The full year results for the SS Trust Fund can now be estimated fairly accurately from preliminary numbers. There is still an unknown. The amount of the 4th Q negative adjustment for overstating prior years income has not been made public. My numbers for 2010 (both operating and pro forma the adjustment):

Operating Results (excludes restatements in Billions):

Payroll tax receipts: 655

Tax on benefits: 24

Interest Income: 118

Total In: 797

Benefits Paid: 702

RR Interchange: 4

Overhead: 7

Total Out: 713

Net 2010 Surplus: 84

Net 2010 Cash Position (surplus minus interest): -34

Adjustments:

SSA announced in October that they would incur a one-time charge of approximately $25 billion in 2010 to adjust for overstating prior year(s) revenue. Through the third quarter of 2010 they have recognized a total of $16b. Therefore the range of the restatement of revenues could range from 0 to 9 billion in the fourth quarter. These adjustments are reflected in a decrease in payroll tax revenue. Using a mid estimate of $5b as the 4th Q adjustment produces these results:

Net 2010 Surplus: 78

Net 2010 Cash Position (surplus minus interest): -40

(note: Due to the unknown adjustment these numbers have an error factor of +/- $5b)

While the MSM and the politicians in D.C. will point to the accounting ‘surplus’ at SSA as the measure of continuing health, I take a different view. The only thing that matters is the cash position. That is negative for the first time in 27 years and is a harbinger of things to come.

SSA has produced a forecast that has the cash position returning to a small positive number over the next few years before going permanently negative in 2015. The economic assumptions used to produce that forecast are not going to be realized. In my opinion we will never see another cash surplus at SSA in history. 2010 marked the year where Perpetual Deficits started. Unless laws are changed the cash deficit will continue and increase every year for the next 75.

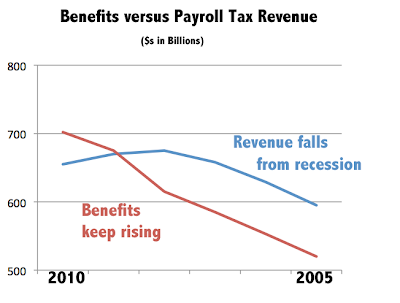

This simple graph tells the story:

Not so hard to see where the problems lie. Revenues have fallen while expenses are rising. SSA is struggling with an employment base that is not producing enough contributors to cover costs.

2010 was an interesting year in that there was no COLA increase. The recession kept the CPI at a level where no increases in benefits were granted. Were it not for this fact the benefit line would have been up by an additional 20-25 billion. However consider that benefits paid increased YoY by b. That is not an inflationary increase. This is people living longer and many new entrants receiving benefits. This increase is a function of baby boomers coming into the system. A significant portion of this increase in beneficiaries is involuntary. These are folks who are 62+ and can’t find a job, so they take an early retirement (and a smaller check) from SS.

For benefits to have increased by 4% in a no COLA year blows my mind. This is very clear evidence of the problem the economy is facing with structural employment. There are some significant macro implications of this should this big trend continue in 2011.

-This transition is a big drag on GDP as workers go from “payer” to “taker” status.

-The accelerated trend to retirement should create demand for other younger workers. To date there is no evidence that this is happening. The workforce is just shrinking.

In summary, it was a miserable year at SSA. The worst in their history. The future does not look so hot either. SSA is a slave to the economy. If the economy improves and new jobs are created the picture will improve. But that is not going to happen in 2011. Next year will also be a no COLA year, this should restrain increases in benefit payouts. But, as we have seen this year, the flood of new (forced) retirees will push benefit costs up.

I am going to wait until I see 1st Q 2011 numbers to make hard estimates on full year 2011. Right now I will guess that SS will suffer a cash shortfall of at least b. If we get modest inflation and the economy is still in the doghouse the numbers will explode. We could easily see a b cash deficit in 2012.

None of this is priced into the market in my view. 2011 will be different. Perpetual cash deficits at SSA will not go unnoticed for long.