It appears as though the rate on US federal corporate profits is going to be reduced. Although US corporations may be considered “people” in terms of the First Amendment, they are not “people” when it comes to paying taxes. Corporations are de facto tax collectors, not taxpayers. Real people ultimately pay the taxes in one way or another on the profits that corporations earn. So, why don’t we relieve corporations of their tax-collecting duties and tax their shareholders directly on the accrued profits of corporations in which they own shares as Laurence Kotlikoff, Boston U. econ professor, and 2016 write-in presidential candidate, has suggested? If this were done, the tax on dividends and, thus, the double taxation of corporate profits would be eliminated. Alas, this kind of tax reform is not in the cards, but a cut in the corporate profits tax would be a step in the right direction.

One of the arguments being made in favor of the cut in the corporate profits tax rate is that it would unleash a torrent of investment on the part of corporations. In turn, this increase in business investment would enhance the potential real growth in the economy and would increase the capital-to-labor ratio. An increase in the capital-to-labor ratio would raise the productivity of labor, which eventually would lead to an increase in real wages.

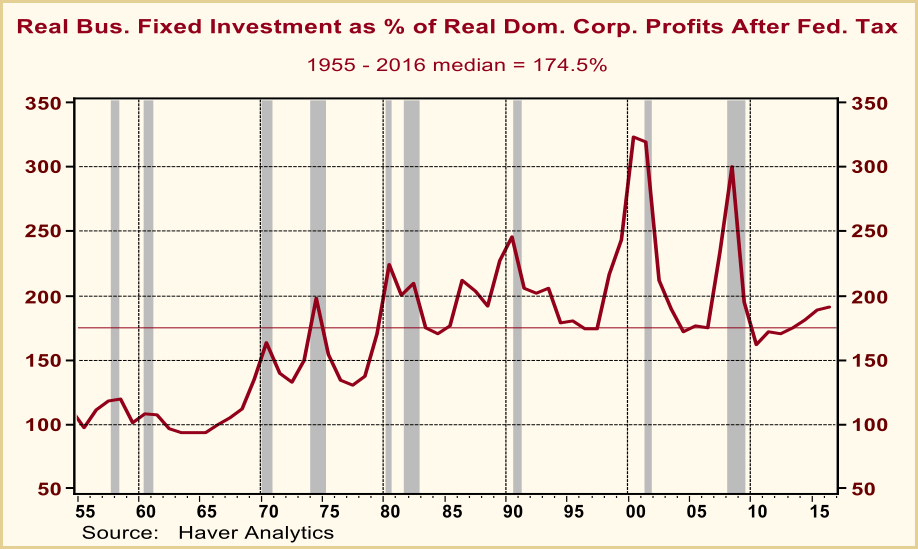

Whoa, Nellie! There are some ugly facts that counter this beautiful hypothesis. For starters, profits from domestic corporate operations after federal tax as a percent of GDP are relatively high in a historic context, as shown in Chart 1. From 1955 through 2016, the high in nominal after-tax corporate profits from domestic operations as a percent of nominal GDP occurred in 2012 at 7.6%. In 2016, after-tax profits relative to GDP stood at 6.9% vs. a median value of 5.5%. Despite corporate after-tax profits being relatively high, real business fixed investment (structures, equipment, and intellectual property products) as a percent of real after-tax corporate profits is not exceptionally high, as shown in Chart 2. In 2016, real business fixed investment was 191.5% of real after-tax corporate profits. Although this was above the median of 174.5%, it was well below the record high of 323.7% of 2000 or the near-record high of 300.7% in 2008. So, despite US corporate after-tax profits currently being high absolutely and relatively, real business fixed investment currently is not particularly high compared to real after-tax profits. Although a decrease in the corporate profits tax rate would, all else the same, increase after-tax corporate profits, it is not clear from the data presented in Charts 1 and 2 that an increase in after-tax corporate profits would result in a big increase in business fixed-investment spending.

It’s just a hunch on my part, but I suspect one of the most important factors driving business capital spending is actual evidence of demand for the products produced by businesses. The world might beat a path to my doorstep if I build a better mousetrap, but I’m taking a big risk if I scale up my better-mousetrap production capability by purchasing a lot of new equipment and the world, in fact, does not beat a path to my doorstep. This hunch on my part might explain why there is a high positive correlation, 0.70, between prior changes in real consumer spending and current changes in real business fixed-investment spending (see Chart 3).

Before betting that a cut in the corporate profits tax will result in an investment boom, it might be instructive to see what nonfinancial corporations have been using their after-tax profits for in recent decades. The data in Chart 4 show that starting in the mid-1980s, nonfinancial corporations stepped up their dividend payments and equity retirement (share buybacks) relative to their after-tax profits. How could the sum of dividend payments and equity retirement be more than 100% of after-tax corporate profits in some cases? Corporate borrowing.

In sum, by all means, cut the tax rate on corporate profits. But don’t expect the tax-rate cut to unleash a torrent of business investment spending. Currently, corporate after-tax profits already are high relative to GDP, yet business fixed-investment spending relative to after-tax profits is not exceptionally high. Moreover, in recent decades, corporations have shown a preference for using after-tax profits to pay out dividends and buy back shares rather than make capital investments.