The following is a summary of our recent FS Insider podcast, "Charles Gave: Possible Paradigm Shift Ahead," which can be accessed on our site here or on iTunes here.

We've been living in a disinflationary environment for last 30 years and, overall, this has been good for companies and the stock market, says Charles Gave at Gavekal Research. This may be about to change, however, and the implications for investors are quite profound if so.

A Changing Paradigm

If we assume we are moving into an inflationary period, the direction of bonds, long bonds and stocks have a positive correlation. This means that if the bond market goes down, the stock market goes down, Gave stated, and if the bond market goes up, the stock market goes up.

This is the inverse of what we’ve seen over the last 30 years, where we had a negative correlation between long-dated bond and the stock market, Gave added, which is typical of a deflationary or disinflationary period.

“Most money today is managed with the idea that if the stock market goes down, the bond market will go up, and that is not what happens in an inflationary period,” Gave noted. “I'm trying to warn our clients to be careful that the diversification tool that they’ve been using for 30 years may be about to stop working.”

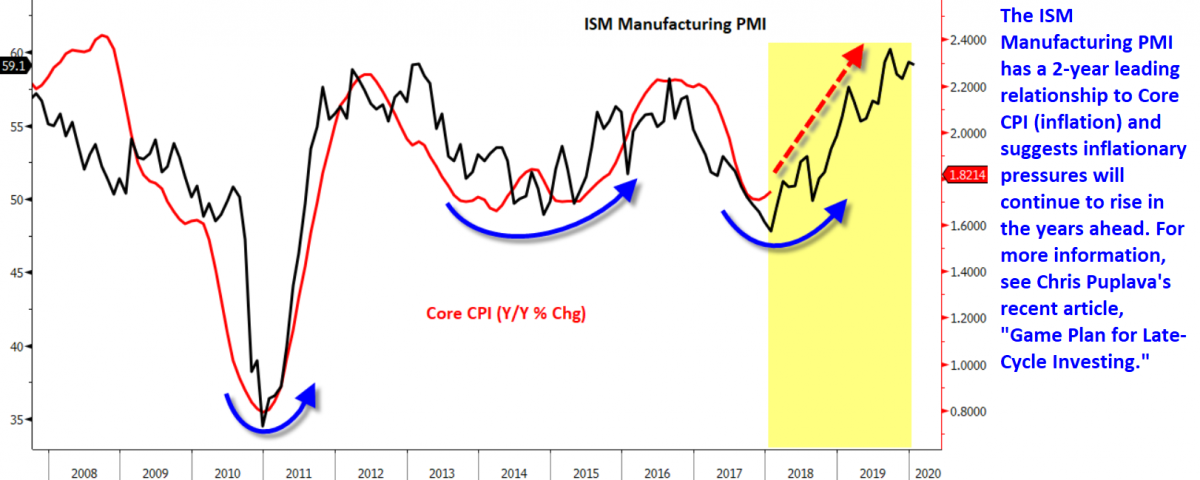

Source: Bloomberg, "Game Plan for Late-Cycle Investing"

Interest Rate Pressures Mounting

With rising US deficits, it may become more difficult to finance the US deficit internally, Gave added, because savings may not be sufficient. To attract financing from abroad, the US either has to raise interest rates massively to attract capital, which is highly unlikely, Gave noted, or the US has to let the dollar take a beating.

Gave believes the second option is more likely. But if the dollar decreases in value relative to foreign currencies, many imports will be a lot more expensive, which will help rebuild industry in the US.

If this dynamic with the US dollar plays out, central banks abroad will have to buy massive amounts of foreign exchange reserves, otherwise their currencies will go through the roof and their economies will be crushed.

Ultimately, Gave expects that owning US bonds in this period could be a bad idea.

“The recommendation that I've made to my clients are basically Asian bond markets … which will give you anywhere between 4 to 8 percent of yield,” Gave said. “If the US moves into inflation, their currencies will go up. You will make money like a bandit on the yields falling and the currency rising. … Build a diversified portfolio of Asian bonds, and you put that in front of your US equities portfolio and, in my opinion, in 10 years’ time you'll be smiling to the bank, whatever happens.”

To hear this and all other FS Insider interviews, sign up for free trial by clicking here. For more information about Financial Sense® Wealth Management and our investment services, click here to contact us.