In its April 2018 projections of the federal budget and economic performance based on current law out through FY 2028, the Congressional Budget Office (CBO) forecast the return of $1 trillion budget deficits by FY 2020 and budget deficits relative to nominal GDP of 5%+ by FY 2022.

As a percentage of nominal GDP, federal debt held by the public has been rising since the onset of the 2008 financial crisis. The CBO projects that the debt-to-GDP ratio will continue to trend higher over the next 10 fiscal years, reaching 96.2% in FY 2028, its highest percentage since FY 1946.

The 10-year cumulative change in the CBO’s budget forecast from its June 2017 report is a .6 trillion widening in the deficit. The principal factor accounting for the forecast widening in the deficit is 2017 federal legislative changes, which are projected to widen the cumulative 10-year deficit by .7 trillion.

In the ten years ended FY 2027, the CBO now projects cumulative federal revenues to be .0 trillion less than it did in June 2017. This decline in the revenue projection is dominated by 2017 legislative changes, primarily tax reform. The CBO now projects 10-year cumulative revenues to be lower by .7 trillion.

By FY 2028, the CBO is projecting that federal outlays will be 23.6% of nominal GDP, above its FY 1962 – FY 2017 median of 20.1%. By FY 2028, the CBO is projecting that federal revenues will be 18.5% of GDP compared to its 1962 – 2017 median of 17.3%.

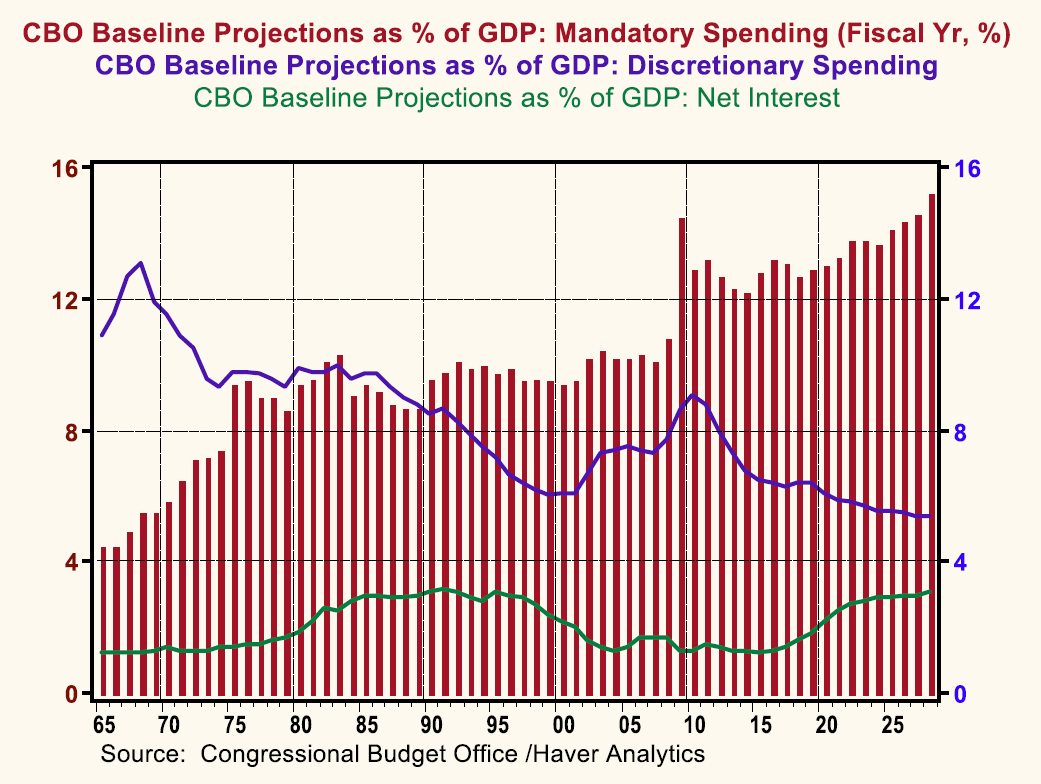

Mandatory spending (e.g., Social Security, Medicare and Medicaid) and interest payments on the rising federal debt are the drivers of the projected rise in total federal outlays relative to GDP in the next 10 years.

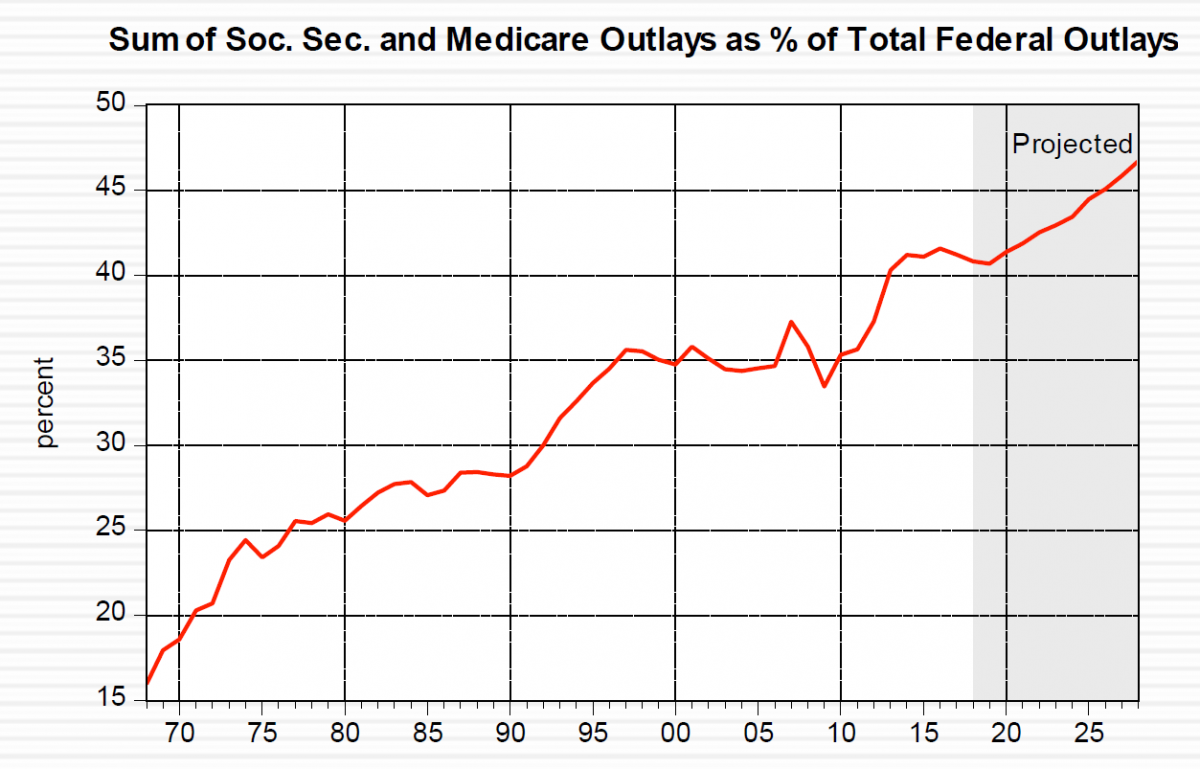

We have met the federal spending “enemy” and it is us – Baby Boomers! By FY 2028, combined Social Security and Medicare outlays are projected to account for almost 47% of total federal outlays.

Federal net interest outlays as a percent of total federal outlays are projected to rise from 7% in FY 2017 to 13% in FY 2028. So, by 2028, combined outlays for Social Security, Medicare and net interest are projected to account for 60% of total federal outlays.

In FY 2017, federal net interest payments were about 40% of the federal budget deficit. By 2027, interest payments are projected to rise to about 66% of the deficit. So, in 2027, 66 cents of every dollar the Treasury borrows is projected to go to debt service.

Key Variables that Determine the Ratio of Government Debt to Nominal GDP

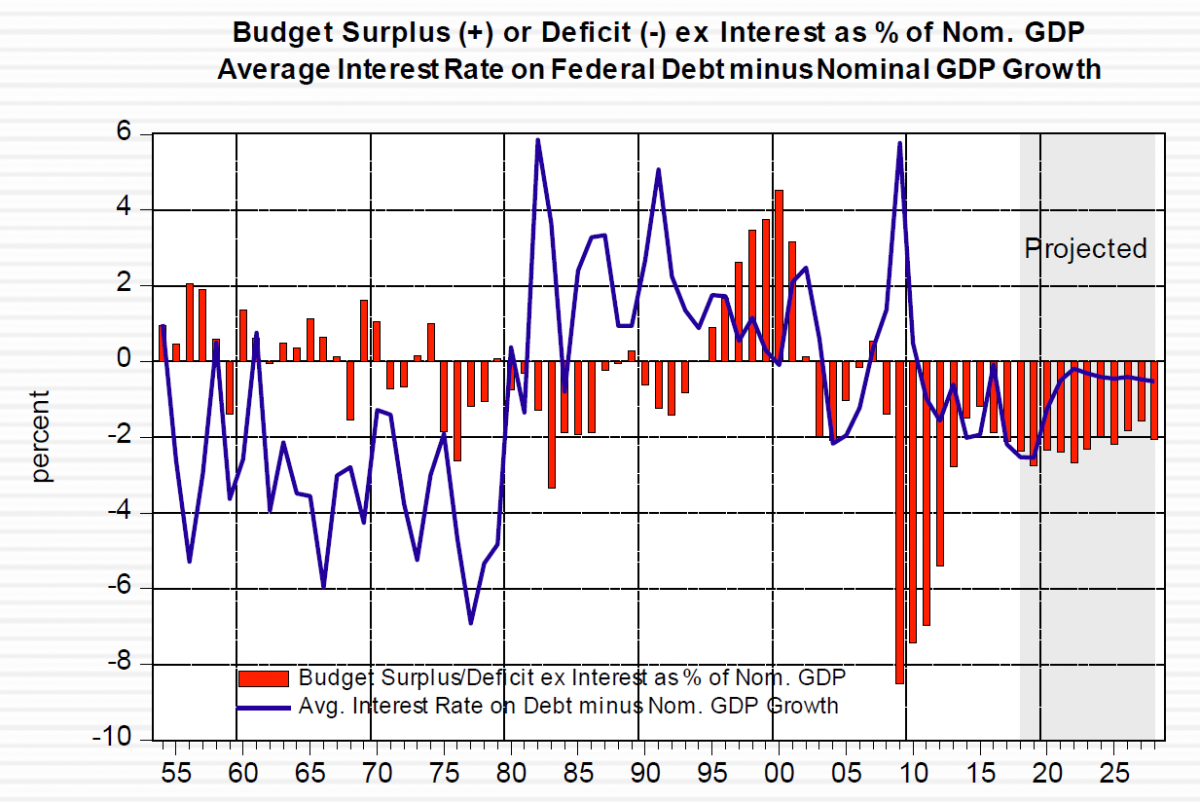

- The debt-to-GDP ratio depends on the average interest rate on outstanding government debt, the growth rate of nominal GDP and the ratio of the government budget balance excluding interest expense (often referred to as the primary balance) to nominal GDP.

- Specifically, the debt-to-GDP ratio = (the interest rate – GDP growth rate) minus the ratio of the primary balance-to-GDP.

- All else the same, if the average interest rate on outstanding government debt is greater than nominal GDP growth, the debt-to-GDP ratio will rise and vice versa.

- All else the same, if the primary balance is in deficit, the debt-to-GDP ratio will rise.

Conversely, if the primary balance is in surplus, the debt-to-GDP ratio will fall.

Over the next 10 years, the CBO projects that the primary deficit-to-GDP ratio will be around minus 2% and that although the interest rate on government debt will be below the nominal GDP growth rate, the interest rate level will be rising relative to the nominal GDP growth rate.

Based on CBO projections of the interest rate on government debt, nominal GDP, the nominal GDP growth rate and the primary budget balance over the next 10 years, the government debt-to-nominal GDP will be rising to levels not seen since the end of WWII.

Economic Implications of Our Current Fiscal Course:

1. Regardless of how it is financed – increased borrowing or increased taxation – Social Security and Medicare expenditures will account for a rising share of US GDP. This implies that there will be relatively fewer resources available for private and public investment. In turn, this will adversely affect the potential growth rate of the US economy.

2. All of our federal debt is denominated in US dollars. Although the US Treasury does not have the authority to create dollars at will, the Federal Reserve does. As the ratio of federal debt-to-GDP inexorably rises, investors might come to expect that the Fed will be coerced into funding the federal government deficit through the creation of “thin-air” credit. If the Fed acted as such, this would increase actual as well as expected inflation, which would induce the Treasury’s creditors to demand higher nominal interest rates on the new debt they purchase. Inflation and the level of nominal interest rates could spiral upwards.

3. If the conditions in Point 2 were to occur, the demand for Treasury debt on the part of foreign investors would wane, causing the U.S. dollar to depreciate vs. other currencies, which would reinforce U.S. inflationary pressures.

4. US federal debt service is projected to rise above 60% of the budget deficit by FY 2026. Unless the federal debt-to-GDP ratio can be turned lower in subsequent years, debt service as a percent of the budget deficit will continue to rise. Federal debt would explode to the upside as debt service approaches 100% of the deficit.

5. The U.S. federal fiscal position appears to be on an unsustainable path. Either federal taxes will have to be raised and federal expenditures curbed or a debt crisis will occur with upwardly spiraling interest rates and inflation.

6. In the words of the late Herb Stein, “If something can’t go on, it won’t.”

A nation is a net borrower when its goods/services spending is greater than its goods/services production. When a nation is a net borrower, the rest of the world is the net lender to it. The rest of the world is, in effect, lending goods and services to the net borrowing nation. So, if the US runs a trade deficit of $X billion, we get $X billion of goods and services from the rest of the world in exchange for out IOUs denominated in US dollars, which our Fed can figuratively print.

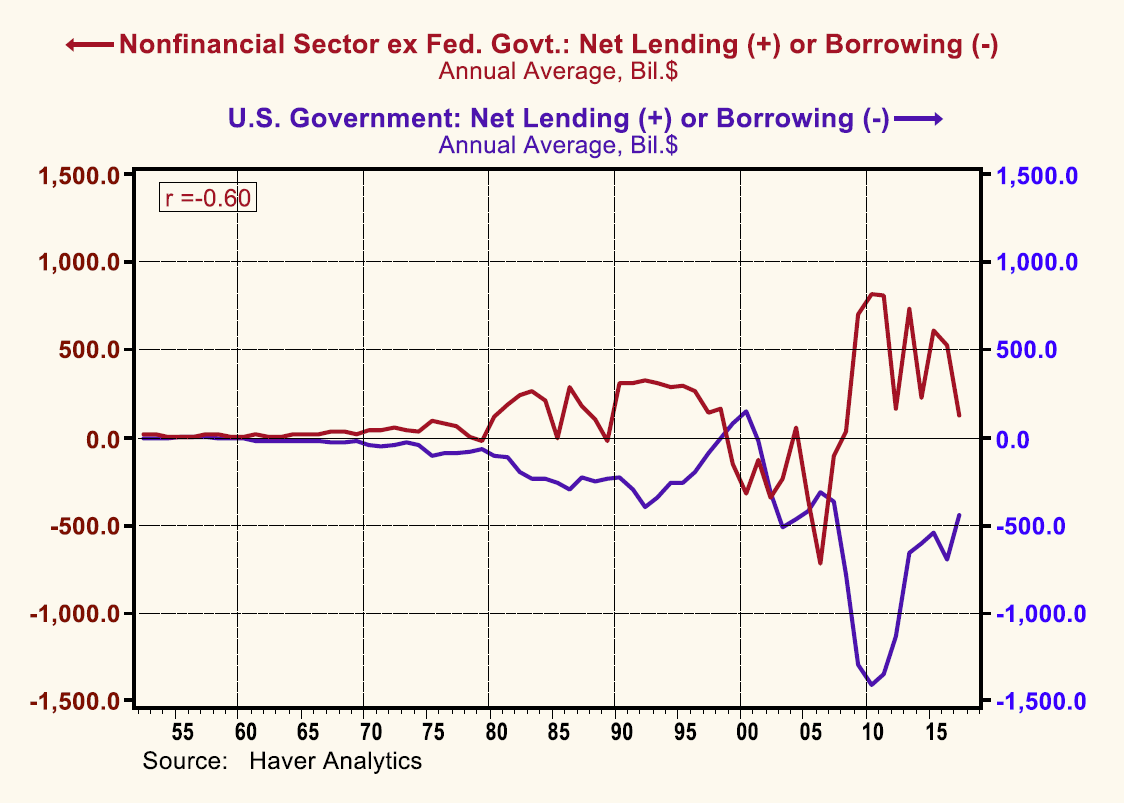

The US is a net borrower primarily because federal government net borrowing typically exceeds net lending by the rest of the nonfinancial economy.

So, the persistent and relatively large federal budget deficits have resulted in persistently relatively large US trade deficits. With federal budget deficits projected to increase over the next 10 years, it is likely that US trade deficits also will widen.

Someone once told me to cheer up because things could be worse. So, I cheered up and, sure enough, things got worse!