It looks to me as though 2012 is likely to be a truly awful financial year, with several crises converging:

- Either very high oil prices or recession,

- The US governmental debt limit crisis,

- The Euro crisis,

- The Chinese debt problem,

- Debt deleveraging in the US and elsewhere,

- Further MENA (Middle East/North Africa) political problems, and

- Conflict between need for greater resources and pollution issues.

It seems to me that we may be reaching “Limits to Growth,” as foretold in the book by the same name in 1972. The book modeled the consequences of a rapidly growing world population and finite resource supplies. A wide range of scenarios was tested, but the result in nearly all scenarios was overshoot and collapse, with the timing of collapse typically being in the 2010 to 2075 time period.

Figure 1. Base scenario from 1972 "Limits to Growth", printed using today's graphics by Charles Hall and John Day in "Revisiting Limits to Growth After Peak Oil" https://www.esf.edu/efb/hall/2009-05Hall0327.pdf

The authors of Limits to Growth did not model the full interactions of the system. One element omitted was how debt would impact the system. Another item omitted was how prices for oil and other resources would affect the system.

If a person follows through the expected effects of high oil prices and debt, the financial system would appear to be the most vulnerable part of the system. The financial system would also appear to be what telegraphs problems from one part of the system to another. Unless a solution is found, failure of the financial system could ultimately bring down the whole system.

Background

Newspapers print endless articles about the need for economic growth, and the need for return to economic growth. But if economic growth really takes resources of some sort–coal, or oil or copper, or fresh water to produce goods and services–it stands to reason that at some point, the resources needed for economic growth will run short. This is especially true for resources that are used up when they are burned, like coal and oil.

Besides the issue of inadequate resources, growing pollution can also interfere with economic growth. As the world is filled with more people, and resources become shorter in supply, pollution becomes more of an issue. For example, we are now extracting natural gas using “fracking” near populated on the East Coast. If we had other options–extracting natural gas in less populated areas, or without fracking, we would be doing them instead. CO2 pollution is another example.

Logically, at some point we can expect to run into limits that are impossible to get around. One of these limits may be inadequate funds for investment in extraction of resources.

Figure 2. Exhibit sowing Feedback Loops fo Population, Capital, Services and Resources from 1972 book, "Limits to Growth."

In the Limits to Growth model, investment is based on a number of factors, including the efficiency of the system (Figure 2). In some respects the efficiency of the system is growing–better technology. But in others, the “efficiency” is getting worse–declining Energy Return on Energy Invested (EROEI) for fossil fuels, and lower ore grades for mined minerals.

How would we know if investment in extraction of resources is inadequate? It seems to me, it would be through relatively flat production and rising prices (or high prices except when the major countries which are large users of the resource are in recession), and this is precisely what we are seeing for oil.

Figure 3. World oil supply (broadly defined, including biofuels and natural gas liquids) and Brent spot oil price per barrel. All data is from the US Energy Information Administration.

Figure 3 shows that even when all kinds of oil substitutes are included, oil supply has not risen enough to keep oil price flat since the 2003-2004 period.

In my view, what has happened since 2003-2004 is very similar to the effect a person might expect from Liebig’s Law of the Minimum, if oil is a necessary component of the economy, and high oil price signals that too little oil is reaching the system. In agricultural science, Liebig’s Law of the Minimum states that the amount of plant growth is governed not by the total resource available, but by the amount of input of the needed resource in least supply (for example, nitrogen, phosphorous, or potassium). In other words, it isn’t possible to substitute one type of fertilizer for another; similarly, it isn’t possible to substitute one energy product for another in the short term. Instead output contracts, if oil is too high-priced. In a way, this contraction might be seen as a dress rehearsal for the ultimate contraction which Limits to Growth models have suggested will eventually arrive.

I am sure that some would say that oil supply would need to actually decline, for there to be a problem. Since the Limits to Growth model does not look at resource prices, it does not consider this detail. It would seem to me that by the time world oil supply actually declines, the world may already be in a major recession, which does not allow prices to rise high enough to keep production up.

Connection with Debt

What relationship does debt have to the economy?

1. Economic growth enables debt, because in a growing economy, the greater amount of resources available at a later date make it much easier to repay debt with interest. I have shown an illustration of this several times.

Figure 4. Repaying loans is easy in a growing economy, but much more difficult in a shrinking economy.

The above relationship does not mean that debt would disappear completely in a shrinking economy. There would still be some situations where debt would be used, such as in short term loans to facilitate trade, and in situations where high rates of return can be assured.

2. Additional debt enables GDP to grow more rapidly than it otherwise would, because GDP is a gross measure–a measure of what an economy produces and sells–and having more debt helps in two respects:

a. Additional debt helps the company extracting the resource or doing the manufacturing, by giving the company additional funds to work with–to purchase plant and equipment, or to hire consultants. It doesn’t have to wait and only use accumulated profits to fund new ventures.

b. Additional debt helps the potential buyer of goods, because the buyer can pay for the new item purchased (automobile, refrigerator, or house, for example) over a period of years while using the new product.

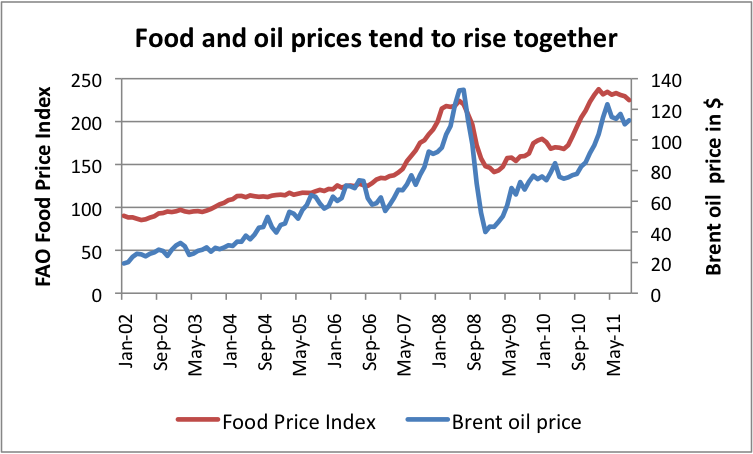

But higher oil prices tend to be associated with higher food prices. (See Figure 6, below.) When prices of oil and food rise, consumers (except for those making more money because of higher oil and food prices) tend to cut back on discretionary spending. This cut-back in spending leads to lay-offs and recession in discretionary segments of the economy. Some laid-off workers default on their debts, and businesses scale back their plans for expansion, because of the “bad economy”. As a result, they too need less debt.

So debt works well in a growing economy, but once an economy hits high oil prices and recession, debt works much less well. An economy has positive feed back loops from debt in a growing economy, but once oil limits (in terms of high prices) start to hit, feedback loops work in reverse–consumers and producers see less need for debt, and in fact, may default on past loans. Shrinking debt levels make it increasingly difficult for GDP to grow.

In my post The United States’ 65-Year Debt Bubble, I showed the following figure:

Figure 5. US Non-Governmental Debt, Divided by GDP, based on US Federal Reserve and US Bureau of Economic Analysis data.

Figure 5 indicates that for the entire period from 1945 to 2007, non-governmental debt was growing more rapidly than GDP, helping to ramp up GDP. The ratio was close to flat for 2007-2008, indicating non-governmental debt grew about a fast as GDP, and has been declining since. Looking at quarterly data, this decline has continued through the second quarter of 2011. This continued deleveraging makes it more difficult for the economy to grow.

If I am right that we are indeed hitting Limits to Growth, I would expect the deleveraging to continue, and would expect it to get worse, as oil supply gets tighter. The reason why oil supply and not some other resource is involved is because oil is the limit (of the many which we might hit) that we hit first. We don’t have good substitutes for oil, except for products already included in Figure 3 above, such as biofuels and coal-to-liquid and gas-to-liquid. While there is plenty of oil in the ground, most of what is left is expensive-to-extract oil, because we removed the cheap-to-extract oil first.

Our problem now is different from our problem of high oil prices in the 1970s, because then our oil shortage was temporary, and we could add new inexpensive supply (Alaska, North Sea, and Mexico). Now we have few options, except expensive ones, which cause problems for economic growth.

Part of the problem with high oil price seems to be related to the fact that high oil permits low EROEI oil to be produced. In other words, with high price, it makes economic sense to use a high level of resources to extract the oil. These resources include both resources used indirectly, such as for roads and ports and education, as well as direct expenditures. Clearly, it makes no economic sense to extract oil if the amount of energy required for extraction is greater than the amount produced. With high oil price, it appears likely that we are approaching this limit as well.

Prospects for 2012

We are heading into 2012 with many clouds over our heads. Oil supply is still tight, and prices are still high by historical standards. No country expects huge additional oil supply during 2012. We can pretty well guess that we will either have high oil prices or recession throughout 2012.

Many of the problems arising from high oil prices/recession in the 2008-2009 period still have still not gone away. Instead they have been transferred to the governmental sector. What has happened is that with recession, employment dropped, as did taxes collected by governments. At the same time, government expenditures rose, for bank bailouts, stimulus funds, and payments to the unemployed. This is true both in the United States and in many European countries who are importers of oil.

Now conditions are not much better, and are threatening to get worse, because of continued high oil prices. Governments already have high debt loads, but still need to bail out more banks and pay benefits to more unemployed. The United States is supposed to have a plan to solve its debt limits problem by November 23, and vote on it by December 23. Any cutback in benefits to unemployed or layoff of government workers is likely to make the recession worse; raising taxes is likely to have a similar effect. At the same time, there are still problems which have not really been addressed–for example, large amounts of “underwater” commercial property. Defaults on some of these debts are likely to lead to the need for more bank bailouts.

Problems with the Euro have been in the news a lot recently. The adverse factors (particularly high oil prices) causing the PIIGS to have financial difficulty are still in play, so the financial condition of these countries is not likely to improve; more likely it will get worse. It appears to me that the Euro has a high likelihood of “coming apart” in the next year, either partially or completely, because of debt defaults. If countries go back to their pre-Euro currencies, it is not clear that other countries would want to trade with the defaulting countries, except on very disadvantageous terms.

China has been growing in recent years, but a lot of its growth is propped up by debt. Now, it is hitting headwinds–high oil prices, rising coal prices, and lower economic growth in countries that might buy its products. With less growth, China is likely to have debt default problems relating to the debt supporting its recent growth. All of these headwinds suggest that China’s growth rate may be scaled back greatly as well.

There is no guarantee that we are through the governmental problems in the MENA region. Getting rid of one leader does not guarantee that the new government will be a significant improvement over the previous one, so one revolution may be followed by another, or by civil war. The US is pulling out of Iraq, perhaps leading to greater instability there.

Figure 6. Comparison of FAO Food Price Index and Brent Oil Price Index, since 2002.

MENA countries generally import a significant share of their food, and high oil prices usually lead to high food prices, because oil is used in the growing and transport of food. Because of these issues, we may see more riots in MENA countries, especially if oil/food prices rise further.

We are reaching limits in areas other than oil, and these may be problems as well. Fresh water is an issue that will become increasingly important. Pollution is another area where limits are being reached. Examples include hydraulic fracturing of wells in populated areas and conflict over EPA regulations relating to coal-fired power plants.

Impact of Omission of Debt and Prices in the Limits to Growth Model

Figure 1 clearly shows a tendency toward overshoot and collapse, based on the Limits to Growth model as it was originally created. The original model doesn’t consider the impact of debt or of resource prices. The omission of debt means that the model doesn’t consider the possibility of moving from an “increasing debt” situation to a “decreasing debt” situation. If such a change takes place about the time resource limits hit, a person would expect sharper peaks and faster declines to the modeled variables.

The omission of resource prices means that the model doesn’t pick up the interconnections between high prices for one resource, and a cut back on demand for other resources. We discovered during the 2008-2009 recession that electricity demand dropped at the same time as oil demand. If financial interconnections cause a shortage of one resource to lead to reduced demand for other resources, this may mean that substitution will not will work as well as some hope.

Nothing happens overnight with the world economy, so changes are likely to take place over a period of years, rather than all at once. We can’t know exactly what the future will bring, but the handwriting on the wall is worrisome.

Source: Our Finite World