to the US Securities and Exchange Commission (SEC). Some drillers have given potential reserves numbers to investors that are more than 20 times those that are filed with the SEC.

[Read also: Falling Crude Prices Put Producers Between a Rock and a Hard Place]

The disparity stems from the fact that, in making presentations to investors, companies aren’t bound by the SEC accounting rules and are protected by the Private Securities Litigation Reform Act of 1995, which provides a “safe harbor” for some forward-looking statements. As a result, what is presented to investors is usually more speculative (e.g., “potential reserves”) than what is reported to the SEC in the annual report on Form 10-K, which provides a comprehensive overview of a company’s business and financial condition with audited financial statements.

Thus, it is important when discussing reserves to distinguish between proved reserves, probable reserves, and the oil resource. With 0/bbl oil some resources will be economic to develop that are uneconomic at /bbl oil. So, sometimes reserves go on and back off the books as prices rise and fall, even in cases where the company still owns the rights to the resources and may develop them after prices rise.

Because of the crash in oil prices, it is likely that many companies will have to write down their proved reserves — especially those in the PUD category. Thus, for the first time in several years, many companies — and indeed countries, including the U.S. — are likely to see a big drop in their proved reserves at year-end when they file their annual reports. I will discuss this in more detail in an upcoming article.

Note: This is a slightly edited version of an article that originally appeared in the Oil and Gas Monitor called Proved Oil Reserves the Real Story.

Link to Original Article: The Link Between Oil Reserves and Oil Prices