A Broken Narrative

Recently I was asked by a high school teacher if I had any ideas about why students today seem so apathetic when it comes to engaging with the world around them. I waggishly responded, "Probably because they're smart."

In my opinion, we're asking our young adults to step into a story that doesn't make any sense.

Sure, we can grow the earth's population to 9 billion (and probably will), and sure, we can extract our natural gas and oil resources as fast as possible, and sure, we can continue to pile on official debts at a staggering pace — but why are we doing all this? Even more troubling, what do we say to our youth when they ask what role they should play in this story — a story with a plot line they didn't get to write?

So far, the narrative we're asking them to step into sounds a lot like this: Study hard, go to college, maybe graduate school. And when you get out, not only will you be indebted to your education loans and your mortgage, but you'll be asked to help pay back trillions and trillions of debt to cover the decisions of those who came before you. All while operating within a crumbling, substandard infrastructure. Oh, and by the way, the government and corporate sector appear to have no real interest in your long-term future; you're on your own there.

Yeah, I happen to think apathy is a perfectly sane response to that story. Thanks, but no thanks.

To understand how our national narrative evolved (or, more accurately, devolved) to become so unappealing, we have to take an honest look at money.

Money is Not Wealth

Money is just a marker for real things. As long as you can exchange your money for real things, your money represents value. Because we tend to conduct all of our most meaningful transactions using money, our perspective can become warped to the point that we think it is the money itself that has value.

The economy is measured in these units, these markers, which we call "money." But money is not the same thing as the economy. Far from it. And money has no value on its own, but only in relation to the things we can exchange it for.

The economy consists of real needs and wants being fulfilled. On one end of the spectrum, we have the basics like food, water, shelter, medical care, and other necessities. On the other end of the spectrum, we have 15-minute neck massages at the airport. Everything else lies in between.

Money, on the other hand, is simply a facilitator of exchanges.

When we reduce the economy to its simplest form, it really consists of a growing number of people trying to meet their needs and wants. More people (~80 million more each year) simply translate into increasingly greater demand for the earth's limited and ever-limiting resources.

Since our human desire to consume is virtually limitless, a key role of money is to provide the scarcity necessary to divvy up a limited amount of goods and services among the population. There has to be a balance between money and the things that humans can produce and distribute, or else prices get out of whack.

So now let's imagine a world where real things are in limited (and limiting) supply, and then compare this idea to our money supply in order to get a sense of where things are headed.

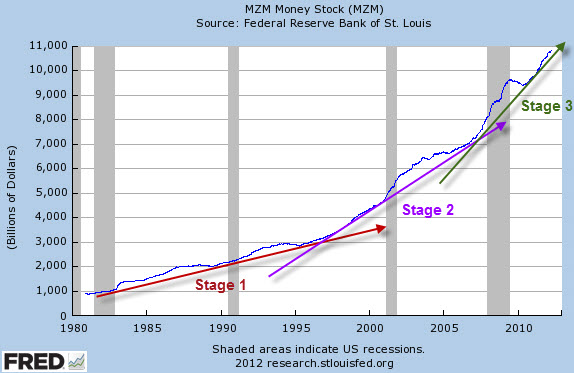

This is a chart of Money of Zero Maturity (MZM), which is the largest and most comprehensive accounting of money in the Federal Reserve system and has been ever since M3 was abandoned.

If that looks like an exponential chart to you, you are correct. Sure, there are a few wiggles and jiggles along the way, but the system of money we've been living under and setting our expectations around is an exponential money system. For it to remain in balance with resources that come from the earth, we need those to expand exponentially, too. If they don't — and they can't forever — things will get out of whack. And it's probably no surprise to hear my view that money is what is increasingly out of whack in this story, not the earth's resources.

One feature of exponential systems is that the amount of accumulation of whatever it is that is being measured increases over time. If we draw a few arrows on the above chart, we can see that money is accumulating in our system at a faster and faster pace:

"Stage 3" in this chart shows what has been happening since 2008. Aside from the little hump there in 2008, MZM is accumulating at the fastest pace in history. Isn't that interesting? Even as employment is historically very weak, income growth is stagnant, the economy is limping along, and inflation is (allegedly) quite low, the US is manufacturing money at the briskest nominal pace in the series.

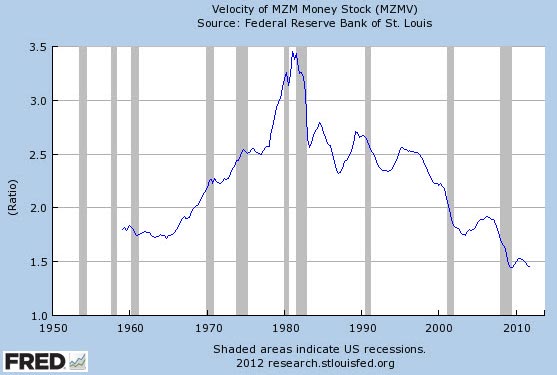

The reason that we've not experienced massive inflation (yet) is that the money that is being injected into the system is basically just piling up and not really doing anything. It's just sitting there. One measure of this is the so-called 'velocity' of money, which is not actually a measured value but an inferred one, derived by dividing the stock of money into GDP. The higher the resulting number, the faster each unit of money is racing around in the economy trying to do something (which usually means to spend itself before inflation steals its value).

In fact, the velocity of money is at an all-time low and seems to be headed lower. When this money all finally decides to go out and spend itself while it still has some value, it will be quite a process to observe. Just think of stored-up money like potential energy, the same as a massive snow cornice hanging precariously over a steep gully. It's not a question of if, but when it will finally release and cause the value of money to plunge.

And the point I am trying to make is that there are two sources adding to the pressure here. One is the amount of money being piled up, and the other is the dwindling quality of oil. Adding more and more snow to the situation (as the Fed and other central banks are busily doing) is not really helping anything, and neither is a decrease in the net energy returns of new oil discoveries.

Just for kicks, here's a chart of money in circulation (including cold, hard cash and coin) stretching back through time to around the creation of the Fed.

Is that a picture-perfect exponential chart or what?

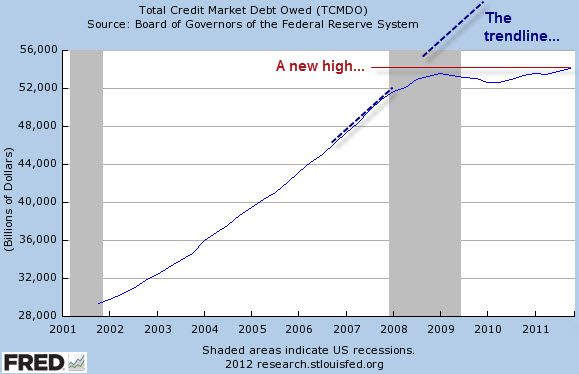

Now the other side of the money situation is, of course, debt. Here we see something quite remarkable, which is that somehow the Fed has managed to achieve a new all-time high in total credit market debt.

I say "remarkable" because what really should be happening here is de-leveraging, not re-leveraging. We should be seeking to decrease the total amount of debt, not increase it. But of course, that is not the business of the Fed. Its business is strictly to keep the exponential money and credit systems growing exponentially.

Well, that and assuring that the big banks never have to have an unprofitable quarter. But that's another story for another day.

Yet even with the heroic efforts of the Fed to push, badger, cajole, and horse-whip the aggregate amount of debt higher, its efforts are falling short. Note that we are still many, many trillions away from the trend line, which is what we'd need to get back to in order for things to return to 'normal,' as abnormal as those times really were.

Recall my other main point about debt, which is that it must double slightly faster than once every decade if we want the future to mirror the past four decades. This means that from 2008 to 2018, credit market debt will need to expand from trillion to 4 trillion, or a bit more than trillion per year, to keep us on the same "normal" trajectory.

Part of my skepticism about the odds of things returning to "normal" rests with the difficulty I have conceiving of what exactly it is that the US might find to suddenly go another trillion into debt for.

If the US cannot find a way to go that much further into debt, then all of the many fine and subtle, overt and gross ways that we've come to expect the economy and financial markets to work will no longer apply. Many things will change and will simply operate very differently if no other reason than credit growth has slowed to a relative crawl.

As we are now four years past the 2008 crisis and we've only just managed to eke out a nominal new high in total credit market debt, this means that we are roughly trillion behind the curve. You could do worse than this for an explanation as to why the national budget is such a wreck, why incomes are not keeping pace, and why the nation's infrastructure and capital investment are in such poor shape.

The bottom line is that, as expected and predicted here many times over the years, money creation with an eye towards keeping the credit markets expanding is the name of the game.

And the problem is that money is not wealth. It's only a marker for wealth. Simply increasing the money supply without understanding where we are in the energy story is an incredibly risky, if not foolish, thing to do.

That's the trouble with money.

Change Is Coming

Look, I hate to be the bearer of what many will consider to be bad news, but things are not ever going to go back to "normal" if we define normal as the period from 1950 to 2000 during which relatively constant economic growth and slightly-faster-than-that debt growth went hand in hand.

Everyone currently in a position of power honed their skill sets during a period of time when the pie was reliably growing and the skirmishes centered around how best to lay claim to one's own portion of the expansion.

Unfortunately for those with these skill sets, we have entered a brand new epoch, where, for a variety of inter-related reasons, old-style economic growth is no longer possible. These reasons are partly demographic, partly related to reaching the mathematical limit of growing one's debts faster than one's income (or GDP, in this story), and partly related to the end of cheap (and easy) oil.

It is this last part, the oil story, which has almost entirely eluded the intellectual grasp of our monetary and fiscal masters. I don't blame them, as mastery of the physical sciences is not a requirement of any classical economics departments in any of the universities that churn out our PhD economists.

This is very strange, when you think about it, because economics is entirely rooted in the process of extracting and converting natural wealth into material wealth. Without the primary inputs of the earth, there would be NO secondary or tertiary wealth for us to divvy up (via a money-driven rationing process) or develop exotic derivative products around. Economics should be the study of energy and resource flows as well as money.

Imagine if medical scientists did not have to learn about digestion and nutrition as a part of their training. After such a course of study, they might come across an emaciated patient complaining of low energy and prescribe exercise because that's been proven to boost energy in most people. Of course, they would then be mystified by why the patient deteriorated and did not recover.

Today we find the world's central banks mystified as to why trillions and trillions of freshly-printed fiat units, be they dollars or euros or yen, are not resuscitating the world economic system. The answer might just be grounded in the observation that we are out of cheap and easy oil. The very food of the economy is no longer as packed with calories as it once was, and the patient is losing weight.

What I am describing here is nothing less than a complete and utter paradigm shift that is so profound and so large that it will, paradoxically, escape detection by most people. That's just how gigantic shifts seem to happen: They go largely unnoticed, perhaps because they are too big to internalize.

If an ever-decreasing net energy return is slowly starving our patient, which we might detect each and every time we spend to 0 to fill our gas tanks (depending on whether we live in the US or Europe), then how should we position ourselves for this very different future?

What sorts of things will change whether we wish them to or not? And what is actually under our personal control?

A Crisis Is a Terrible Thing to Waste

Times of great upheaval offer a gift — the chance to really sit down and rethink things. Certain fundamental questions can arise, such as Do I have the right job? and What should my kids study in college? and Should we really have increased total derivatives by 0 trillion after the financial crisis erupted in 2008?

When faced with the sort of predicament we currently find ourselves in, even more existential questions might dominate our thinking, such as Is there more to life than working hard, buying stuff, taking on debt, and getting older? or even What's the meaning of life? The primary narrative telling us that we are supposed to work hard, consume harder, and keep ourselves centered on the treadmill that we seem to have been born upon is beginning to unravel.

It's a mark of maturity to use a moment of crisis as an opportunity to engage in introspection and as a springboard for personal (or societal) growth and development. Unfortunately, there are virtually no signs that either our dominant culture or our leadership is that mature.

So our opportunity here is to really question ourselves and our actions, hold them up to the bright light of day, and decide what needs to change, what we should keep, and what new things we might start doing.

In Part II: True Prosperity, we explore what constitutes real wealth, both material and intangible, as well as what alternative aspirations we can consider as individuals and as a society if we find the courage to change (or at least step out of) our broken narrative .

With the certain change discussed above headed our way, how do you personally want to enter that future? What will your work be? What will your relationship be to those around you and the place where you live? Where will your happiness come from?

Is your strategy simply to do more of the same and hope for the best? Or do you plan to use the time we still have to reposition your priorities, your behavior, and your resources to meet that new future with as much resiliency as possible?

Click here to access Part II of this report (free executive summary; enrollment required for full access).