The fundamentals for silver today are even better than they were last year when its price and sentiment were higher. Nevertheless, consumer affinity for precious metals has turned rather pessimistic presently. This may be indicated by those who see a rise in the COMEX silver inventories as well as a drop-off in Silver Eagle purchases. Furthermore, our favorite so-called precious metals analysts (more like Bears in a Bull’s skin) have come out of the woodwork to rub it in that the “GOLD BULL MARKET IS NOW OVER.”

For instance, one of these so-called bullion specialists never seems to put in a good word for gold when the price is heading higher. However, when the tide has turned, there is no shortage of negative rhetoric in this analyst’s articles. Another interesting member in this camp of so-called precious metals analysts believes gold stocks are a GOOD BUY at prices 30-50% less than where they are currently – isn’t that nice? I gather this analyst doesn’t play much golf with CEO’s of gold mining companies.

Some believe that when things are down, it’s nice to have friends to lift up one’s spirits. I say, with precious metals friends like this… who needs enemas? Yes, enemas.

And lastly, if you can’t get enough bearish information and data from their articles, some of these fine so-called precious metals analysts offer a subscription service to fill the void. For a fee you will be able to tap in to more detailed information on just how LOUSY gold and silver really are as investments.

With the formalities now aside, we can focus on critical factors that will impact silver in the future. Before we discuss these factors, let’s take a look at some interesting information that took place in the silver industry in 2011.

The Top Two Silver Mines Production Falls over 15% in 2011

The largest silver producing mine in the world is the Cannington mine in Australia. Silver production at Cannington declined from 38.6 million oz in 2010, to only 32.2 million oz in 2011. The Fresnillo mine, which is the second highest silver producer in the world, saw its output drop from 35.9 million oz in 2010 down to 30.3 million oz in 2011. For sake of clarity, Fresnillo plc is the name of the largest primary silver mining company in the world that operates several gold and silver projects. Fresnillo is also the name of its largest silver mine.

Cannington’s silver ore grades fell from 453 g/t (grams per ton) at year end in 2010 to an average of only 352 g/t compared to the same period in 2011. This damage of declining ore grades becomes even more apparent when we look at the total amount of ore milled each year. In 2010, Cannington milled a total of 3,075,000 tonnes of ore compared to 3,213,000 tonnes in 2011. Even with a small increase in total milled ore in 2011 over 2010; Cannington’s silver production decreased 16.5%.

Fresnillo didn’t fare any better. Its average silver ore grade fell from 474.4 g/t in 2010 to 395.5 g/t in 2011. This 16.6% decline in average ore grade accounted for Fresnillo’s 15.5% decline in silver production in 2011. Furthermore, Fresnillo’s first quarter silver production fell an additional 4% compared to the last quarter in 2011 with an average ore grade of only 335 g/t.

There is an interesting trend taking place at Fresnillo’s mining operations that is indicative of what is occurring in the broader mining industry. I will discuss this later in the article. Before I continue, I want to emphasize to the reader-investor that the information presented in this article (as well as future articles) is not meant for investment recommendation. I use the data from these public companies to show trends that are taking place in the overall industry.

Polish Copper Miner becomes the Largest Silver Producer in 2011

While the two largest silver producers lost ground in 2011, a Polish Copper miner took up where they left off. KGHM Polska Miedz, the 9th largest copper company in the world became the largest silver producer in 2011. Not only did KGHM Polska beat out Fresnillo, the largest primary silver company, it also surpassed BHP Billiton – one of the largest mining companies in the world.

We can see from the graph above, BHP Billiton lost the most overall production of the three, due to the large decline of their Cannington mine which provides 83% of their silver output. KGHM Polska Meidz produced 40.5 million oz in 2011, BHP Billiton came in a second at 38.9 million oz and Fresnillo finished third at 37.9 million oz.

This was indeed a surprise because BHP Billiton produces nearly 2.5 times more copper on an annual basis (according to 2011 statistics) than does KGHM Polska Miedz. Again, falling ore grades at Fresnillo and BHP Billiton’s Cannington mine were responsible for allowing KGHM Polska Miedz to become the largest silver producer in the world in 2011.

Now that we have an idea of what took place in the top silver miners in 2011, let’s look at the important factors that will impact silver in the future.

CRITICAL FACTOR #1: Controlling Silver Market Sentiment

The present silver market is a far cry of what it was just a year ago. Silver hit nearly an ounce last April and demand for Silver Eagles in 2011 hit all time records. Today we have quite the opposite. Silver is trading at an ounce and Silver Eagle sales are off approximately 25% so far in 2012. Even though this seems pretty bad for the silver investors, don’t worry – demand for Gold Eagles is down a whopping 44% compared to the same time last year.

Why the big change? It is due to the change in the psychology or market sentiment in silver. There has been an orchestrated effort to manipulate silver in order to crush the motivation for investors to buy or trade the precious metal. Over the past year, there have been several raids on silver by which massive numbers of contracts are dumped on the market within a relatively short period of time.

Controlling market sentiment in gold and silver is critical in keeping faith in the US Dollar. Of course parabolic movements in the price of stocks and commodities are not sustainable, but neither is money printing or increasing national debts to infinity by central governments. While the takedown of silver during May, 2011 was impressive, it didn’t come close to the 38% decline that took place in September – an overall decline of 46% from peak to trough in just four months.

In order to kill market sentiment, one raid is not enough… several over a period of time are necessary. The last large raid took place on Feb 29th, 2012, when a year’s supply of silver production (paper contracts) was dumped on the market in a single day. The beauty of this tactic is that the manipulators don’t need to do the majority of selling. Once a large amount of contracts are dumped on the market, the algorithms take over and do most of the damage – just like knocking down the first domino and watching the rest follow.

This tactic is also taking place in the Mainstream media analysts’ brigade. Just like algorithm trading, these MSM analysts who are completely clueless to the fundamentals of the precious metal markets are now jumping on the bandwagon by writing bearish articles and producing negative charts. Here is a perfect example taken from the post “The Other Side Of The Gold And Silver Coin” from Zerohedge.

This chart originally came from a Bloomberg source that Zerohedge was unable to link. The so-called analyst who produced this chart is trying to make an argument that the build of silver inventories in the COMEX is what will push the price of silver lower. If we look at the chart we can see that the movement of inventories (IF THEY ARE ACTUALLY REAL) has no real correlation to the price of silver whatsoever.

In one week in Sept 2011, the price of silver was knocked down 27% with no apparent increase of COMEX silver inventories. From Jan to Feb 29th, the price of silver shot up 36% while the supposed COMEX silver inventories increased 13%. This can be proven further by looking at the changes in COMEX silver inventories and the price of silver between 1995 and 1999.

From Jan to Dec 1995 the COMEX silver inventories declined approximately 110 million ounces and the price of silver only increased __spamspan_img_placeholder__.40 from .80 to .20. Now, there was some initial volatility when the inventories were removed in April 1995. The price shot up from .60 to .00, but by Aug 1995 it had already fallen to .00.

An even bigger decline in silver inventories took place from 1997 to 1998. This was probably due to Warren Buffet’s short stint in the silver market. In the middle of 1997 the silver inventories fell from approximately 200 million ounces to only 50 million by the end of 1999. Excluding all the initial volatility, the price of silver increased from .80 in July 1997 to .30 by the end of 1999. All in all, as the silver inventories dropped a staggering 75% during this time period, the price of silver increased only 10%.

If we look at the movement of silver inventories compared to the price of silver from the total period between 1995 and 1999, it becomes even more of a farce. COMEX silver inventories fell from 270 million ounces in the beginning of 2005 to a lousy 50 million by the end of 1999. The price of silver changed a measly __spamspan_img_placeholder__.50 (.80 to .30) in this timeframe.

There are two bits of wisdom we can take away from the movement of silver inventories and the change in the price of silver:

- There is no correlation whatsoever

- It provides further proof that the Silver Market is manipulated

So, I say let the mainstream analysts do what they do best and that is to continue to provide the world with totally useless analysis while those in the gold and silver community just have to be patient and wait for the fundamentals to finally override the manipulation and insanity. This is explained in more detail in my past article THE COMING PARADIGM SHIFT IN SILVER.

While the silver market is indeed manipulated on a short term basis, it cannot be controlled over the long haul. Fundamentals always win out in the end. To see this more clearly, we need take a step back and look at the silver market in broader scope.

CRITICAL FACTOR #2: Energy Supply & Diesel Consumption

Another critical factor concerning silver is the future energy supply. The mining industry runs on liquid energy – the majority of which is diesel. Not only is the world currently peaking in conventional crude oil production, but net oil exports are already declining. I will discuss global net oil export declines in more detail in a follow-up article.

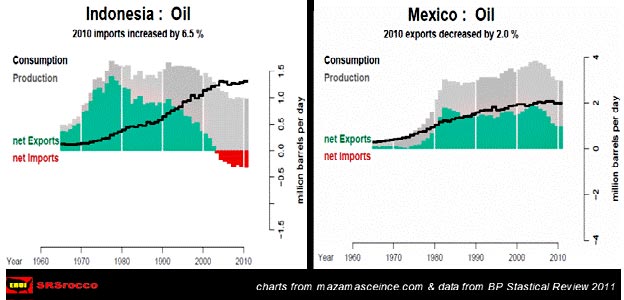

For now we will look at Mexico’s example of falling net oil exports, focusing primarily on Fresnilo’s processed ore and diesel consumption. All oil-exporting countries go through the same cycle of increasing oil production and domestic oil consumption. This ratio works fine until production declines while domestic consumption continues to increase. A perfect example of this at work is Indonesia.

Indonesia used to belong to OPEC until it became a net oil importer. In 1977, Indonesia produced 1.7 million barrels a day of oil while it only consumed approximately 300,000 barrels. Thus, it had a net oil export of 1.4 million barrels a day (mbd). By 2010, Indonesia became a net importer of oil as it consumed over 1.3 mbd domestically while it only producing 700,000 barrels a day (BP Statistical Review 2011).

This same fate of falling net oil exports will take place in Mexico, as well. In 2004, Mexican oil production peaked at 3.8 mbd while domestic consumption was 2.0 mbd. Even though its oil consumption remained relatively flat at 2.0 mbd by 2010, the country’s production declined to 2.9 mbd. In just six years, Mexico’s net oil exports were cut in half from 1.8 mbd in 2004 to approximately 900,000 barrels a day in 2010 (BP Statistical Review 2011).

Mexico is the largest silver producer in the world with many future silver mining projects in the works. These projects will rely upon additional supplies of diesel to run their operations for the next several decades. Will they be able to obtain enough diesel to power their mines?

Fresnillo has stated in its 2011 Annual Report that it will increase its silver production to 65 million ounces and its gold to 500,000 ounces a year by 2018. In order for Fresnillo to achieve this production forecast they will have to increase their diesel consumption, as well.

In 2007, Fresnillo processed 13.9 million metric tonnes (MMT) of ore and consumed 8.6 million gallons of diesel. By 2011, their mining operations processed 37.7 MMT of ore and consumed 24.7 million gallons of diesel. This rise in diesel consumption was due to Fresnillo starting two new mines and ramping up production in three existing mines.

The majority of the increase in processed ore and diesel consumption at Fresnillo came from ramping up production at Herradura and starting commercial operation of the Soladad-Dipolos mine in 2010. Both of these mines are predominantly gold producers. The chart below shows the breakdown of gold and silver mines at Fresnillo:

Here we can see that of the 37.7 MMT of ore that was processed at Fresnillo’s operations in 2011, its gold mines accounted for 34.2 MMT – or 91% – of the total amount. Even though Fresnillo is described as the largest primary silver mine in the world, the majority of its energy consumption is geared towards gold production.

This increased gold production has been revealed in an interesting trend taking place at Fresnillo’s mining operations. In 2005, Fresnillo’s electric energy demand was 41.8% of its mix, while its diesel consumption accounted for 57.1%. Today, this ratio has changed significantly.

According to information obtained from Fresnillo’s 2011 Annual Report (just released), its diesel consumption now consumes 72.5% of its total energy requirements, while only 25.5% is attributed to its electricity demand. If diesel supplies become harder to acquire in the future, Fresnillo’s energy trend may be indeed heading in the wrong direction.

CRITICAL FACTOR #3: Declining Average Ore Grades

On top of dwindling future energy supplies, declining average ore grades in the mining industry makes matters even worse. This was shown in detail in my article “Peak Silver Revisited: Impacts of a Global Depression, Declining Ore Grades & a Falling EROI”. The graph below represents the changes that took place mining silver in the United States between 1935 and 1993:

In 58 years, average silver ore grades declined 92%. This had a profound effect on the mining industry in the United States, whether they realized it or not. During this time period, the amount of milled ore increased a staggering 1240% to produce an additional 7.8% of silver production. These figures included the production of metal ores from gold, silver, copper, lead and zinc mining.

This trend of falling ore grades is also taking place in the two largest silver mines in the world. When BHP Billiton first opened its Cannington mine, it started producing silver at over 600 grams per ton (g/t). However, in 2011 its average ore grade had fallen to only 352 g/t. Cannington processed 2.3 MMT of ore in 2002 to produce 38.2 million oz of silver, but by 2011 it had to increase this amount to 3.2 MMT, which netted only 32.2 million oz of total silver production.

The decline in average ore grades at Fresnillo also impacted its silver production substantially in 2011. In the Fresnillo graph below, I focused on the average ore grade as it compares to silver production. Even though the graphic displays the changes of these statistics in a five year time period, the most important aspect in the chart is the drop in average ore grades in 2011 (395 g/t) compared with 2010 (474 g/t). In both years, the Fresnillo mine processed about the same amount of ore, but its silver production declined 15.5%.

To mitigate declining ore grades at its flagship silver mine, Fresnillo plans on expanding its operation by increasing its milling capacity in 2013 from an 8,000 ton per day (tpd) to 10,000 tpd. This will allow them to process an additional 700,000 metric tonnes per year enabling them to stabilize their silver production. Again, the more ore there is to process, the more gallons of diesel will be consumed.

The two examples above have shown that as ore grades decline, it takes the mining and milling of more ore to produce the same amount of silver – or even less when we consider the big declines that took place in 2011. Some may say that the increased diesel consumption in these two mines over the past several years is not that big of a deal – which may be true. However, if we realize that this is occurring on a global scale, it adds up to some serious diesel consumption.

Again, the information on Fresnillo and Cannington were used as a form of reference as it pertains to the mining industry as a whole. This material is not meant to put either company in a favorable or unfavorable light. That being said, it is the opinion of this author that Fresnillo will more than likely be able to achieve its stated goals in its recent annual report due to the fact that Mexico still has ample energy supplies to run its own domestic operations for the foreseeable future.

CRITICAL FACTOR #4: Future Silver Mine Supply

You can spend a great deal of time and money looking through Analysts’ Metal Reports on the forecasted growth of metal production in the next several decades. I have seen prices range from 0 to over ,000 for each report. To arrive at their forecasts, these analysts research companies’ mining plans and predict the time and amount of metal coming online as well as subtract declines from existing projects and those that have been shut down.

It would be nice to show some of these silver production forecasts in this article, but the companies and analysts who produce these reports don’t have much of a sense of humor when someone reproduces their work for free which others pay dearly to access. The last time I contacted an organization for permission to reproduce just one of their charts, I found out that it was possible to do so for a cool fee of ,500.

That is why you get to look at my own chart below (for free):

In 2011, global silver production was approximately 23,800 metric tonnes. This was an increase of 26% since 2001. If we assume a similar continued growth, the world is forecasted to produce 30,000 metric tonnes by 2020. Even though this is a ballpark estimate based on a ten-year prior trend, the results are surprisingly similar with its pricier counterparts.

So there you have it. All we have to do is wait around for nine more years and the world will be producing 30,000 metric tonnes of silver. Or will it? In my next article I will go into more detail about the declining net oil exports and its impact on the gold and copper mining industries.

We have found out by the information provided in this article, that it is the mining of gold rather than silver from primary silver operations such as Fresnillo that consume the majority of diesel. Furthermore, over 70% of silver production comes as a by-product of base metal mining which switches the focus to the base metal sector in determining on whether or not these estimates of silver can be attained.

My gut tells me the world starts to run into liquid fuel supply problems by 2014-2015. On top of that, if net oil export decline forecasts become apparent, those expensive metal reports predicting higher metal production for the next several decades, may not be worth the paper they are printed on.

CRITICAL FACTOR #5: Nationalization & Monetization of Precious Metals

Unfortunately, the majority of the public gets their news from the TV and mainstream media. From this perspective, gold is only something to be hocked at the pawn shop or to be sold to those rip-off gold dealers advertised on late night TV. Silver, on the other hand, is totally off their radars altogether. Very few individuals understand the real reason to buy and hold precious metals.

Currently, the world is witnessing the disintegration of the global fiat monetary system. The 40+ year experiment in the global reserves status of the US Dollar is presently experiencing serious side effects. China and India have decided to ignore the U.S. sanctions on Iran by going around the international SWIFT system of monetary transactions, by purchasing oil with gold. That’s right, using the worst four-letter swear word in the book according to the Federal Reserve – G.O.L.D.

As the world continues to go down the path of printing its way out of debt, the fundamentals of gold and silver become even more important. Countries that have a great deal of foreign investment and ownership in their domestic gold and silver mines may be forced to rethink these arrangements when the world fiat monetary system finally dries up and blows away.

Some have seen the writing on the wall and have taken necessary measures already. In 2011, Hugo Chavez nationalized the gold mines in Venezuela and at the same time, repatriated all Venezuelan gold from foreign banks. Argentina has decided to gain control of its energy resources by taking a 51% interest in YPF, a Spanish oil and gas company – the largest in the country.

Furthermore, Indonesia announced a 25% increase in export taxes earlier this year on foreign coal and base mining companies that could jump to 50% by 2013. Again, as the global financial situation becomes grimmer in the future, countries may be forced to nationalize their resources as the global economy switches its system from exchanging paper money for goods to trading goods for goods.

If we look at the global production of silver in 2011, we can see that the majority of its supply comes from countries that may be the most at-risk in nationalizing their resources in the next several years.

Mexico and the countries in South America produce the lion’s share of the world’s silver production (366 million oz). Anyone who has been investing in and reading about gold and silver for the past several years knows who Hugo Salinas Price is and what he is attempting to do in Mexico. Hugo has been gaining support in his effort to introduce the Silver Libertad as a form of competing currency in Mexico to help protect its citizens from the ravages of high inflation in its Peso.

Mexico is the number one silver producer in the world, supplying 153 million oz in 2011. The majority of this silver is exported, but that could change rather quickly if its citizens’ faith in fiat money disappears.

China and Russia have been the predominant suppliers of government silver sales over the past several years. However, in 2011 this supply declined substantially to only 11.5 million oz compared to 44.2 million oz the previous year.

In reality, no country is safe against the threat of nationalization when the central banks of the world are no longer capable of kicking the fiat can down the road. At some point in time, more of these countries shown in the chart above may be forced to nationalize their resources; making the availability to acquire cheap silver a thing of the past.

Conclusion and Final Remarks

There is a war going between those who favor gold-silver and others who are clinging onto the last remnants of the US Dollar. The tactics utilized by the fiat monetary authorities in this campaign have been strategic dumping of massive gold and silver contracts, as well as the control of market sentiment by negative hit pieces put out by MSM analysts.

While the conspiracy to manipulate the precious metal markets is more than likely being accomplished by only a select few, the majority of the damage is taking place in computer algorithm trading programs and through clueless analysts who get paid to regurgitate the information that is spoon-fed to them.

One of the examples to persuade investors that the price of silver will be heading lower is a chart showing increased COMEX silver inventories. I proved why this theory was faulty by providing historical examples where these changes resulted in no significant changes whatsoever.

I went into detail explaining several different factors that will impact silver in the future. I believe the most important factor will be the peaking of global oil supplies and declining net oil exports. As world oil production declines along with net exports, significant stress will put on an industry that is reliant on diesel to power its operations.

Another factor relating to the energy situation is the phenomenon of falling average ore grades. As mines age, average ore grades also decline necessitating the mining company to consume more diesel just to keep silver production stable. This may seem insignificant when we consider a few operations, but becomes a great deal when realized as a global phenomenon.

Analysts spend a great deal of time putting together metal reports that forecast silver production that will occur in the next decade(s). They produce these reports from the information obtained from mining companies that have proven reserves and resources in the ground along with a timeframe to reach commercial production. There is little or no effort in analyzing on whether or not the industry will have the required energy to run their operations.

Even though global silver production is forecasted to increase in the next decade, there is growing evidence that there may not be the adequate future diesel supplies to enable the mining industry to attain this goal. This will be discussed in greater detail in my following article that focuses on energy consumption in the gold and copper mining industry.

Finally, as the lights continue to go out for the world’s reserve currency, the US Dollar; trade wars escalate and threats of nationalization and the monetization of the precious metals become increasing probabilities. All these are critical factors that will impact silver in a negative and positive way – negative for those who hold a sweaty palm of Federal Reserve Notes and positive for those who have decided to own the precious metals.

In reality the best tactic for those who put their faith in the oldest forms of money in the world is to purchase and take delivery of the physical metal.