Originally posted on Topdown Charts.

Three quickfire charts on US bond market sentiment...some of these sentiment charts are clearly at an extreme - and that's usually when you go looking for contrarian signals. But then I look at a lot of charts on the bond market and it's quite easy to make a case for a major trend change.

1. Speculative futures positioning:

The standout here is speculative futures positioning in the 30 year, which has gone from neutral to extreme short. Total capitulation.

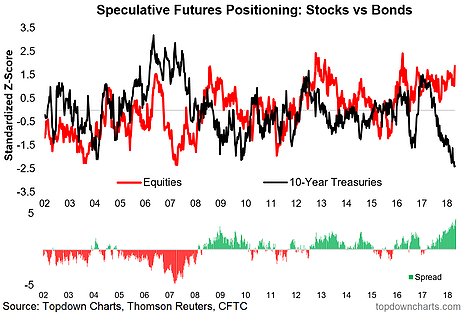

2. Stocks vs Bonds futures positioning:

This one shows where equity vs. bond market futures positioning lies right now - notice how the gap is at a record high. Traders are doubling down on growth/inflation here.

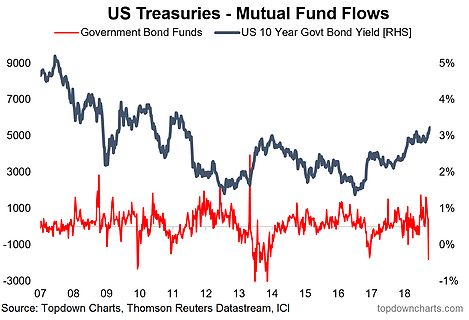

3. Bond mutual fund flows:

Last one shows a massive lurch in bond fund flows, with net-outflows the most extreme since the taper tantrum.

Read next: Louis Gave on Corporate Debt and the Next Liquidity Crisis