Central banks are the current sovereign debt market. It is a vacated market. They are the majority bidders via debt monetization. The monetary inflation has become the New Normal and a travesty. In perverse fashion, the financial markets celebrate the monetized purchases, even calling for higher volume. In the process, bond and stock market integrity has been destroyed. Foreign creditors depart the USTreasury Bond market. Large European banks depart the Southern Europe sovereign debt market. Central banks step in to avert panic as the underlying structure to the global monetary system crumbles. When government bond yields rose quickly in Europe, it was not from abandonment by their central bank. The big Euro banks sell boatloads of bonds while the EuroCB buys only truckloads. The bond market integrity has been deteriorating very quickly. The dependence upon the debt monetization process is vividly clear. It is hyper monetary inflation to fill the void, thus providing the dominant bid. Ironically, the dullard stock market mavens celebrate the arrival of the central bank purchases without truly comprehending the destroyed integrity of the bond market. IQ levels are falling along with stock index levels.

Next Ground Zero is Italy

Upcoming budget impasses and bank failures will break the European Union wide open. A perceived temporary patchjob solution in Europe has been delineated. More of the same will accomplish nothing. A march toward a federation is apparent, despite the desire for decentralization. A motive to force a system failure is at work to create the federal structure. Recent appointments prove the point. Again Goldman Sachs knights arrive to the rescue in secret appointments. They earn the title technocrats, but crowds reject them as unelected leaders. Ignore the term Technocrat given both to Monti and the newly installed Mario Draghi at the Euro Central Bank. They are Syndicate loyalists.

Howard Davies is former director London School of Economics, and former deputy director at the Bank of England. He calls for 1) fiscal federation with a unified central bank, 2) broad purchases of sovereign bonds, and 3) unlimited liquidity provided by the Euro Central Bank. The prescription is stark and clear for hyper monetary inflation, the central bank serving as the entire government bond market, and the installation of a federation across Europe. The last 12 years have proved without a doubt that a unified Europe is a disaster in a bottle, whose cables and levers eventually break under the pressure of grand differences and the passage of time.

The raging crisis in Italy festers as it turns to a boil. Italy will serve as the agent of contagion, next to France and Spain. No solution is possible, as the summits are futile. Italy will expose the Euro Central Bank as both powerless and ruined. The focus has shifted away from Greece and squarely on Italy as the center of chaos in Southern Europe. Once more the meter for disorder is the benchmark 10-year Italian Govt Bond yield. It has surged toward the critical 7.0% mark as investors cast bond market votes against the policy in Rome and the upcoming austerity measures to be pushed through. Such level is regarded as unsustainable, given the massive Italian debts. Worker strikes have made vividly clear that Uber Leader Mario Monti will not succeed in large budget cuts without consequences. Striking Italian metal workers in Turin are shown in the photo. The biggest Italian unions (ports, highways, truckers, banks) went on strike. They oppose measures as painful hits pensioners and workers, leaving the wealthy untouched. Numerous big Italian banks are on the verge of failure. Neighboring France faces scrutiny of the bank asset feces. Markets brace for an expected debt downgrade to remove its coveted and undeserved AAA rating by Standard & Poors.

Syndicate appointed (not elected) Prime Minister Mario Monti believes Italy risks a Greek-style economic collapse without approval of the hotly debated austerity package. Italy stands as the third largest economy in the EuroZone, whose borrowing costs began to approach the levels that forced Ireland, Greece, and Portugal to seek an international bailouts. The controversial package has the support of the Organization for Economic Cooperation (OECD). It is designed by Monti to save Italy. The decree plans to raise more than 10 billion Euros (=US.4 bn) from a property tax, impose a new levy on luxury items like yachts, raise the Value Added Tax, crack down on tax evasion, and increase the pension age. Monti supports the French and German calls for tighter controls on national budgets. He said,

"If Italy were not capable of reversing the negative spiral of growth in debt and restoring confidence to international markets, there would be dramatic consequences, which could go as far as putting the survival of the common currency at risk. Italy is ready to do what it has to do but Europe must not fail to do its part. Without this package, we think that Italy would have collapsed, that Italy would go into a situation similar to that of Greece. It would be perfectly understandable that the European Commission should have the same enforcement powers in the area of budgets that it has in the area of competition."

He describes loosely a federation, where Goldman Sachs sits in the thrones of Europe, in a quasi debt failure receivership role. Unfortunately, the pressure on the Euro Central Bank to purchase Italian, Spanish, and Greek Govt Bonds has put its balance sheet in total ruins. It is the buyer of last resort for fast falling toxic bonds. The only central bank more ruined is the US Federal Reserve.

Felix Zulauf, the former hedge fund manager and asset manager, has very strong European knowledge and experience, a very sharp eye. He expects a depression to hit Southern Europe, and for one nation to exit the Euro Monetary Union next year. The process has no rules. The day after exit, the nation will suffer ruin of their banking system, forcing a rapid nationalization in a reverted currency. The end result will be a sovereign debt default and pure chaos across the continent. The coming depression will lay waste to the USDollar, the British Pound, and probably the Yen too. All fiat currencies will endure a powerful stress test, but based in reality, not a charade. As soon as any group of big Euro banks enter a failure and bust, the cascade of contagion will act like a fast moving virus to destroy many Western banks. We will then see a repeat of history with 20 Lehmans in bank failures, if not sooner.

Central Banks Averted Bank Failures

The Euro Central Bank averted 10 to 20 Lehmans with the extended Dollar Swap Facility provided by the USFed. Money is almost free. The volume of money grants is enormous, likely never repaid. Witness the effect of the central banks showing reluctance to enter into bond purchases. The system breaks down in powerful manner. The European Central Bank said demand for three-month US$-based loans surged after it announced a broader Dollar Swap Facility for European usage. The USFed cut the cost of the financing from an ultra-low 1.0% to an almost free 0.5% rate. The USFed discount window was made cheaper for foreign banks than US banks (who pay 75 basis points), an indication of the destruction. Rumors persist that a cool trillion has been made available. Five other central banks participated in the coordinated move which included the Bank of Japan. The Frankfurt-based EuroCB immediately made loans for .7 billion to 34 big teetering Euro banks on December 1st, the terms for 84 days at a fixed rate of 0.59 percent. That compares with the 5 million lent in the last three-month offering on November 9th at a 1.09% rate. The EuroCB also lent five banks .6 billion in regular weekly dollar operation on a single day as December opened, up from 2 million the previous week. The borrowing done at the Discount Window catapulted by 127-fold, from a paltry 5 million to .7 billion in a sudden move.

The public will not be informed of which banks tapped the credit line, more like a slush fund. They claim they do not wish to put the bank at risk of unwarranted attack. My view is the attack would be to put the proper value on the bank, ZERO. My sources tell that one major French bank was on the verge of failure, probably Societe Generale. Another source of bank and gold information was very clear in telling that the USFed acted reluctantly and forcefully, in order to avert a major catastrophe. He described a situation where several big Euro banks (the usual suspects in France, Spain, and Italy) were on the verge of failure. The USFed was appealed to by the EuroCB so as to prevent an estimated 20 Lehmans from occurring overnight, as in multiple bank failures from a flash event. He went on to mention that a flash event is inevitable, which the central bankers are powerless to stop. It will come in time, with an unknown trigger event that lights a fuse. Each new $trillion credit line buys less time and covers fewer obligations.

The Wall Street banks filled a void in providing liquidity in USDollar denomination to the big European banks. In doing so, the New York banks have tied themselves with a lethal financial tether to Europe. The London banks had already been connected. The connection lies in the shadowy derivative market. It used to be kept in the shadows since the contracts provided the majority of bank profit, and even supported the artificial rates in the bond market to a great extent. Now the derivative market is kept in the shadows because the big banks are mutually destroyed by insurance awards after failures. A little publicized trend was put into effect in the middle months of 2011. The big Wall Street banks filled a void. The inter-bank lending in Europe came to a halt in response to the sovereign debt crisis, a euphemism for the Southern European Govt bond market collapse. The big US banks offered a lifeline in the form of leveraged liquidity based upon unregulated derivatives whose notional value is in the $trillions. In doing so, the Anglo banks created a mutual risk factor in the umbilical cord of shadowy structures. If a handful of big European banks go bust, the contagion will be felt instantly (as in overnight) in New York and London. To claim that the US is insulated from Europe is nonsense. To claim that the European distress makes the US more attractive is patently false. Fifty major financial firms are tied around the necks with a common thick rope, weighed down by insolvency, going down together. Matters are so bad in Europe, that most banks have shut down the inter-bank lending, thus isolating the weakest. Huge funds placed at the Euro Central Bank signal the failures. The big European banks are soon to fail. They distrust each other.

The Great Gold Price Divergence

The Gold market has gone into the Twilight Zone. The ruin of the European banking system, dragged down by toxic sovereign debt, has made the big Euro banks desperate. They are tapping into the virtually unlimited Dollar Swap Facility, using borrowed money to lease gold. The Powerz have made the lease rate negative in order to attract borrowers. The supply has come from both Libya and Greece.These corrupted bankers require more gold, thus more wars and more victim nations. The system has turned to extreme abuse in order to keep a lid on the gold price, or better yet, to avert a string of Lehman-type financial firm failures in Europe. In the process, a Jackass forecast has begun to come to pass. The paper gold price (dictated by the bizarre COMEX market) is diverging from the physical gold price (determined by actual large private purchases). In late November, a great reliable global gold trader source assured that despite a posted 40 gold price, the true physical price paid for large gold bullion purchases in the private market was more like 50 per ounce! That is a 0 price divergence, or 12% higher. The COMEX has been drained of gold inventory. The MF Global event was motivated by the desire to avoid meeting delivery notices. Instead, JPMorgan stole the accounts demanding delivery, a neat trick fully permitted by the Syndicate that controls the USGovt, the US regulatory bodies, and the US law enforcement. The lawsuits will be full of drama and intrigue. The integrity of the US financial system has been exposed, this time in full glory that even financial news anchors cannot deny.

Here is the smoking gun. Days after the MF Global bankruptcy was filed, and a vast array of deliveries in silver were expunged. The silver vault inventory tells the story of the crime. JPMorgan simply converted what should have been MF Global client silver into JPM licensed vaults. Review the timeline. MF Global declared bankruptcy on October 31st. About a week later the CME began reporting that 1.4 million ounces of Registered silver was unaccounted for and unavailable for delivery, including 627,182 ounces from non-cartel banks. About 7 to 10 days afterwards, JPMorgan suddenly reported a deposit of 613,738 ounces into Eligible vaults. Exactly seven days later, JPMorgan adjusted this silver into Registered vaults. JPMorgan had not seen one significant silver deposit in months prior to this bountiful day. Great work on the part of the Silver Doctors to decipher the story. The charade continues before the USCongress. They are told of claims that investigators are searching avidly for the missing funds. They know where the funds are, in JPMorgan London accounts. They told us they were avidly looking for Madoff Funds too. They know where those funds are too, in the Land of Yodels. Reckoning is coming.

Big bank failures are coming. Unspeakable debt monetization is coming. Flash events are coming. More vanishing acts for private accounts are coming. Divergence in the gold price is coming that will shut down the COMEX altogether during a parade of lawsuits, but probably not prosecution. National debt defaults are coming. The new 2012 year will prove to be a tumultuous year, will chaos reigning and the global monetary system laid to waste. Gold will soar, probably not for the leverage addicts who choose to play in the rigged corrupted futures contract arena, the chronic victims of fraud. If lucky, their accounts will not vanish, possibly stolen. The wise who will survive and thrive will snag the physical gold offered at attractive artificially low price. Large purchases are not available at the current posted paper price.

Desperately Seeking Bullion

The Powerz need more Libyas and Greeces. They tapped into 144 metric tons captured in London from the Libyan accounts and 111 metric tons seized from the Greek accounts. It is the bankers New Gold, as reported by intrepid Jeff Neilson. In a fresh sign of bankster desperation, the lease rates for gold have been pushed down to net negative levels. Contrast to the extraordinarily high premiums paid on gold purchases. Big European banks on the brink of ruin, the next Lehmans, are leasing gold in order to raise cash and stave off failure. It is simple math. The great enablers are the central banks. Cases exist of multiple sellers of the same gold bullion bars, a common trick made famous by the GLD exchange traded fund, the SPDR Gold (dis)Trust. All leasing is done without regulation, like the derivative market. Neilson concludes,

"Here is where we come upon a seeming paradox with respect to the recent explosion of gold leasing. We know that the banksters have virtually run out of their own bullion, as the evidence is absolutely conclusive. The same Western central banks which were openly selling 500 tons of gold per year onto the market every year have now all totally ceased their gold sales. They have no more gold, or at least they had no more gold."

The Washington Accord guided official gold sales, a completed process. The physical gold price is diverging from the false paper price directed by the COMEX and guardians like JPMorgan. If truth be known, over 40 thousand tons of gold bullion has been leased and sold that does not exist. In the coming years, reconciliation will assist in sending the gold price much higher, toward 00 per ounce. As time passes, more criminal actions will be visible in the open, like MF Global.

Political Leaders Turn Irrelevant

Pointless meaningless exercise in futility is seen in the big European summit meetings. They are wasting their efforts, biding time, deceiving the public, and supporting the bankers in last ditch attempts to salvage what cannot be saved. The sovereign bond market is loaded with rollover interactive explosive devices that will continue to explode without relief. The politicians offer no solutions, as Merkel and Sarkozy are the only members meeting in public eye, yet neither has any power left. They meet and sign deals only to be contradicted and countermanded later by the bankers with power and court judges reciting law. The German leaders at the summit meetings are all for public show, even financial market management. None has any power left. None is involved in the new alliance. The informed observer need not follow what they decide upon anymore, because in 2 to 3 weeks their pact will all vaporize into nothingness. Markets are impressed for minutes and no more. Witness their last several accords, none of which endured. The movie keeps repeating like Ground Hog's Day. They cannot solve the ultimate entrenched problem of toxic sovereign bonds within the PIIGS nations of Southern Europe. They have no tools in their medicine chest, only phony money and more debt, even silly new Uber-Bonds. They actively avoid putting their decisions to a public referendum vote, since the people would vote down any further bank welfare in the form of more bond redemptions or bailouts. No evidence of democracy can be seen. Politicians debate, dispute, then make accords, but their communiques are common graffiti.

The dirtiest secret is that France has already been tossed into the PIIGS pen by Germany, no invitation given to join them in the next chapter. Nothing is decided anymore in Paris without Berlin approval. Germany owns over 90% of French Govt debt. Absolute desperation is seen with the string of absurd vacant meetings held by two powerless figures, Angela Merkel of Germany and Nicolas Sarkozy of France. Merkel has zero political base, yet insists on conducting more meetings that lack enduring substance. Sarkozy attends the meetings but has been stripped of his privilege to cleave with Germany, rejected. The French are going through a flailing stage beset by convulsions on the political stage without proper identification by any geopolitical doctor. Their crippled president actually claimed publicly that loss of AAA rating for government debt would not be insurmountable. Within days, the extreme pressure placed upon one US rating agency caused a delay of the debt downgrade.

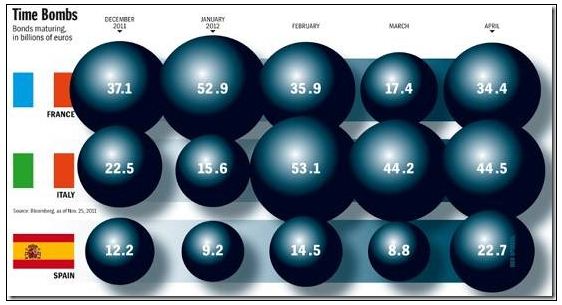

The key to Europe is the chain of explosive devices linked to France, Italy, and Spain. No solution exists. Rollover of their debt will exacerbate the crisis. The leaders are like witchdoctors presiding over a bonfire. The OECD has thrown some water on the faces with a forecast of government debt in industrialized nations, set to rise from .4 trillion to .5 trillion in the coming year. The prospect to finance the debt is perilous.

Wall Street Subterfuge in New Weapons

Wall Street is reported to be sabotaging the Euro currency. They are using a Japanese Yen position front. They also rely upon debt rating agencies to sling key attack arrows. The belief is that what hurts the Euro currency will help the USDollar. Such shallow strategy. It will result in mutual destruction with gathering momentum, along with an unstoppable collapse of big banks in Europe, London, and the United States. A sordid story was reported by Zero Hedge last month about how the Wall Street villains had created short trades directed against the Euro currency and even the big European banks. They had created a complex network of positions designed to conceal their nefarious intentions. At the center was a funding mechanism from the Japanese Yen currency. The belief was that further damage and destruction in the European financial structure could be helpful in lifting the USDollar, or at least buying some more time. This is the very essence of the Competing Currency War and its mutually destructive tactics, so much so that analysts adroitly describe it as a race to the bottom in the protection of the export trade.

Joining the subterfuge are the US-based debt rating agencies. They have been dutiful in delivering painful debt downgrade banners to fly over both government debt and corporate debt across mostly Southern Europe. Theirs are non-stop financial assaults. The very same corrupted agencies were bought off from 2000 to 2007 with rosy undeserved AAA ratings on toxic bond securities sold by their Wall Street masters. A pretty cream topping on a pile of cow manure does not make the paddy delectable to eat. The USGovt debt downgrade was followed by an endless skein of European downgrades for banks and sovereign debt, the motive being to even the wrecked playing field, and make the US not so alone, subject to intense scrutiny. The USDollar has performed well since the Greek Govt Bond disaster spread to Italy, even spreading the stench to France. Some European leaders have openly complained that the US-based debt rating agencies are doing damage with motive, ignoring the rot in US banks.

Hyperinflation & the Failure of 0%

Hyper monetary inflation is the advantage almost entirely for the banker class. It is being used to prepare for domination in the next chapter. By directing largesse to Wall Street, and obstructing it to the Main Street, the Powerz believe they are winning the battle over inflation. But they have presided over a wicked rot instead, in addition to causing a class war. The eventual cost will be lethal inflation and a thrust inevitably into the Third World. The theory is simple enough. Prevent the massive flow of monetary largesse from reaching the main channels of the USEconomy. Keep the labor wages down, even if costs are rising universally. Direct the enormous sums of money into the banking sector to cover toxic bonds, to redeem preferred stocks, and to replenish funds for executive bonuses. Then claim success over inflation after falsifying the official CPI data. Furthermore, use public disclosure with all the fanfare concerning big relief packages like the TARP Funds to distract attention away from the truly mindboggling multi-$trillion grants at 0% never to be repaid by central banks and major financial allies. The above scenario is an over-simplified account that glosses over further illegal activity in the form of forged home foreclosure documents. The end result is a profound resentment that has sparked the primary roots of a class war, and the Occupy Wall Street movement. The bitter fruits are many, such as lost market integrity from chronic interventions, lost moral fabric from moral hazard swallowed whole, and a nation that undergoes systemic failure without relief or compassion. Any actual steps toward a legitimate solution are nowhere seen, like big bank liquidation, like home loan modification, like the return of industry from Asia. When any reconstruction begins, the ultimate cost must be paid by the stern hand of Economic Mother Nature, the effect to include a dynamo of price inflation, a powerful currency decline from global rejection, if not isolation and punishment.

The 0% monetary policy should be interpreted as a monetary failure. It forces an economic failure. Worse, it is a badge to represent failure, not a remedy from failure. It is a road sign on a dead end in a grotesque liquidity trap if monetary growth is halted, and hyper-inflation if continued. The United States is repeating the Japanese lost decade policy, but doing a better job of lying about the results. The United States has learned nothing from their lost decade. The US is much worse off than Japan. The US has no broad industrial base. It has no trade surplus. It has no self-contained federal debt. It has no long school season. It has no sense of responsibility when grand crimes are revealed. Jim Rickards has made the point in the speaking circuit that despite knowledge and awareness, the United State bank leaders are repeated the exact same monetary errors that Japan made. Adding liquidity to an insolvent system does not accomplish anything, but the US will do it over and over again without success. In fact, after the ineffective policy is evident, the US will double the effort in a glaring example of futility. Worse, as the US repeats the errors, it boasts of being superior, even as the official statistics are grotesque lies worthy of derision. The US protects the grand larceny perpetrators, the big banks. See JPMorgan and the MF Global case.

The 0% marquee is actually a tombstone epitaph, since the US cannot exit from its clutches. It will force the ruin of entire fortresses of capital. The wrong price of money assures that capital destruction. The USGovt cannot permit a rise from 0% in capital cost, since it is running .5 trillion annual deficits. Normal cost of money would result in hundreds of $billions in higher debt service costs. The United States is trapped by 0%, not stimulated by it. As time passes, more capital will be retired, more speculation will be the norm, and healthy capital formation will become a mirage. The system will hurtle toward systemic failure.

The USGovt debt ratio is about to reach 100%. The once powerful beacon of freedom and juggernaut of financial prowess looks like yet another PIIGS nation. The debt monetization is orders of magnitude greater than admitted, part of the policy landscape, a QE To Infinity. More debt downgrades are coming. In early 2009 the US populace was told that the USGovt budget deficit would return under billion. It did not. According to the Jackass forecast, it zoomed up to .5 trillion and stayed there for consecutive years. The deficits persist chronically without remedy in the 00 billion range annually, a staggering 43% ratio of the total budget. The other debt ratio is the cumulative debt versus the USEconomic size as measured by the Gross Domestic Product. The United States Govt is soon to hit the 100% debt mark versus GDP. The pair of debt ratios is typical of PIIGS nations in deep trouble. The profound risk to the US financial system is masked by the USFed activity. They are monetizing 10 times as much as they admit, and the Quantitative Easing programs never were interrupted. The Operation Twist was a grand deception to conceal coverage of what foreign central banks wished to dump. Look for another debt downgrade of the USGovt in coming months, after the Q4 shows a ripe trillion in added deficits.

Compare to Canada which has a mere 34.9% total debt burden versus its GDP, a much stronger financial situation. The nation in the Great White North could have been a powerhouse leader with a huge sovereign wealth fund like Norway, except they followed the Goldman Sachs path to the fields of corruption and fealty, selling almost all their gold in a grand Wall Street game that even Switzerland joined. Then Canada followed the Bush Doctrine of fascism, embracing the war footing, sending soldiers to support the narco war, and tightening the security vise. Next they will become a Chinese commercial colony, a better fate than the US to be sure.