The stock market is just coming out of a big rogue wave event. And that gives us clues about what lies ahead.

The term “rogue wave” gets used in other areas of science, most notably in an analysis of big waves in the ocean. But they can occur in any medium where wave action is present, not just the ocean. They have even been observed in the transmission of light waves through fiber optic cables.

Rogue waves in the ocean get a lot of attention, especially from ship designers who need to make a hull and keel that are strong enough not to be broken by them.

Don't miss Positioning for a Peak in the Bond Market

A German research project known as MAXWAVE, funded by the European Commission, studied the phenomenon of oceanic rogue waves, and it had several findings that are relevant. First, a rogue wave seems to “borrow” energy from adjacent waves to build to a much greater height than the surrounding chop. Second, the height of the crest of the rogue wave above “sea level” is usually matched by the depth of an adjacent trough, making such waves all the more destructive to ships.

The third, and perhaps most significant finding, is that “ship accidents were found to happen mainly in fast-changing sea state conditions and in cases of crossing seas,” according to a paper by W. Rosenthal of the Institute of Coastal Research in Geesthact, Germany. I will get to why this point is relevant below.

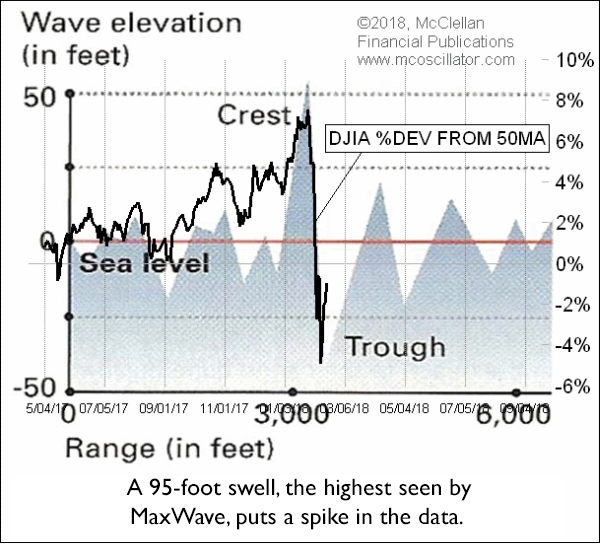

This diagram shows data from that MAXWAVE study, depicting the actual wave height of a rogue wave passing an oil drilling platform.

Notice that the peak and the trough are roughly equidistant from sea level. And that after the wave and trough pass by, the sea state returns back to sea level, with roughly even peaks and troughs afterward.

Rogue waves also occur in the financial markets. When I saw that MAXWAVE diagram a few years ago, it immediately reminded me of the 1929 stock market peak and the ensuing chaos. So I put together the twin images that I could see in my head, the better to see them together on the screen:

When applying this principle to the financial markets, the idea of “sea level” requires a little bit of interpretational latitude. Markets are not level, and they trend upward and downward. So if you substitute the idea of sea level with the word “trend”, then it all makes more sense.

Note in that comparison that in the 1910s and 1920s, there were normal oscillations above and below a median line. Then in the early 1920s, the oscillations quieted down, as the building rogue wave started to steal energy from the normal wave oscillation of stock prices. The price peak in 1929 was way above that median line, and then the trough in 1932 was equidistant below it (on this log-scaled chart). Afterward, the DJIA went back to oscillating up and down around the median line again.

The 1929 peak also fits the model of oceanic rogue waves by marking a “change in sea state”, ushering in a Great Depression, and fundamentally changing the banking system, the value of the dollar versus gold, the practices of workforce versus management, and other huge elements of how the economy operates. It also led to another world war.

That is of course not the only example of a rogue wave. The oil price peak in 2008 provides us another textbook example of this principle:

Note that prices saw normal oscillations above and below the median line, or trend. But then something changed around 2007, leading to the big blowoff up move to 5/barrel in July 2008, followed by the equally big drop to in December 2008. And after that low, crude oil prices returned back to the preceding trend, as a way of getting back to sea level.

In this example with crude oil prices, there is an additional cool element, in that there was a new equilibrium channel established after the 2008 low, and that channel saw its own miniature rogue wave in 2011. But all of this was part of a change in the “sea state” of the oil market, as fracking came to be a major factor, and OPEC eventually lost control of oil production quotas in 2014.

Coming back to the current day situation in the stock market, we have been seeing a steep uptrend in the stock market since the 2016 election. A steep uptrend makes it difficult to define “sea level”, or the trend for prices to return back to. But if we employ a plot of the SP500’s deviation from its 50-day moving average, that factors out the uptrend in prices and lets us see the wave action. Here is a plot of that deviation from the 50MA, compared to the MAXWAVE pattern:

The events in this rogue wave are obviously unfolding far faster than in the 1929 example. But the concept of fractal structures occurring on different time scales is nothing new in technical analysis. The stock market's mission from here is to get back to “trend”, whatever that is going to mean this time. It probably does not mean a surge to a higher high than the Jan. 26, 2018 price top, but just getting back up to the trend shown in the top chart would be quite a nice rebound.

And the final point, about rogue waves occurring at a change of sea state, provides us a lesson about what lies ahead. The summer of 2018 is not likely to see a continuation of the “Trump Trend” off of the 2016 elections. It is time to start being a market timer again.

Related Charts

Dec 10, 2010 After The Rogue Wave | Jan 18, 2018 Ending How It Began (Parabolically)? | Feb 23, 2017 Crude Oil Foretold the Trump Rally 10 Years Ago |