Originally posted at Briefing.com

When we published our first quarter earnings preview on April 6, the projected earnings growth rate for the first quarter was 17.3%. Today, it sits at 23.2%, according to FactSet, which would be the highest earnings growth since the third quarter of 2010.

If Tony the Tiger was around, he would undoubtedly proclaim that the first quarter earnings reporting period has been G-r-r-r-r-r-eat!

What hasn't been so great is the stock market's reaction to it. Since JPMorgan Chase reported its results before the open on April 13, the S&P 500 has increased a measly six points.

With rounding, we'll call it unchanged, which seems completely out of line with the strongest earnings growth seen in nearly eight years.

What's the problem?

The market's behavior suggests this good earnings news was already priced in; moreover, there is a nettlesome sense that this earnings growth cycle is at, or near, a peak.

A Metamorphosis

Coming away from this week, just about every pundit will call attention to the guidance from Caterpillar (CAT) as the moment that crystallized concerns about being at, or near, peak earnings.

Briefly, after reporting some terrific first quarter sales and earnings, Caterpillar said it thinks its first-quarter adjusted profit per share will be its high-water mark for the year.

In effect, Caterpillar's revelation induced a metamorphosis in the stock market, which suffered a sharp reversal on the heels of that remark.

The truth of the matter is that there were latent concerns already about earnings growth nearing a peak. All Caterpillar did was bring those concerns to the surface.

To wit, there was ample talk throughout the first quarter about how good the earnings growth should be for the first quarter and all of 2018. Despite that talk, the S&P 500 on April 12 (the day before JPMorgan Chase reported) stood at nearly the same level it closed at on December 29, 2017 (2673.61).

A lot transpired between December 29 and April 12, including a big jump in earnings growth estimates on the heels of the tax reform plan, yet the earnings growth story didn't lead the market; it only supported it.

Is the Fix Due to Break?

The problem for the market now is that it seems to be at a loss for determining what will drive the market higher in 2018 if the strong earnings growth hasn't been able to do the trick.

One can argue, incidentally, that the projections for strong earnings growth this year pulled 2018 returns forward into 2017 and helped catalyze the January rally as a fear of missing out on further gains led to some speculative buying interest.

The fear now, then, is that the earnings fix is in and that rising input and labor costs are going to break things.

Several industrial companies have made note of rising input costs and so, too, have several consumer staples companies. Chipotle (CMG), meanwhile, has raised its menu prices to help offset higher food and labor costs.

On a related note, the first quarter Employment Cost Index revealed compensation costs for civilian workers increased 2.7% for the 12-month period ending in March 2018 compared to a 2.4% increase for the 12-month period ending in March 2017. Wages and salaries were up 2.7% versus 2.5% for the 12 months ending March 2017.

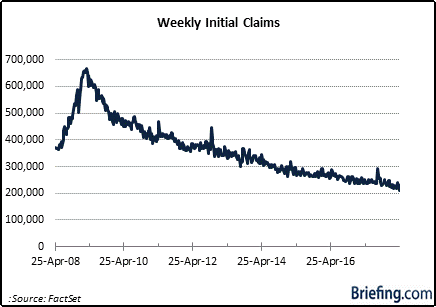

The latest initial claims report also created some anecdotal angst about the potential for wage-based inflation pressures to pick up.

There were 209,000 initial claims for the week ending April 21, which was the lowest level of weekly initial claims since December 6, 1969, and a sign of a tightening labor supply that typically precedes wage increases.

What It All Means

Companies confronted with rising costs have a choice. They can protect profit margins by passing those costs to their customers or they can eat those costs at the expense of higher levels of profitability, assuming they can't cut costs elsewhere and/or increase productivity.

If companies choose to pass the higher costs to their customers, that will likely spur increased inflation pressure as those customers pass the higher costs to their customers and so on. And, if inflation pressures go up, so will the Federal Reserve's proclivity to raise interest rates.

Conversely, if companies eat the higher costs, their profit growth won't be as strong and that will make investors more cautious about paying up for that earnings growth, which is to say valuation concerns will hold back their stock price.

It's a dilemma for the companies and a conundrum for the market.

What will it be?

Neither choice is a great option for the stock market to ponder, which is part of the reason this bull market has stalled in the face of really strong earnings growth.

Inflation could be going up and/or earnings growth could be slowing in the months ahead.

That understanding is the basis for the multiple compression seen this year, as investors recognize it's not a G-r-r-r-r-r-eat backdrop to pay a premium for future earnings growth that might not be all that it is expected to be.