According to the Organization for Economic Cooperation and Development (OECD), global growth in 2016 was the lowest since 2009. The good news? It’s on the rebound, with growth this year expected to reach 3.5%.

The bad news to counteract that good news? In the long-run, nearly all developed countries are converging to 0-1% trend GDP growth.

See G-20 Meeting Shines a Spotlight on Global Divisions

That last unfortunate fact notwithstanding, a small pickup in global growth suggests that the current trend in equity markets will continue in the near term, as international growth continues to exceed that of domestic.

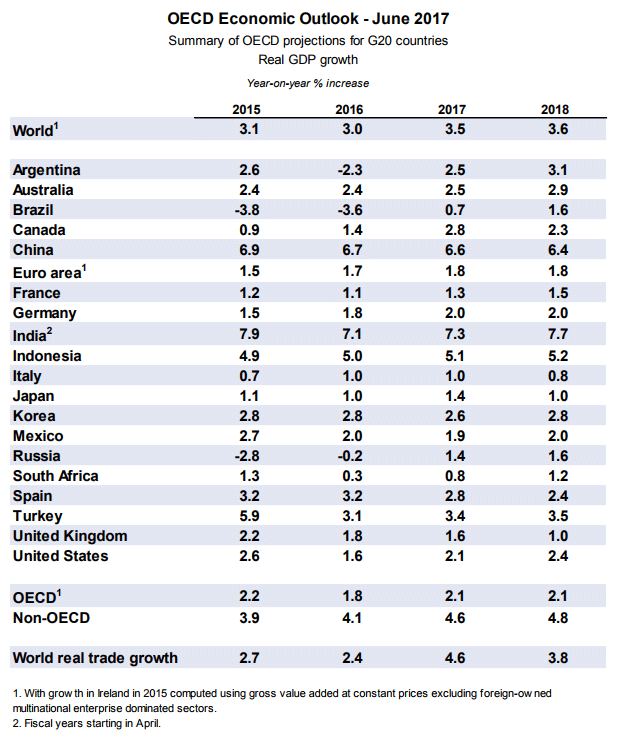

Previous years’ growth for G20 countries, along with projections for 2017 and 2018, are included in the table below. As you can see, world growth is expected to come in at 3.5% this year, with a subtle acceleration in the works for 2018.

Only time will tell how accurate these forecasts are, but in aggregate there are some interesting trends at play here. Notice in the above chart how developed countries are stuck in low-growth mode, exhibiting essentially flat 2% GDP growth all the way through 2018 (see the OECD1 line in the table above).

This should come as little surprise, as we’ve discussed the concept of secular stagnation – driven by low productivity and labor force growth – frequently here at DTL.

What this means is that any global growth above ~2% is generally being driven by smaller developing countries (notice that Non-OECD countries are exhibiting roughly double the growth of their developed brethren).

What does this imply for investors? There are two takeaways, in my opinion, and they both relate to optimal portfolio allocations. Both of these takeaways also revolve around one central theme, which is international exposure.

With US equity markets near the upper end of their historical valuation spectrum, and real GDP growth seemingly stuck at 2%, one begins to question the risk/reward setup in US markets … that is, how the potential upside compares to the downside risks.

Check out Rydex Trader Bullishness Surpasses 2000 Tech Bubble

Now, don’t get me wrong, US markets are still poised for growth in the months ahead. But that does not trump the fact that a prudent investor should always be looking for opportunities that present the best potential return per unit of risk (the highest risk-adjusted returns).

When you consider that many developing countries’ stock markets are trading at lower valuation levels while their economies are exhibiting significantly higher growth levels, the case for increased international exposure starts to become clear.

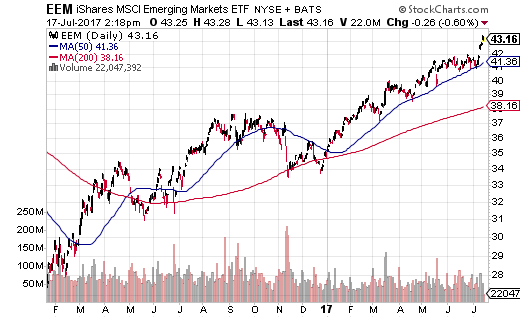

Jon Strebler has made the case for international diversification in recent months and that recommendation has born itself out well. Take a look at the tremendous growth in EEM (emerging markets ETF) over the last 18 months.

This next chart allows us to see the relative performance between emerging markets and their developed counterparts (using VEA – Vanguard FTSE Developed Markets ETF as a proxy) over the same 18-month time frame. As you can see, emerging markets have offered substantially stronger performance.

All of this suggests that while some of us may be more comfortable investing in large, established, developed markets, there is significant risk premium to be picked up elsewhere, particularly in emerging markets.

Looking at the OECD’s projections for growth moving forward, it’s evident that any acceleration in global growth that we do see in 2017 and 2018 is likely to come from these emerging markets.

You may also like MIT's Andrew Lo on Adaptive Markets, Passive Indexing, and Systemic Shocks

The trend toward increased global growth is not only creating a dichotomy between developed and emerging markets, it’s creating a rift between US companies that cater to international markets and those that are more domestically oriented.

FactSet recently took a look at Q2 earnings estimates for S&P 500 companies that have significant international exposure (greater than 50% of their revenue from abroad) and those that have less exposure (less than 50% of revenue generated abroad). The results are rather striking, and are depicted below.

Overall S&P 500 earnings for Q2 are expected to grow by 6.8%. For companies that generate a majority of their sales inside the US, that figure drops to 4.5%. Companies with a majority of their sales exposure outside the US are expected to grow earnings at an 11.4% clip.

This same dynamic holds in terms of overall revenue growth, though the delta is much smaller.

Everything we’ve looked at today suggests that investors are being rewarded for having international exposure, and particularly exposure to emerging markets. OECD projections suggest a likelihood that these emerging economies will continue to be the main drivers of global growth moving forward. And that, in turn, suggests that we as investors may want to broaden our exposure beyond US markets if we tend to be domestically siloed.

Read Stock Market Headwinds Approaching, Says Louis-Vincent Gave

Moving on, there’s one more chart (it’s really a table) that I thought I’d show before signing off.

In the table below we can see recent changes to The Conference Board’s leading economic indexes for major developed markets.

Even though most of these economies are not exhibiting robust growth (per the OECD table at the top of this page), the vast positive trend across leading indicators suggests that these economies are doing just fine and are in little danger of rolling over. If you recall, these leading indexes have a solid track record of changing direction 6-12 months prior to the onset of a recession.

So for now, the outlook for asset prices remains positive, with perhaps an emphasis toward international markets, where valuations are not as elevated and economic growth appears to be more robust.

The preceding content was an excerpt from Dow Theory Letters. To receive their daily updates and research, click here to subscribe. Matt is also the Chief Investment Strategist at Model Investing. For more information about algorithmic based portfolio management, click here.