If we set aside ideological biases and seek financial common sense, we can see that the public sector costs are simply unsustainable.

I'm going to ask you to do something very difficult before reading further: please leave your ideological biases, certainties and emotions at the door, for the goal here is Financial Common Sense, something which is in desperately short supply in the "debate" over public employees and their unions, taxes and State budgets.

Let's scrape away all the ideological baggage and just look at the numbers, shall we? If you must assign a point of view, then let's take the POV of someone who is, broadly speaking, sympathetic to unions and wants to "do the right thing" but who is also a private sector worker who has seen his/her income and assets fall in the past three years even as inflation, official and otherwise, has further eroded the purchasing power of his/her stagnant income. As a result, paying higher taxes is a direct reduction in disposable income and thus a serious sacrifice.

There are about 106 million private sector wage earners and about 24 million public sector employees in the U.S. for a total of about 130 million jobs.

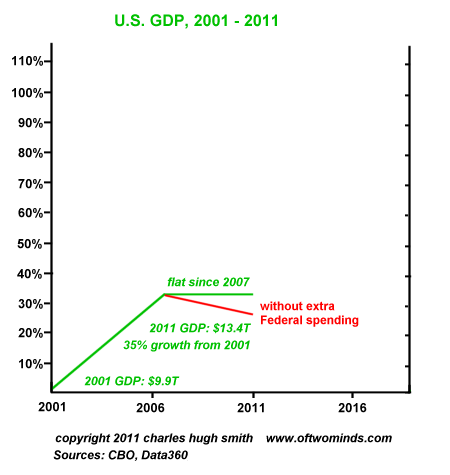

Here is a graph of the GDP growth of the U.S. since 2000. Broadly speaking, GDP grwoth is the foundation of higher taxes and higher incomes. If GDP is flat, then household incomes are also flat. The State (broadly speaking, all government) cannot increase taxes above the growth rate of the GDP without crimping private-sector households.

For context on Central State borrowing (Federal deficits): Here are the deficits of the past three years, and the estimated shortfalls for fiscal years 2011 and 2012:

2008: 8 billion

2009: .4 trillion

2010: .3 trillion

2011: .5 trillion (est.)

2012: .6 trillion (est.)

total: .258 trillion in five years.

And this isn't even the real total being added to the national debt, as "supplemental appropriations" for war costs and other large expenditures are "off budget" and not included in the "official" Federal deficit. The same is also true of funds appropriated to bail out mortgage giants Freddie Mac and Fannie Mae and other financial institutions. (source)

This is why gross debt increased by trillion fiscal year 2008, .9 trillion in 2009 and .7 trillion in 2010—considerably higher than the "official" deficit numbers. This is roughly 11.5% of the nation's GDP, and .6 trillion in a mere three years.

Note that the 2009 7 billion Stimulus Spending runs its course in 2011 (a few billion remain to be spent in 2012 and beyond) and the hated TARP bailout of banks and Wall Street officially ended in 2010. So higher spending and deficits in 2012 cannot be attributed to "recessionary" spending measures. (Recall that the recession officially ended in August 2009.)

Federal spending has leaped up .5 trillion—a staggering 60%--in just six years,from 2004 to 2010, and trillion—36%--just since 2007. Though the Great Recession officially ended in mid-2009, Federal deficits just keep going up.

Meanwhile, the U.S. economy has been treading water. In adjusted-for-inflation dollars, the U.S. Gross Domestic Product (GDP) in 2010 was almost precisely the same as it was in 2007: .363 trillion in 2007 and .382 trillion in 2010.

Remove this extraordinary rise in Federal spending, and the GDP would have declined by about 11%.

Does anyone seriously think this is sustainable in the long term? Of course not. But the players--the State and its fiefdoms, including public employees, and the State's partner, the Financial Cartels/Elites--are all pleased to continue the charade as long as "the music keeps playing," i.e. the public and the global bond market keep acting as if it is all sustainable.

Anyone who thinks the U.S. economy is suddenly going to start growing rapidly organically--that is, via private-sector growth, not ever-rising Federal borrowing and spending--is delusional.

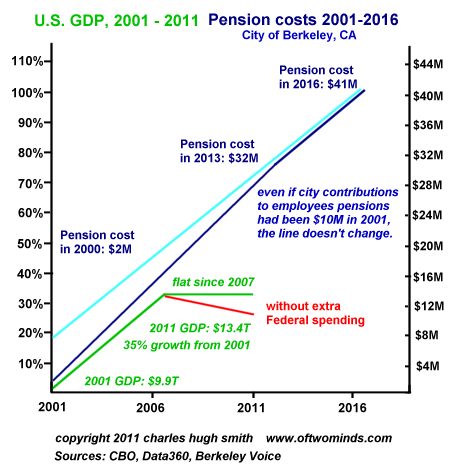

Now let's overlay the pension costs for public employees in one small city as an example of what's happening to pension costs nationally. Let's take the city of Berkeley, Calif., which provides substantial services to its 102,000 residents (about 30,000 of whom attend or work for the University of California) but in general goverance is typical of many other town-gown cities in the U.S.

While these numbers may be higher than your local city, county and state, they track national trends in public pension and healthcare costs.

As we can see, pension costs are rising significantly faster than GDP. Even if we assume the million pension costs in 2000 were far below what should have been paid, and kick that starting point up to million (the light-blue line), the line doesn't really change: it's still a steep ascent while GDP is either flat (i.e. dependent on unprecedented Federal borrowing and spending) or declining (if we factor out the massive Federal spending spree).

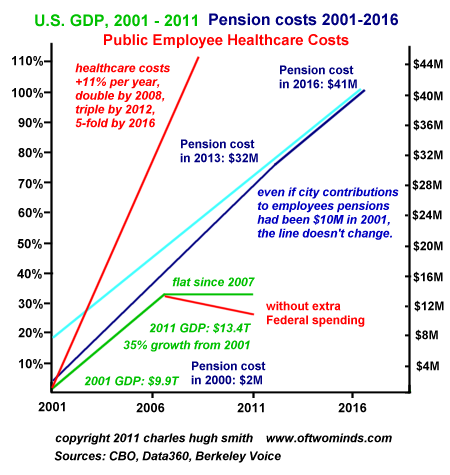

Next, let's add public employee healthcare costs, which according to the Berkeley Voice newspaper, have been rising an average of 11% per year in the decade since 2000.

Here is what happens to in healthcare costs which increase 11% per year:

1 (2001)

1.11

1.23

1.37

1.52

1.69

1.87

2.08 (2008)

2.3

2.56

2.84

3.15 (2012)

3.5

3.88

4.31

4.78 (2016)

By 2012, these costs have more than tripled and by 2016 will have jumped five-fold. Once again: does anyone seriously believe these trends are sustainable?

Here is another chart to ponder:

Many public employee pension and benefit packages were "sweetened" during the 1990s stock bubble, based on the hopelessly unrealistic expectation that pension funds could count on huge annual capital gains increases from stock and bond funds to pay for higher pensions and benefits.

Adjusted for inflation, stock gains since 2000 have been negative, even counting dividends. The S&P 500 has declined from over 1,500 in 2000 to around 1,300 in 2011: a 13% decline that must be added to a reduction in purchasing power (inflation) of another28%. Not counting dividends of around 2% a year, that's a decline of 42%. Just to stay even with inflation, the SPX would have to be above 1,900 now.

A 2% annual dividend yield compounded since 2000 turns 0 into 4.34. So buy and hold pension funds have experienced a 24% gain since 2000 and a 42% decline: net-net, an 18% decline.

So much for 8% returns forever.

These charts make it clear where we're going in terms of public pension and healthcare costs. The real economy isn't growing at all, or is actively shrinking if we remove massive Federal stimulus, and long-term returns in stocks are negative.

But let's make the happy-story assumption the U.S. economy is about to resume its long-term GDP growth rate of abour 2% per annum.

A 2% (inflation-adjusted) growth rate in the real economy compounds to a 24% increase over 11 years, while an 11% annual increase in pension and public employee healthcare costs compounds into a 315% increase.

Is that disparity sustainable? Clearly, it is not.

Note to mobile device users: I've launched a new mobile version of the oftwominds.com weblog which features a simplified, fast-loading single column with a larger font size. While I am unable to optimize the mobile version for all mobile devices (Blackberries, smart phones, iPhones, etc.) I hope this version will provide you an easier reading experience. Please bookmark the new mobile version page if you prefer it to the full-sized blog.

If you would like to post a comment, please go to DailyJava.net.