Originally posted at Breifing.com

Please, can we get some bad economic news? Is that too much to ask?

That's not too much ask, it's just really dumb to ask for it. Nevertheless, we have heard it asserted in the face of the recent sell-off that bad economic news would be good news for the stock market.

Why would that be? The assumption is that bad economic news would get the Federal Reserve off the stock market's back and help tamp down the concerns about rising interest rates that precipitated the sell-off.

Bad economic news might serve as a palliative for a bit, yet it's a silly reach for a cure-all when bad economic news would ultimately translate into bad earnings news.

If nothing else, the silly plea to hear bad economic news so the stock market can right itself serves as a stark reminder that investors should not mistake the stock market for the economy.

Don't miss: Big Picture: Bubbles Are Popping, but Stimulus Is Keeping Us Afloat

Healthy Indicators

There are a host of economic indicators supporting the idea that the U.S. economy is strong right now:

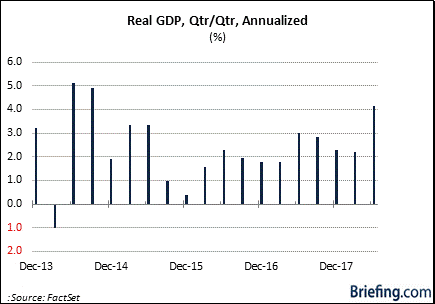

Second quarter real GDP was up 4.2 percent on an annualized basis (the Atlanta Fed's GDPNow model is currently forecasting another 4.2 percent increase in the third quarter).

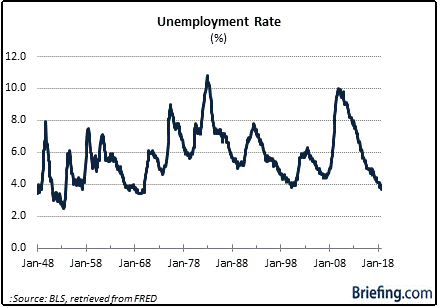

The unemployment rate of 3.7 percent sits near a 50-year low.

Consumer confidence is at its highest level since September 2000.

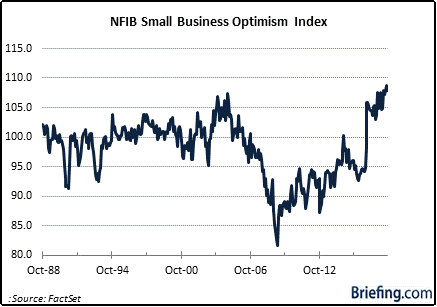

The NFIB Small Business Optimism Index hit a record-high in August.

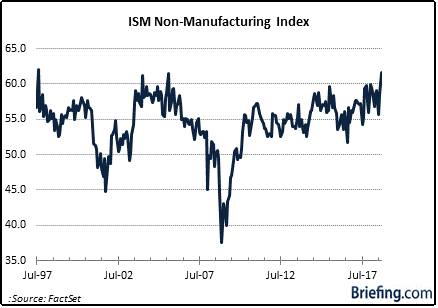

The ISM Non-Manufacturing Index hit its highest level in September (61.6 percent) since the inception of the composite index in 2008.

The ISM Manufacturing Index hit a 14-year high in August.

It isn't perfect out there. Auto sales are slowing and so are home sales. Economic activity outside the U.S. is faltering, too.

The majority of the economic data for the U.S., however, still looks pretty good, so why would the stock market suffer such a selling conniption?

Because the stock market— which isn't the economy— fancies itself an economic soothsayer and what it's saying right now about the outlook is that it will be dimming.

That view has manifested itself in the underperformance of the auto stocks, the homebuilder stocks, the bank stocks, the semiconductor stocks, and the transportation stocks to name a few areas.

It has also shown up in the Russell 2000 whose performance hasn't matched the confidence of small business owners of late. To wit, the Russell 2000 is down 9.1 percent this month, having cascaded through its 200-day moving average and surrendering nearly all of the gains it had registered through September.

Interest Rates and Other Factors

Might this just be a reset for a stock market which had a huge third quarter and invited a heightened sense of complacency about return prospects? Sure, but it sticks out that the weakest performers have been some of the most economically-sensitive areas.

That weakness has coincided with a steepening yield curve, which is what is typically seen in a stronger growth environment. The back end of the yield curve leads the steepening since it is thought higher growth will lead to higher inflation.

When that happens, it is referred to as a bear steepener, because it is also thought that higher inflation will invite higher policy rates aimed at keeping inflation in check.

Those higher rates might serve the Federal Reserve's purpose, yet they have the attendant consequence of slowing economic activity.

That's what the stock market seems to have on its mind as it recognizes slower economic activity translates into a slower pace of earnings growth, if not an outright decline.

Accordingly, valuations are being called into question as investors reconsider their willingness to pay up for earnings in what more people are starting to think will be a higher interest rate environment that prompts downward revisions to earnings growth estimates.

Interest rates aren't the only factor driving that concern either. The strong dollar, the latent impact of tariffs, and rising raw material and wage costs are also showing up in the stock market's crystal ball as worrisome factors.

For good measure, it can be argued that mid-term election uncertainty is part of the mix, too, as market participants contemplate a potential shift in the balance of power in Congress that preempts further efforts to push for deregulation and making the individual tax cut permanent, which might otherwise be considered market-friendly policies if they came to fruition.

Listen to: Death by Higher Rates? Not so Fast, Says Ralph Acampora

What It All Means

Is it possible that we start to hear more disappointing economic news? Anything is possible.

The performance of the cyclical sectors named above suggests the stock market is assigning a higher probability to it than it did in the not-too-distant past.

Just to be clear: bad economic news is not good news.

It could translate to good things for a while for the stock market, however, which recognizes bad economic news just might convince the Federal Reserve to take fewer steps on its rate-hike path.

The stock market, though, needs to be careful with what it is wishing for. Bad economic news that keeps repeating itself will lead to downward earnings revisions that keep repeating themselves.

That's not a strong foundation on which to build a bull market. Rather, it is grounds to tear one down and to make it clear that the stock market is a better place when the economic news is going from bad to good and not from good to bad.

Read next: This Isn't Your Grandfather's Market