Listen to this podcast on our site by clicking here or subscribe for a free trial by clicking here

Gary Dorsch at Global Money Trends recently told Financial Sense Newshour that this will likely be the longest bull market in history with a powerful trifecta of shrinking share counts, record buybacks, and massive M&A activity.

Support for the Current Bull

The big shakeout and panic selloffs of February are essentially forgotten, Dorsch said, and markets have fully digested talk of trade wars with China. Even Fed rate hikes aren’t disturbing the stock market right now. The question is, why?

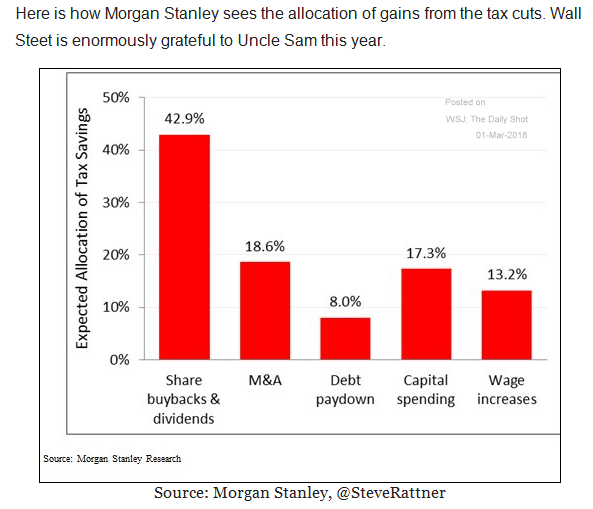

There are three main factors supporting this unrelenting bull market, said Dorsch. First, a large portion of the corporate tax cuts are going directly into share buybacks and dividends.

Source: The Daily Shot

These tax cuts have also fueled record corporate earnings recently, with the Wall Street Journal attributing half of the improvement in earnings to these tax breaks.

Additionally, we’re in a long-term trend of market shrinkage via buybacks and M&A activity. Over the last 20 years, roughly 55 percent of all listed companies have disappeared from exchange listings due to mergers and acquisitions and other factors, and companies are retiring about 2 to 2.5 percent of existing stock every year through buybacks.

“This is not your father's or your grandfather's stock market,” Dorsch said. “It is something completely different. … It's a shrinking market and that means there’s a heck of a bear squeeze. If you're bearish and trying to short sell, you’re being squeezed by buybacks.”

Fed Policy is Hammering Foreign Markets

Though US equities aren’t reacting to Fed rate hikes so far, the dollar is heading higher, and foreign equities are feeling the pinch.

Roughly three-quarters of stock markets around the world on a US dollar-adjusted basis are down this year, Dorsch noted, and two-thirds are down more than 10 percent. The Chinese stock market dropped 23 percent in the last few weeks alone, and emerging markets are down sharply.

Source: Global Money Trends

The primary driver has been emerging currencies falling significantly versus the dollar. Money flows from emerging markets to the US to the tune of trillions of dollars may have capped increases in US Treasury yield.

We saw 10-year yields threatening to move above 3 percent in May, but have since fallen to around 2.85 percent, Dorsch noted.

“Perversely, the rest of the world is not doing well under the Fed's tightening policy,” Dorsch said. “But the US market is benefiting from international trade flows.”

For more information about Financial Sense® Wealth Management and our current investment strategies, click here. For a free trial to our FS Insider podcast, click here