One of the most common questions that I’m asked goes something like this: “If the deflationary long-term cycle is in its ‘hard down’ phase until 2014, why should we expect gold’ value to rise? Shouldn’t we instead expect to see a rising dollar along with a falling gold price?”

That’s a good question and on the surface it makes sense. The dollar after all has historically been inversely correlated with gold, and since the currency tends to benefit from deflation it stands to reason that a rising dollar during “runaway” deflation would lead to lower gold prices. The answer is more complex than this, however.

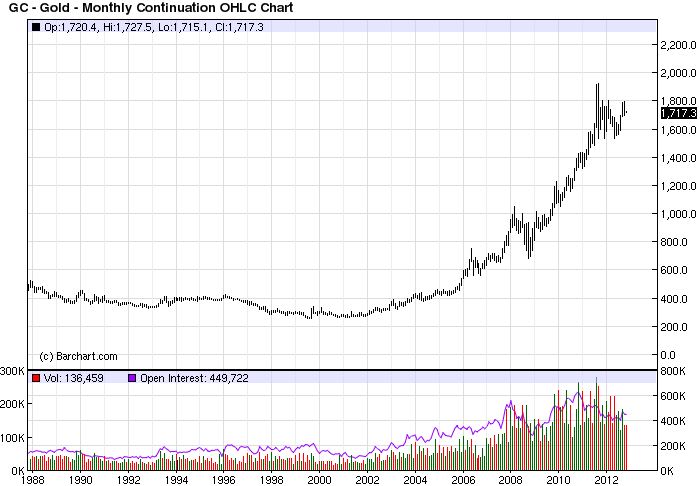

Gold tends to outperform other assets at the two extreme ends of the 60-year economic “long wave” cycle, namely during the runaway inflation and runaway deflation parts of the cycle which occur approximately every 20-30 years. The last time we saw a strong performance in the yellow metal was the late 1970s when the inflationary cycle was peaking. The latest gold bull market began roughly 10 years ago with the start of the final deflationary portion of the 60-year cycle. The closer we get to the final bottom of this cycle (due in late 2014), the more upside pressure there should theoretically be on the gold price. There are of course some basic some fundamental reasons for this.

The simplest way of understanding why gold directly benefits from extreme deflation (as opposed to mild deflation) is because it results in not only a flight to quality, but also in widespread fear and uncertainty. The flight to quality may explain why there is a tendency for U.S. government bonds to benefit from deflation along with the dollar (when there is panic). Gold benefits not so much from panic as from the long-term fear and uncertainty generated by the ravages of deflation. Consider the last decade: a tech stock bubble bust followed by a real estate debacle and credit crisis followed by economic trouble in the euro zone and a potential recession in China. All of these factors have conspired to cause investors to re-evaluate their savings and investment strategies, making gold a clear beneficiary of this fear.

The last several years have caused millions to question one of the most basic of economic assumptions Americans have always made, namely that real estate was the single best long-term investment you could make. Clearly that assumption has been turned on its head and its proven failure caused many Americans to turn to gold as a long-term investment.

Another way of understanding why gold benefits from runaway deflation is to look at the tendency governments and central banks have of trying to inflate their way out of a financial crisis. For a time, this monetary inflation results in rising asset prices and gold is one of the assets that benefits from it. Eventually, however, the monetary inflation subsides as governments and central banks begin quarreling over how to address the underlying deflation. Some governments choose the austerity route, which is the surest way of letting deflation run its course. Other governments (namely the United States) prefer the stimulus route. But additional monetary stimulus only goes so far, as we’re finding out now. Despite the confusion these conflicting monetary policies breed, gold continues to increase in value while the deflationary cycle is still raging.

Let’s look at just one recent example of how deflationary undercurrents are still ravaging the global economy and threatening to get out of control. Europe’s fourth-largest economy is on the brink of having to ask for a bailout. Spain has just announced that retail sales for the country fell 11 percent in September compared to a year ago. The country also released data on Tuesday which further highlighted the extent of the damage brought on by its debt crisis.

Spanish Prime Minister Mariano Rajoy was elected just under a year ago on an austerity ticket. His government has signed off on a belt-tightening program worth over 60 billion euros through to the end 2014 to cut the country’s deficit. But as Reuters observed, “the spending cuts have dented investment while tax rises have hit consumers’ pockets and driven prices higher.”

Along those lines, ECB President Mario Draghi recently announced the ECB would do “whatever it takes” to end the euro zone debt crisis. That announcement coincided with the launching of a $650 billion bailout fund in early October. But while the European Stability Mechanism, or “bazooka,” as it has been nicknamed, is meant to help struggling European countries by extending loans or making bond purchases, its implementation is a far cry from what has been promised. Since EU member countries have been slow to provide start-up reserves, the fund will only have about $100 billion by 2014, according to reports. As one source pointed out, “That suggests that troubled countries like Spain may not get much help in the meantime.”

Think of austerity as oxygen deprivation for a hospital patient who’s in desperate need of air. By refusing the life giving oxygen to a dying patient, both Rajoy and Draghi are exposing Spain to the ravages of the 120-year cycle decline as we head closer to the fateful year 2014. While this won’t bode well for the euro zone economy or the people of those countries, it will benefit the gold price as investors look for a financial safe haven in the coming storm in 2013-2014.