The Buyer Wins

Trump understands that, in a world of surpluses, the buyer, not the seller, has the upper hand. And the U.S. is the absorber of the world’s excess goods and services for which there are no other major markets. Add in Trump’s zeal for deals and you have the foreign trade dust-up he’s promoting.

We doubt, however, that all-out global trade wars will result. When they flourished back in the 1930s, competing countries were much more equal in economic size and foreign trade. But now, with the dominant U.S. buying so much of foreign exports, American trading partners are likely to grumble but in the end acquiesce to many of Trump’s demands.

That’s assuming they act rationally in their own long-run best interest and are not swayed by social and political pressures. It’s probably fair to say that the U.S. and other Western countries are already in a trade war with China, but so far at a relatively low level. If it intensifies, however, it could be highly disruptive to globally-traded commodities, their producers and their users.

The U.S. Dollar

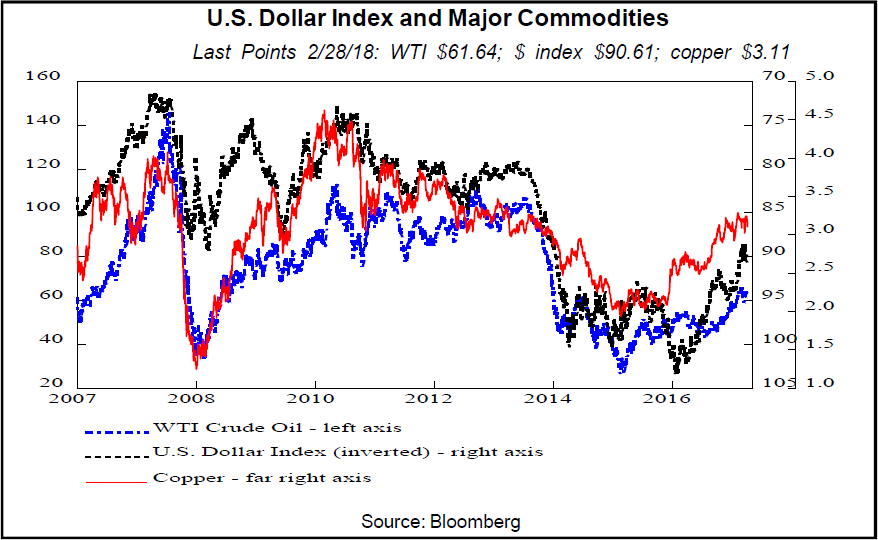

The dollar’s weakness in the last several years has been an important spur to the many commodities that are globally priced in greenbacks. A lower greenback makes those goods cheaper in other currencies, and therefore spurs demand. Chart 19 shows the strong correlations between the U.S. dollar, inverted in this graph, and prices of crude oil and copper.

Oil is a crucial global commodity due to its importance as a fuel for transportation and electricity generation. So too is copper, sometimes referred to as the commodity with a Ph.D. It’s found in almost every manufactured product including autos, machinery, computers and plumbing fixtures.

With the Fed leading the way in raising interest rates among major central banks, the U.S. greenback may well strengthen. Also, any major financial, economic or military disruptions on the global scene may, as usual, send foreigners scurrying to the buck. This would be detrimental to the many commodities traded worldwide in U.S. dollars as their prices rise in weak currency countries. Also, a robust greenback makes their U.S. dollar-denominated debts more expensive to service.

Services vs. Goods

In the long run, commodity producers also need to face the reality that as economies grow, a greater share of spending is on services and a declining portion of outlays are for goods. That’s true for the U.S. and other developed economies but also for developing countries such as China. There are only so many vehicles you can fit in your driveway, but spending on recreation and travel, medical care, education and other services is almost limitless.

Services do use commodities. Think of aircraft, computers and office equipment. But the commodity use per dollar of value is clearly much less than for machinery, mining equipment or autos...

To read the rest of Gary Shilling's November INSIGHT newsletter, click here for subscription information. Each issue includes an extensive overview of the economy, exhaustive investigations of key economic indicators and how they affect your investment portfolio, detailed examinations of emerging business and financial trends that could spell opportunity or danger to you and your investments, our investment themes, a wrap-up of recent economic data, and Gary Shilling’s back-page Commentary on matters great and small. You can also follow Gary on Twitter @agaryshilling.