The Greek debt and banking wipeout may be coming to a head. Ten-year government bond yields have spiked to over 12% versus 11.2% when I last wrote a post. Greek CDS are up to 907 from 833 last week.

Many commentators feel there needs to be a 50% haircut taken, along with massive national fiscal reform to get Greece back on track. Greek's cost of money (COM) is only 4.1% today because in better days it was able to piggyback (and abuse) the implied guarantee of the EU. Now, even despite aggressive monetizing by the ECB, short term T-bills are nearly 6.5%, so this COM will ratchet higher. Greece so far has sucked the IMF, ECB and other EU members (€78 billion so far) into its bottomless pit.

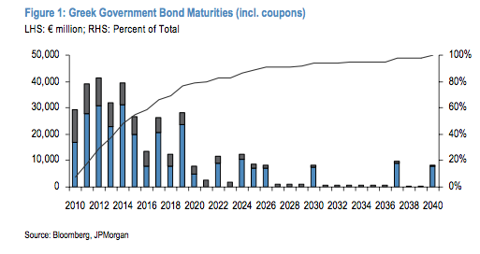

Although small ineffective debt plans have been discussed (see option one), one plan is to stretch out Greece's (and Ireland's) debt to 30 years. This would be an interesting challenge, given the steepness of the global yield curve. Moreover, if the yield is over 4%, there would be no relief to either countries' debt trap. Even if rates were set around Greece's old COM, that means other European na must bear the cost of the subsidy. Greek debt is very front loaded with large sums coming due in 2011-2012. 2010 was relatively light, so the test has arrived.

[Click all to enlarge]

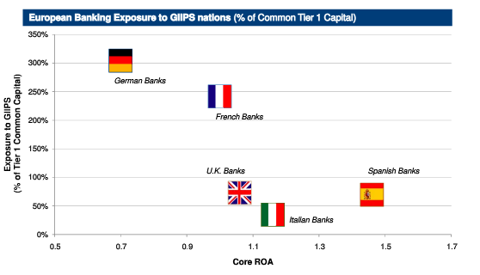

Despite all the round a clock negotiations there really is little if any political will to continue this bailout game. 62% of German voters oppose bailouts, and four regional elections in the next month will bring in more anti-bailout politicians into the fray. If such a 30 year with subsidy PIIGs scheme were to fly, look for a rapid spike in the CDS and borrowing costs of France and Germany. Despite the anti-bankster and "beware of Greeks bearing gifts" mentality in both Germany and France, those countries' banks are very much exposed to large scale losses in the PIIGS complex. The banking systems of Greece, Portugal, Spain and Ireland account for over 60% of ECB lending.

Source: Knight Research

Greek banks hold 3-3.5 times their equity in Greek government. This doesn't even include private loans made by Greek banks, many of which are also dicey. There is a 35% Greek govie haircut version similar to the"Brady plan" making the rounds. This would leave Greece still struggling and officially wipe out the equity of Greek banks. Other European banks would also take losses. An EU source says banks are currently holding 80 percent of Greek debt to maturity to avoid declaring losses, and only 20 percent on trading books are at a discounted "fair value," as seen in thisInternational Business Times piece.

This haircut might be marginally palatable to other Europeans who wish to start privatizing instead of socializing losses. Then, supposedly, somebody could reinject new equity into these banks, inherit all the other toxic garbage and new Greek Brady bonds, and start the process all over.

The problem for markets is two fold: One, the haircut and Greek reforms have to be enough to bring in new equity players; two, the markets are highly addicted to the bank and bondholder bailouts, and this is a major departure from that. Despite the common occurences of sovereign debt defaults historically, this is a market that operates (moral hazard) like default is some rare black swan, thinking people might decide to apply the "new reality" analysis elsewhere. And if a notion that bank equity wipeouts (plus some) is the considered outcome, then we will see a CFO-initiated European bank run.

The "new reality" analysis applied to Ireland isn't much better. Greece's sovereign debt in euros has greater impact at €300 billion, versus €100 billion in Ireland. But Ireland leans towards a "you do the crime, you do the time" solution, meaning banks privatize losses. The thinking is that Ireland's sovereign debt will be completely trashed even beyond its current horrible state, if losses are eaten by the state.

Since there are substantial foreign interests in Irish banks, the EU and Irish CB have already ponied up €220 billion in loans, and the banks are quickly sucking them all down. The add-on effect on prior throwing good money after bad is quite nasty. The bond vigilantes in turn have taken Irish 10-year yields up to 9.26%, and two years to 7.26%.

Next up will be a look at Portugal, Spain and Italy.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

This sample article is reprinted in its entirety from Russ's premium service, Russ Winter's Actionable. Learn more about Russ Winter's Actionable, and get instant access.

Click here to access Russ Winter's Actionable