The typical human reaction to any infection, vermin, danger, or toxicity is to stand back, to isolate the agent, to trap it, to prevent its further spread or release, then to remove it in a safe secure way if possible using trained professionals. Eventually decisions must be made on the level of acceptable risk on the removal, like what is willing to be lost or damaged or killed in the process. Risk analysis, cost trade-offs, and minimization decisions must be evaluated and executed. The toxic agent in global trade, global banking, and global bond market is the USDollar. In 2009, the Jackass began making a certain firm point. Those nations that depart from the entire USDollar system early will be the leading nations in the next chapter, with stronger foundations, richer solvency, emerging economies, healthier financial markets, efficient credit engines, growing wealth, stronger political helm activity, and better functioning systems generally. Imagine a contaminated blood system that infects, corrupts, and destroys all interior organs from the spread of the toxin. Those nations that stick with the crumbling USDollar system stubbornly will find a horrible fate with devastating effects, rampant economic damage, broken financial markets, sputtering credit engines, tremendous loss of wealth, wrecked supply lines, poverty spreading like wildfire, ruined political structures, social disorder, isolation from the rest of the world, and a fast ticket to the Third World. That is EXACTLY what is happening in the last several months. A division has begun, as the East has been busily installing the next generation platforms, as related to trade, banking, and commercial integration.

NEW ASIAN TRADE ZONE

The division between East and West actually accelerated when the extremely ill-advised decision for Iran sanctions was made by an increasingly desperate United States Govt and its handler on the Southern Med. The division continues, matures, and develops with each passing month. It has become a story, as the Eurasia trade zone concept has been born. It has a long way to go, but Asia however has made great strides lately in unifying commerce. The climax event of the Asian trade zone conference held in Vietnam could not have been more important, as they rejected the US-led plan. The Asians partners and players even rejected the United States from the entire Asian trade zone, but did include Australia and New Zealand. The incredibly stupid naive US-led plan, the Trans-Pacific Partnership, attempted to create a trade zone with Asia which would have blocked China. Imagine the incredibly obtuse blockheaded maneuver of trying to have all of Asia not conduct facilitated trade with China, its leading trade partner.Talk about shooting both legs and genital region with a double barreled shotgun! This is the signal flare of US political stupidity that has turned highly destructive for the USEconomy and its people. Such failed leadership and counter-productive initiatives will push the US into the Third World even faster than previously thought possible. The isolation is firming quickly. Most of Asia does not wish for strong trade ties with the United States, most likely since they do not see mutual benefit. They see a ravaging appetite to grab capital.

A Paradigm Shift is taking place, and the ASEAN-China summit gave proof positive in a seminal event of the vast changes in progress. The United States just suffered its worst humiliation ever as a nation on the Eastern global stage. It was exceeded only by the humiliation for a US president personally. The story went uncovered by the lapdog inept US press. The late November Asian summit meeting held in Phnom Penh included 15 Asian nations, which represent half the world's population. They decided to form a Regional Comprehensive Economic Partnership that excludes the United States. The Asians are pushing to isolate the United States. Regard it as punishment for hegemony, or a reaction to prevent further capital drainage, or to protect from central bank abuse, or to wall off continued bond fraud export, or to defend against military aggression. Regard it as confirmation that China is the regional leader in Asia, even for military security. Regard it as a response to banker criminality, or simply for being totally full to the brim of American corruption and arrogance and abuse of position, led by creation of the USDollar as an elaborate weapon and credit card whose balance is never to be repaid. Abuse of power and sponsored financial corruption will have extreme consequences in the reshaping of global commerce and banking. The US will be isolated, so as to protect the rest of the world from its fascist exhibitions and deep manifestations.

FLUSHED NATION

The shift is in progress, and the American people have no idea what is happening. They are too pre-occupied by the agency torture of the population, urgently needed to remove guns and to create the police state. Current events are heinous and genocide on large scale and small scale. Any comments will be limited on the orchestrated travesty, travails, and tragedy. They all have one traceable element, which connects to a certain Virginia suburb where an intelligent pillbox operates in the shadows with puppet strings to the press networks and maybe Hollywood. The security agencies turned to the dark side years ago, with full devotion to narcotics, money laundering, and collusion with the castle dwellers. When the Praetorian Guard plots to bring about a police state, the only words that come to mind are disaster, disorder, mayhem, betrayal, degradation, death. Their tools are psychotropic drugs, violent training, weather altering devices, and basic sabotage. Treason is the calling card unfortunately for much of the US leadership class, whether banking, politics, economics, pharmaceuticals, or news networks. Think Syndicate, as my work has described for several years. The United States with its harsh new visa policies, molestation at airports, heavily defended borders, sponsored gun running, has shown a vicious visible visceral fascist streak that has begun to bring memories of the national socialists of Central Europe 70 and 80 years ago. They are back, stronger than ever, not having been eliminated. They were instead assimilated within the banking and security organizations, able to plant seeds which germinated with the sons in offspring. Two sons became presidents.

DEUTSCHE MARK GONE

In the 1960 and 1970 and even 1980 decades, the favorite currencies off the standardized tables of commerce were the USDollar and DeutscheMark. At one time in the Soviet Union and the Soviet Bloc of Eastern Europe, more USDollars and DMarks were in circulation than official Russian Rubles or Polish Zlotys or Hungarian Forints or whatever. Those years are long gone, as in long gone, all paper alternatives lousy. Under a strange bizarre compromise arranged to assimilate East Germany and to conceal the French sovereign debt, the Euro Monetary Union and the common Euro currency was born. It is now in the process of disintegrating. So the powerfully strong and stable German DMark went away. Back in those decades, only limited travel was done by the Jackass, confined to a honeymoon in France and Switzerland with a cold woman no longer inflicting her plague-like touch in my life. The Jackass deals exclusively in Latin currency of paper and human variety. No exposure to alternative currency held under the table was discovered in beach locations to the south or modest hotels in the green hills to the north. But friends reported stories. My older brother spent two months in Germany and Czechoslavakia, with ample stories of hoarded USDollars and DMarks. Store owners and wise families were eager to obtain USD and DM currency, even young kids. He and some ambitious friends heard stories of vast black market activity in Russia, where the US$100 bill was a favorite. In that era, Gold was not an item of pursuit or stored wealth. Times have changed radically, and Gold is the new store of value.

Times have changed with the sunset of the DMark and the toxicity of the USDollar. The people, the shop keepers, the business men, the small financial firms, they all have been turned upside down in recent years as they struggle to find a safe place to store wealth. Money has been corrupted. The purveyors of money have lost control by accelerating its supply by central banks, lost control of bank solvency, lost control of anything remotely acting like an honest tether to money itself. As a result, all those people, the shop keepers, the business men, the small financial firms, have been discovering Gold & Silver bars and coins. Their combined actions have resulted in an implicit isolation of the USDollar, even an isolation of the Southern European sovereign debt. Swiss havens have grown, in parallel with Gold havens. The toxic monetary plague has been identified, and its toxic sources too. They are the US Federal Reserve and the Euro Central Bank. They are ruining money, undermining wealth, and destabilizing the entire world related to wealth, banking, commerce, and economies. The armies of people, the shop keepers, the business men, the small financial firms, are working to isolate the USDollar as toxic agent in a demonstration of survival.

FREEDOM FROM DELUSION

Many bright people within the gold community cling to hope, harbor delusions, and maintain expectations, none of which have much value in the fast changing world of fascist entanglement and full integration. The Jackass has operated without delusions, firmly in belief that the corrupt systems would flourish. That viewpoint and operating principle has proved to be correct since 2004 when the Hat Trick Letter began to spout deeply disturbing forecasts. One after the other, most of the forecasts have indeed occurred, to the detriment of the nation and its systems and its society at large. No pleasure has come from forecasting a wrecked housing market (burdened by lax underwriting and bond fraud) or a broken insolvent banking system (from bond losses and dependent upon money laundering) or a desperate chronically USGovt budget (dragged down by adopted socialism and sacred war costs) or a spreading Southern European bond crisis (addressed only by higher subordinated toxic paper).

No pleasure is taken from seeing vast legions of struggling Americans, including a few close friends, who have lost jobs, lost homes, lost savings, lost pensions, and lost a valuable sense of security, as they continue to hang on. Many might actually find the warmth of the official camps, only to disappear later on. Argentina and Chile had their desaparecidos, and so will the United States. My ugly expectation is that before their bodies are incinerated, vital organs will be extracted for black market gains. Inoculations upon entry will assure them of good health and fully functioning organs. Later, vaccines will infect them, just like with the swine flu vaccine. By the way, in Costa Rica a brief story to enlighten on vaccines. In early 2008, the Jackass advised a couple families with numerous children and cousins in school to reject the swine flu vaccine that was promoted by the school authorities at the urging of US officials. They took my advice after their confidence was won on several other matters. Only one of about 20 children took the vaccine. She has been sick with a mysterious cerebral disease for over two years. My mention of searching for Guillain Barre symptoms has not helped. The mothers are grateful, as they did not understand at first my emotional outburst to discourage following the school advice. The official US camps will involve forced vaccines. Later on, false stories will be promulgated that the dead bodies were the result of already sick people entering the camps for quarantine purposes. In reality, the people would only have suffered from hunger and exposure and despair.

Hope is not part of my forecasts, but rather the reality of the corrupt human power game mindset. The US banking, economic, and political leaders can easily be expected to continue their corrupt games, with easy forward calls. No expectation of USGovt regulatory agencies is part of my forecasts, but rather the reality of their nearly perfect track record of big bank loyalty and fraud protection. The US regulators can easily be expected to continue their corrupt games, with easy forward calls. Clinging to precious metals mining stocks is not part of my forecasts, a decision made back in early 2008. They are bound in paper wealth, subject to inflation in share dilution just like the USDollar, vulnerable to jurisdictional confiscations, and at the mercy of labor unions whose production is increasingly halted. Unfortunately, too many fine people within the gold community, including GATA, hold firm on hope, regulators, and mining stocks. Not here! The major financial networks rely upon advertisement revenue from Wall Street, fund managers, an market exchanges. GATA has a business model that has one key vulnerability, with strong links to the mining firms. It has tainted their viewpoint sadly. My support of GATA is firm on challenge of USDollar legitimacy before the Supreme Court, on challenge of US regulators to enforce the law, on challenge of the big banks to prove their solvency, on challenge of the central bank to reveal their activity. But the Jackass does not expect the Supreme Court to ever rule the USDollar as illegal, nor the US regulators to ever enforce the law, nor the big banks to ever remove themselves from corruption, nor the central bank to ever conduct business in opposition to the biggest banks under supranational orders.

My personal background has taught me well that a corrupt system never corrects itself. Instead, it spins out of control with broken platforms, layered mechanisms to impose its servitude and influence, complete with side projects to illicitly support itself. See the theft of Iraq gold and theft of Libyan gold. Their people will never again see that wealth. The US system will remain broken until it collapses, never to be corrected until after its collapse.

The Jackass does not align with the expectation of mining stock rise. The stocks are paper wealth in a new era of paper wealth implosion, during which inflation of shares through dilution is rampant. My full expectation is for physical metal prices for Gold & Silver to rise, while mining stocks continue to fall in value from dilution and reduced metal output. The leverage is a mirage when large deposits are seized by desperate foreign governments in need of income. What on earth is complicated about understanding this point?? The leverage is a mirage when workers are the focal breakdown point for a higher cost of living. If workers cannot afford to feed their families and survive, mine output will suffer. What on earth is complicated about understanding this point?? The leverage is a mirage when rising mine operation costs must be handled, by the simple practice of share dilution. Combine with regular executive stock options, and the dilution on stock shares is huge. What on earth is complicated about understanding this point??

POWERFUL CORRUPTION INERTIA

Corruption Inertia is a principle firmly believed in when Jackass forecasts must be made. The corruption will continue with firm immutable momentum, without an external force acting as agent of change. At times, this is simple science. When colleagues introduce hope and what must be, the OFF button is engaged quickly here in my office. Their views are out of touch with reality. Corruption will persist as long as the Syndicate continues to hold power. It will remain the constant while the USDept Justice remains, while the USDept Treasury remains, while the US Regulators remain, even while the US debt rating agencies remain. They all support the current system. They are all subject to momentum pressures. Only an external force will result in change. When the USDollar is further isolated, that change will come. To expect change from the inside due to internal forces is lunatic, kind of like expecting an alcoholic to change on his own from an awakening. Al Capone was removed not from inside the Chicago crime boss conference of dons. He was brought down by external forces related to income tax. The world will similarly reject the USDollar for its tax on the system, unwanted, discarded as a toxic agent.

PROTECTION FROM THREAT TO WEALTH

Again, delusion works well when fashioning a creepy little shell of existence to protect oneself from the psychological damage of a predatory government syndicate or security agency apparatus. The Jackass mocks such defense mechanisms, since a guarantee for poverty and misery. The vast legions of Americans will soon awaken to find their jobs are hanging by threads, their wealth either vanished or converted to USTreasury Bonds by force, their liberties long gone, and their ability to seek out foreign lands for residence curtailed. In fact, one nation after another is actually banning acceptance of Americans for bank accounts. See Switzerland, Panama, and Hong Kong. The US subjects are seen as persona non grata not for their own characteristics, but for the passport they hold from the United States. The USGovt as lord acts like syndicate bullies, agents to abuse embassy privileges, with imposed extra legal paperwork like an extra burden. The isolation is not only of the United States, but of its citizens, whose business is not desired. Hence the Americans will increasingly be trapped in the US along with their money. The Jackass response to threat is not to embrace delusion, and not to seek a blanket to cover my head in the basement quarters. Instead, the response has been to head for the hills with pockets filled.

People, both clients and colleague, inquire when the Gold price will rise with vigor, when the mining stocks will rise with gusto. They remind that with all the central bank debasement of currency from Zero Interest Rate Policy and Quantitative Easing, the ultra-cheap, artificially cheap, desperate cheap money to finance USGovt debt should make the Gold price zoom upwards with each QE official announcement. My answer is quite simple. Each new QE program gives the dark forces more motivation to slam the gold price with naked shorts in sale of paper gold and paper silver. To be sure, the true value of Gold and the true value of Silver is higher, but it is not reflected in the COMEX price. That market is the epitome of corruption. If they were in charge of measuring fevers, they would place the thermometers on ice. Instead, a vast divergence comes between the paper Gold price and metal Gold price. Unless and until the Gold market is freed from corruption and freed from the shackles of Wall Street and London and Swiss influence, it will continue to be suppressed. My full expectation is not for the system to correct itself from within. Instead, the COMEX seeks out new sources of supply, like the GLD Exchange Traded Fund. It is probably far more gutted than publicly stated. It has been converted into a bullion bank central repository for easy raided inventory. The Gold price will not rise from internal forces to push up value, in response to central bank monetary policy or shortage of COMEX inventory. The Gold price will rise from external forces in USDollar isolation, along with isolation of the big banks in the US and London. Their gold inventory will be removed, returned, and drained. In time, the USDollar will widely be rejected in trade.

THE NEW ISOLATION HAS BEGUN

The process of isolation is not just now beginning. It is a process well along. In fact, it has been told that immediately following the Lehman Brothers death (a deliberate exploited execution) and the adoption of toxic vats by the USGovt in the form of Fannie Mae and AIG, the major foreign players located primarily in the East began to feverishly prepare for new platforms on trade and banking. They sought to develop an alternative. For the last 20 to 25 years, a backwards principal has been at work. It dictated that the USDollar would prevail in reserves management, actually the USTBond as vehicle. The rules for trade surplus recycle were constructed to lean toward usage of the USTBonds. Therefore, the global trade would be dominated by USDollars. In other words, banking would dictate trade settlement. That is backwards, and keenly exhibits the brute force of the USDollar hegemony. Also the crude oil payments have been standardized in USDollars, ever since the Saudis cut a major deal with the USGovt and UKGovt in the mid-1970 decade after the famous embargo. Protection came to the Saudi regime and Persian Gulf emirates, in return for exclusive USDollar payment on trade for oil. The Petro-Dollar defacto standard is the primary plank behind the USDollar global trade patterns shown for over three decades. It is coming to an end, a sunset.

IRAN SEMINAL EVENT

The Iranian sanctions put forth by the USGovt and adopted by the EuroZone nations have contributed more to unwinding the USDollar trade system than any event in decades. It sounded the death knell for the USDollar. It hastened numerous nations to seek a US$ alternative. It provided a fertile environment to fashion new trade settlement mechanisms. It pushed Turkey into acting as a gold bullion intermediary role in the provision of gold for usage in trade settlement. See their role with India and Iran, fully described in the December Hat Trick Letter. When an independent highly reliable gold trader source was asked to confirm the role of Turkey as a test case in developing gold based trade settlement, he gave a tacit confirmation. He has mentioned Turkey in past conversations over the last couple years frequently. Just as Turkey was a swing nation in the NATO alliance against the Soviet Union, Turkey will serve in my view as a critical swing nation in the movement to create a non-US$ trade settlement system. The new system will be decentralized, meaning not funneled through the major banks, not passing through the USFed as clearing house. Turkey will be essential in the formation of the Eurasia trade zone. First comes the Asian trade zone (the US excluded), and next comes the hand shake between the Asians and Europeans to create Eurasia. Some folks have expressed doubt toward the arrival of a vast trans-continental trade region. They seem painfully unaware of an incredible network of railway lines connecting Russia to Germany and China, and of a incredible network of liquified natural gas lines connecting Russia with all of Europe and Central Asia. Across the new trade zone and its diverse commerce, the USDollar will not be at the center. It is in fact being isolated, since it is a toxic agent. Everything US$-based is crumbling, from currencies to bonds to banks to credit lines to economies.

CHINESE YUAN BILATERAL CURRENCY SWAPS

The advent of barter has come. It has not been noticed by the incredibly distracted, misled, deceived, poorly trained, mentally challenged, and myopic American public. They read about a currency swap accord, give it no emphasis or importance, and then turn to the fund manager opinions on rotating stocks from one sector to the next. They read about a workaround to the Iran sanctions, express some puppet-like response of anger or disgust, and then turn to IPOs and stories on Google, Apple, and Facebook shares. They do not even read about the failed Trans Pacific Partnership, since it did not make it onto the financial pages. Sadly, the Jackass is slowly adopting a cold view that vast swaths of the US populace will suffer from a Darwinian event. Their home equity has vanished. Their job security has vanished, unless they work for defense contractors. Their pension funds have been damaged. Their wealth has been over 90% dedicated to paper securities in very obedient fashion. The great majority has dismissed the arguments for sound money or gold investments. Some have a pitifully small portion devoted to hard assets like perhaps some energy companies. Only those who adopt a Gold strategy will survive the powerful storm underway, as it intensifies. Great wealth is being destroyed, and only Gold & Silver will enable that survival by the construction of lifeboats. Paper wealth is being blown away, as only hard metal assets will prevail. Add energy and farmlands.

When people ask about the best allocation, my standard response is at least 90% precious metals, the rest to energy deposits, but not actually stocks, perhaps farmland if possible. The best diversification in my view is for laddering of silver purchases, starting at $10/oz and moving to $15/oz then $20/oz and finally to $25/oz with continued accumulation at $30/oz and above. Gold will win the monetary war, but Silver will take the greatest gains. Gold is fine for a more stable long-term protection against toxic paper wealth, but my ongoing objection is that the New York, London, and Swiss syndicate centers play too many games. Silver is subject to global shortages, vast industrial demand, non-replaceable usage, and a much more dangerous situation that the powerful dark forces cannot manage. Silver coins will be widely used in commerce, while Gold bars will thrive in banking transactions. Besides, killing werewolves is the zinger factor with silver bullets.

China has made numerous bilateral swap accords with other nations. As the label indicates, they are deals cut between China and another nation to freely use Chinese Yuan from a credited account that will retain equilibrium. So far many nations have signed up and even renewed deals. The list of nations includes Brazil, Russia, Japan, and India. One might be correct to include all of Asia on the list, as nations like South Korea and Taiwan and Vietnam freely trade in Yuan transactions. The first major signal that the bilateral swaps have taken hold sufficiently to undermine the USDollar through a new trade foundation will be the complete arena of Asian trade being conducted in Yuan transactions. They have no need for USDollars in trade. They see their USTBonds held in reserves under management as vulnerable to serious loss. They see their USTBonds held as subject to grand debasement from USFed central bank monetary policy itself. They see their USTBonds held as supported by Weimar machinery in hyper-drive. They see their USTBonds held as part of a corrupted Wall Street arena and its vast trappings. They see their USTBonds held as prisoner to the USGovt debt battles and a potential crush victim on a fall from the fiscal cliff.

The Chinese bilateral swap accords are actually barter deals. They often represent rather balanced trade, unlike with what the nations have set up with the United States. Unless nations purchase enormous lots of military hardware, they have little need for US products. Hence the end result is a bigger batch of toxic USTBonds to purchase in order to balance the accounts and to avoid the local foreign currency exchange rate from rising enough to damage their export trade. The bilateral swap accords work to create numerous two-way ties as part of a latticework that eventually will form a transnational fabric without the USDollar as nuclear cores in each connection weld. The bilateral swaps are barter without the name in a direct confrontation against the USDollar and its catbird seat. That seat, once a throne, is being dismantled. The latticework of bilateral swaps has created the critical mass of a global blanket with no centralized control room, no choke points with bank transactions, no SWIFT code ticket taker. The bilateral swap accords work to build a critical mass that isolates the USDollar from an entirely new foundation for trade. The USDollar is being isolated.

COMEX PRESSURE POINT

The COMEX is under constant unrelenting pressure. They must shift around ill-gotten precious metal inventory in order to avoid a default. That would be embarrassing. The main device for maintaining order at the COMEX continues to be naked shorting of futures contracts, a blatantly corrupt practice. The naked short ambushes occur with greater frequency in recent months. The arrival of Scotia Mocatta as a provider of gold supply and naked short commitments will kill them eventually, as they have made a deal with the devils. The overnight dispatch of silver from the US to London has grown enormous. One can only suspect that the raids of GLD gold inventory and SLV silver inventory is much greater than is estimated even by its most ardent critics. The illicit sources for COMEX precious metal are fast drying up.

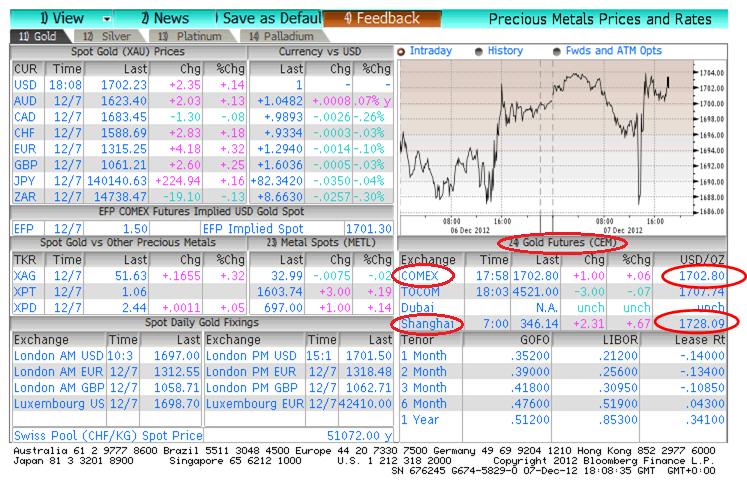

The new wrinkle to render damage to the COMEX is the arrival of the Shanghai Gold Exchange. The graphic displays the differential, a basis for potential arbitrage. Complex arrangements can be constructed that take advantage of the differential, basically buying the gold metal in New York, finding a way to make it available in Shanghai, where it is sold at a $20 to $30 higher price. The end result of the arbitrage is high volume drainage of gold in New York. The snapshot below is taken from December 7th. Several other snapshots are available, with similar price spreads. Finally COMEX based in New York, a major nucleus of corrupt financial markets, has some competition. Expect the spread to widen, the opportunity for arbitrage to grow, and pressure to build for a breakdown.

Sadly for the evil camp, they are fast running out of sources. They stole the entire MF Global private accounts, denied the clients their legal right to receive silver in delivery, and received legal protection by the USGovt and Appellate courts, after changing the law applied to financial firm liquidation instead of brokerage firm liquidation. It was a blatant maneuver that has depleted the COMEX of a major slice of legitimate business. The subsequent similar raid on PFG-Best had an echo effect, adding to the removal of COMEX clientele. The end result is that the risk hedge trade is finding ways to conduct their business without use of the indescribably corrupt COMEX. So the COMEX is being isolated in risk hedging just like the USDollar in global trade.

PETRO-DOLLAR SUNSET

The upcoming Petro-Dollar sunset has very uncertain timing indications. The assassination of Prince Bandar in Saudi Arabia, followed by the potential incapacitation of King Abdullah could work to weaken the foundation of the Petro-Dollar itself. Back in April 2010, the Saudis and other main Persian Gulf nations struck a deal with Russia and China for protection in the gulf region. That accord was not given much emphasis anywhere, nor publicity. But to the Jackass, who had a source at the meeting, the event signaled the sunset of the Petro-Dollar defacto standard. The Saudis would turn to Asia for protection and security, at a time when their crude oil trade was growing with Eastern nations, and when the North American production was made more available for the US demand in markets. The day is nigh where the Saudis accept non-US$ payments for crude oil. They might first accept Chinese Yuan, then Japanese Yen, then Korean won, then Gold itself through big Turkish bazaars. The Petro-Dollar is being isolated for sunset, and will be a key event is the removal of the USDollar as center for global trade settlement. Also, the Saudi regime in my view does not have much longer to survive. Numerous companies and financial firms and export facilitators have exited from the United Arab Emirates in preparation for the fall of the House of Saud. The Saudi Arabian royals have unstable neighbors in every border, especially Bahrain, Iraq, and Yemen.

WILD CARD FACTORS

Numerous wild cards float on the global trade table. Bank strictures head the list, with imposed rules on account reporting abroad, with tax information requirements, and with capital controls. It is harder each month to move large amounts of funds. The forms to complete have become onerous and imposing, acting like implicit restrictions. It is harder each month to use simple bank cards at ATM machines. With a simple rule change, the banks cannot complete these transactions. The organized and patterned restrictions work to trap USDollars within the local US borders. Consider it an internal mechanism to assist the global isolation of the USDollar.

LOST GLOBAL RESERVE STATUS

The described isolation on numerous fronts, whether trade or COMEX or banks, all work toward the elimination of the toxic agent in the USDollar. The world wants a more just, more functional, more efficient, more equitable global trade system. The United States has abused its global reserve custodian position too long. The world is fighting vigorously to remove it. The usage of the USDollar as a credit card to finance its consumption binge without ability to pay will come to an end. The usage of the USDollar as a device to enable powerful aggression in war to advance syndicate interests like vertically integrated narcotics will come to an end. The usage of the USDollar as a banking monopoly device will come to an end. The usage of the USDollar as an instrument for bond fraud will come to an end. The usage of the USDollar as a free lunch device to finance the USGovt deficit will come to an end. When the USDollar is no longer the global reserve currency, the door to the Third World will be opened wide. When the USDollar is no longer the global reserve currency, the supply lines will be interrupted to the USEconomy, giving off a prominent Third World stench. When the USDollar is no longer the global reserve currency, the price inflation effect will become a national topic of grand debate and extreme anger. When the USDollar is no longer the global reserve currency, the United States as a nation will experience tremendous additional isolation and hardship, as most Third World nations do. The level of corruption within the USGovt and US banking corner offices is already far more entrenched than any Third World nation. The vote fraud for US national elections is equally prevalent, but more sophisticated.

When the USDollar is no longer the global reserve currency, the Gold Standard will be right around the corner, if not already in the implementation stage. The Gold price will react quickly to the removal of the USDollar from its prized perch of abuse. The center of the new trade settlement system will be GOLD, which is not even being discussed by the enlightened denizens of the gold community. It will be the basis of the Letters of Credit, in the form of gold trade notes. The short-term credit that facilitates trade will have a truly magnificent grand Gold core. The common agreement will be to make the Gold price at least $5000 per ounce, probably closer to $7000 per ounce. They will in the process dismiss, overrun, and put into oblivion the COMEX and the LBMA, rendering them to the scrap heap of irrelevance.