While I still foresee a significant correction beginning between late Q1 to early Q2 as highlighted in a previous article (link), incoming fundamental and technical data suggest the stock market heads to new highs first as incoming data has been overwhelmingly bullish.

Fundamentals Show a Robust Recovery

Highlighted in last week’s article was November's Philly Fed State Coincident data, which showed a broad-based economic expansion in 45 of the 50 states. This week we were treated to the Philly Fed’s State Leading Index for November, which is supposed to predict where the state coincident data will be in six months. The report definitively contradicts the message out of the Economic Cycle Research Institute (ECRI) which says the U.S. fell into a recession last July. The report predicts that the state coincident activity will increase in 49 out of 50 states for the next six months. Not only are 49 of 50 states expected to show expanding economic activity for six months, but nearly the entire country is in the upper two tier growth ranges of 1.5%-4.5% and >4.5% growth.

One development in this economic cycle that I don’t think has been given enough media attention is that we have a mini manufacturing renaissance. The U.S. has been shedding manufacturing jobs ever since the 1980s as we’ve transitioned into a service economy. It took three years after the end of the 2001 recession for manufacturing payrolls to see their first monthly gain in 2004. However, from 2004 to the beginning of the 2007 recession, monthly manufacturing payroll gains averaged a loss of nearly 12,000 jobs a month. This time around it took not three but one year for the U.S. to see its first monthly manufacturing payroll gain after the recession ended in the summer of 2009. What’s even more encouraging, while monthly manufacturing payrolls averaged a 12K decline once they turned positive, we are currently averaging 14.5K GAIN in manufacturing payrolls with only a few months over the 2.5 years with negative payroll gains.

Still Too Much Pessimism Out There

While there are plenty of major structural issues with the U.S. economy that are likely to lead to subpar growth for a prolonged period of time, that shouldn’t cloud one’s view of the short to intermediate outlook, which appears to be the case with many economic fortune tellers these days. Over the last month I’ve seen many economic reports come out that handily beat the consensus forecasts of economists and strategists as they remain too scared and too pessimistic. A perfect example of this is today’s release of the ISM Non-Manufacturing Composite for December. There were 66 estimates from economists across the globe and the most pessimistic estimate was for a reading of 52.0 while the most bullish estimate was for 56.0. Well, the actual number came in at 56.1 which beat every single one of the 66 economist estimates.

The same deal came with the December release of the Dallas Fed Manufacturing Index, though there was a smaller set of estimates.

Technicals Suggest New Highs Ahead

Perhaps more important than the “Don’t fight the Fed” maxim is “Don’t fight the market.” Everyone is entitled to their opinions but their opinions don’t alter the facts on the ground. If you are bearish on the stock market and yet it continues to rally you are wrong. Conversely, if you are bullish on the market and its plummeting you are wrong as well. The beauty of the market is that it provides a real time verdict of one’s bullish or bearish thesis.

The current message of the market is that bears are wrong and the market will be heading to new 52-week highs in the coming days to weeks. The mini bear market of 2011 that witnessed a 21.6% decline from the May high to the October low was preceded by a steady decline in new 52-week highs on U.S. exchanges as more and more leaves were falling off the stock market tree and gave ample warning of a coming top. However, we see no such occurrence in the present situation as the new 52-week highs matched the peak seen in 2012 and was one of the highest readings in the last 2-3 years. There is a lot of bullish participation in this rally which is being led by small cap and economically-sensitive stocks, which is clearly bullish for the stock market as those groups typically lag near a market top.

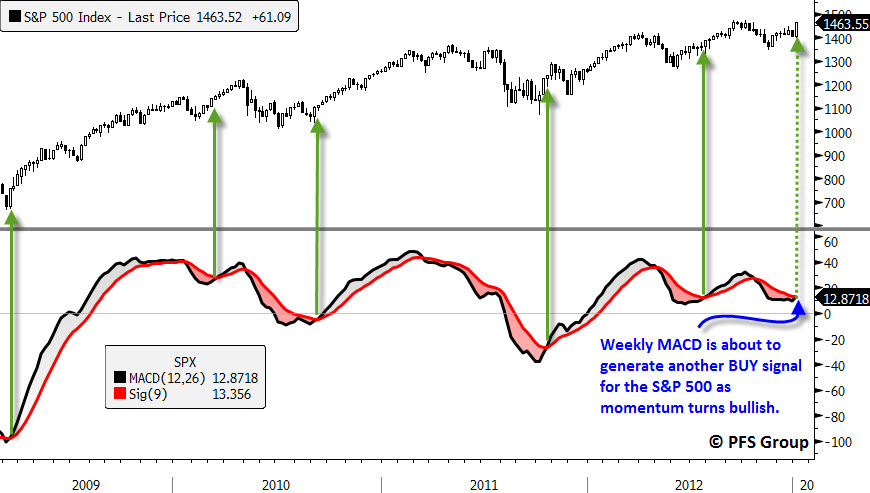

Not only is breadth robust but momentum is also picking up steam indicating we may have a decent rally in the weeks ahead. The weekly MACD for the S&P 500 is on the verge of giving the BUY signal since last summer and if it occurs it likely means we will be treated to a multi-week to multi-month rally in stocks ahead.

Summary

Current fundamental and technical data suggest we have an expanding economy and stock market through much of the first quarter. I still am concerned about a significant correction beginning between in late Q1 to early Q2, but I see no evidence of a significant correction on the immediate horizon. We will obviously have some political turbulence in the months ahead with the debt ceiling debate, but it does look like we will be treated to some positive weeks in the market first.