- Key trend changes in the yen have a close correlation with major moves in the price of gold

- Both yen and gold are at another major inflection point

- Diverging monetary policy between the Fed and BOJ suggest next move is to the downside

Background: Moves in the Japanese yen have been a reliable indicator for gold due to the effects of the yen carry trade. Given ultra-low interest rates in Japan, its currency has been the funding currency for global speculators who borrow in cheap yen and then speculate in other assets. When the yen weakens, there is greater borrowing of the currency to chase financial assets all over the globe. This pushes financial assets higher and reduces overall market volatility, which decreases the allure for gold as a safe haven asset. A weak yen relative to a stronger dollar is also negative for gold since a stronger dollar is typically associated with lower overall inflation rates. Thus, when the Bank of Japan (BOJ) decided to embark on a massive money printing program in 2012 to end deflation in Japan, that effectively marked the end for the bull run in gold.

In this chart and those that follow, I show the yen inverted (in red) next to gold (in black) to illustrate the relationship over the key timeframes discussed. Here is the price of yen and gold from 2007-2012:

With the increase in financial stress in global financial markets caused by the selloff in oil from 2014-2016, coupled with the Chinese currency devaluation in the middle of 2015 and early 2016, financial risk globally picked up and, with it, came the bottom in the yen currency and gold. The yen bottomed first in the summer of 2015 when China surprised the world with devaluing its currency, and then gold bottomed later that year.

The 2015 bottoms in both gold and the yen were followed by strong rallies into 2016 before finally topping out in the second half of the year. As you can see, the two have moved in a nearly lockstep manner.

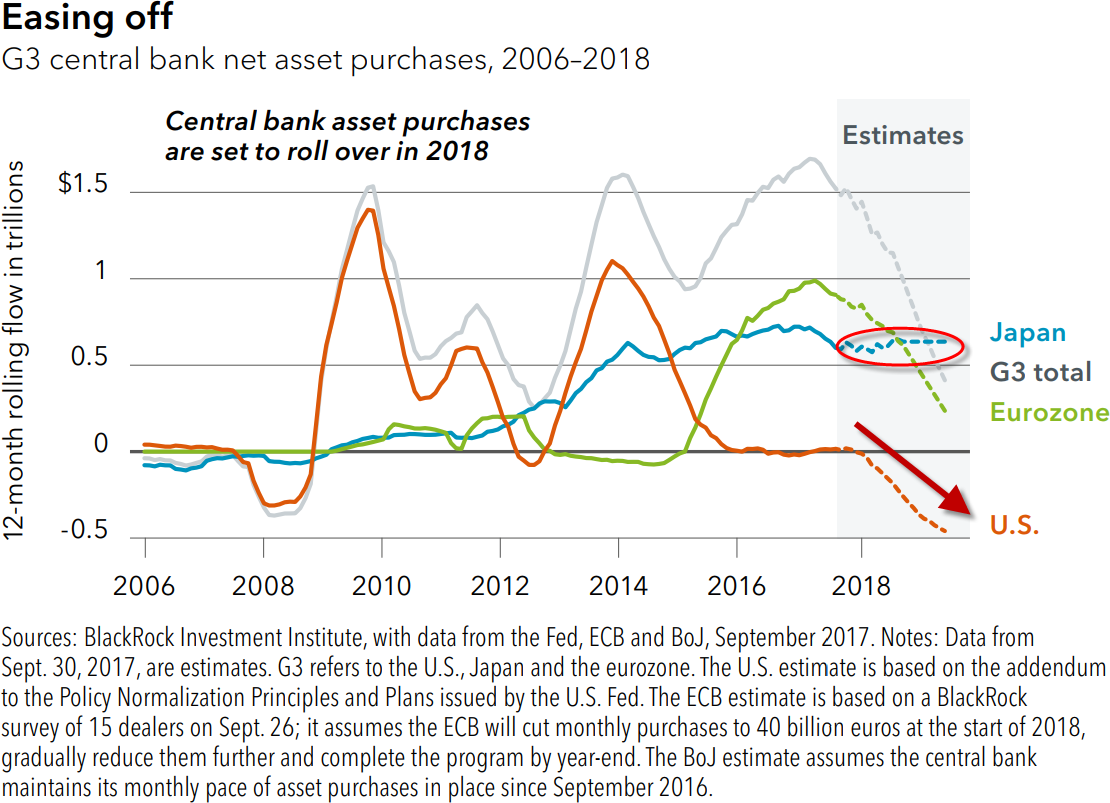

Given the strong yen-gold relationship, gold investors should take into consideration that the bear market rally in the yen from 2015 until now may be over, which would lower the outlook for gold. The likely catalyst for a decline is continued monetary tightening in the U.S. and continued easing by the Bank of Japan. Of the world’s three major central banks—the BOJ, the European Central Bank (ECB), and the U.S. Fed—the Bank of Japan is likely to stay accommodative the longest.

Here is a chart from BlackRock showing the estimated path of central bank asset purchases from the three major central banks into 2018. According to their projections, only the BOJ will continue its asset purchase program while the ECB “tapers” and the Fed moves to outright shrinkage of its balance sheet this month.

Source: Q4 2017 Global Investment Outlook

Hindsight is always 20/20 and looking back it was clear that 2012 was a significant pivot point in the yen (as well as gold) when a multi-year bullish uptrend moderated and then finally broke:

Now, as above, it appears we are approaching yet another major inflection point. The yen peaked in 2012 and bottomed in 2015 and has been coiling ever since, which is leading to two conflicting trends: a long-term downtrend and a short-term rising uptrend since 2015. These trends are converging and we are likely to experience a resolution in the coming months either of another leg down in the yen and gold after a respite from 2015-2017 (the more likely scenario indicated by current monetary policy projections), or the more desired scenario of gold investors across the globe—that is, 2015 marked the bottom of a cyclical downturn from the 2011 highs and gold is now in the beginning stages of commencing its long-term (secular) bull market, which started in the early 2000s.

If the strong (and much overlooked) relationship between gold and the yen continues, this will be a key chart to watch for which outcome ends up playing out:

I'll be presenting more of my thoughts and outlook on the global investment landscape October 21st in Del Mar, San Diego. For any of you that would like to attend, click here for more details. As I've mentioned in prior articles and podcasts, I do believe we are nearing the end of this bull market and will present a very useful framework for tracking the business cycle, understanding current risks, and how this all relates to our investments.