Turkey lies north of Syria and across the Mediterranean from Libya. Because of its proximity to the unrest in North Africa, Turkey has been punished by equity investors. The country has gone from one of the best performing emerging markets in 2010 to levels not seen since March 2006.

In addition, there are concerns that rising oil prices will negatively affect Turkish imports and curb export demand from key partners such as Libya and Oman—those two purchase a quarter of Turkey’s exports.

We feel that this punishment has been overdone and think the country’s history of political stability and solid long-term fundamentals will help Turkey emerge unscathed.

Turkey’s foundation as an economic force was forged nearly a century ago. In the 1920s, Mustafa Kemal Atatürk, the first president of Turkey and “The Father of All the Turks,” dramatically changed the country’s political structure from a dictatorship to a democracy.

Atatürk was instrumental in altering many aspects of the country: He chose a new capital, renamed Constantinople to Istanbul, pleaded with women to unveil, changed the Turkish alphabet to improve communication abroad and literacy at home, and moved the day of rest from Friday to Sunday.

Atatürk’s successful development of a new Turkish identity has been memorialized with a statue bearing his message: “Turk! Be proud, hardworking and self-reliant!”

Since the days of Atatürk, Turkey has increasingly become an economic role model in the region, most recently leading many emerging countries in the recovery from the global crisis.

In 2010, Turkey GDP grew about 8 percent, faster than many of the country’s emerging market counterparts. A quarter of that GDP was from industrial production, which increased significantly in December. Turkey manufactured a record number of cars (761,000) in 2010, 37 percent more than the previous year. That follows a 13 percent rise in auto production in 2009.

The March Manufacturing PMI output survey shows the trend has continued into 2011. Real GDP growth is now more than 12 percent and motor vehicle sales, which include both passenger cars and light commercial vehicles, increased 88 percent on a year-over-year basis to an all-time high in February.

Meanwhile, inflation, a key concern for any rapidly growing country, hit a 41-year low in February. The inflation rate is currently just above 4 percent but it is expected to rise along with oil prices.

We think there’s still room for growth based on the improving confidence felt among Turkey’s consumers and businesses over the past two years. Access to credit has been a big driver of this improving consumer sentiment.

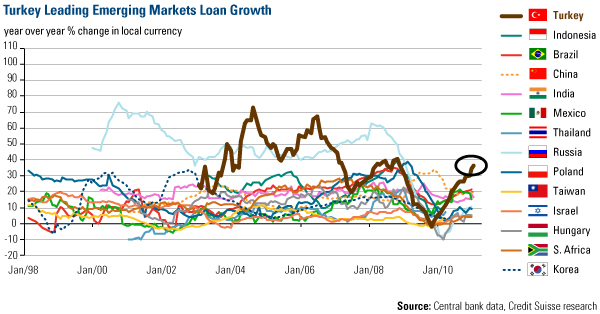

This chart from Credit Suisse compares the pace of lending growth across emerging markets. Most emerging markets have recovered from the recent dip, but Turkey is leading the way. Loan growth in Turkey is just under 40 percent on a year-over-year basis, nearly ten percent higher than number two Brazil and well above the majority of emerging markets which are in the 10 to 20 percent range.

The amount of credit being offered to these confident consumers is an important driver of consumption for goods such as refrigerators, furniture and air conditioners.

It remains to be seen how much of an effect increasing oil prices will have on Turkey’s imports and exports, but we believe these concerns are already priced into Turkish stocks.

Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. By investing in a specific geographic region, a regional fund’s returns and share price may be more volatile than those of a less concentrated portfolio. The Eastern European Fund invests more than 25% of its investments in companies principally engaged in the oil & gas or banking industries. The risk of concentrating investments in this group of industries will make the fund more susceptible to risk in these industries than funds which do not concentrate their investments in an industry and may make the fund’s performance more volatile.

The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment.