It is often difficult to ascertain the actual level of credit and liquidity in China, as the “shadow banking” segment is near $8.5 trillion strong. But China’s Total Social Financing (TSF) data, released Tuesday, attempts to do just that. China’s Leverage data came in hotter than anticipated, a Bernstein report noted. While the number decreased, it was due, in part, to a drop in shadow bank lending. But China’s Leverage reduction last month is not enough to satisfy the International Monetary Fund, which warned China is on a “dangerous trajectory,” as debt is being used to engineer growth to an unhealthy degree, a charge China denies.

China's Leverage TSF number hotter than anticipated, raising concern at the IMF

Amid deleveraging impacting corporates, state-owned enterprises and individuals, China was anticipated to have seen a July drop in TSF to nearly 1,000 billion yuan. That number came in at 1,220 billion yuan, down 32% on a month over month basis, as Chinese loan data in July is typically weaker than June. The problem for certain analysts is the loan data was 22% above consensus estimates, pointing to a growing leverage problem.

Bernstein’s Michael Parker, in a note out Tuesday, said the anticipated signs of credit tightening and deleveraging “are not in evidence again in the July data.” For Bernstein, they will let the July report pass but rather will watch for clearer signs of tightening in futures months.

The IMF was not as kind or patient.

You may also like Todd Mariano: Turkey Greater Risk than North Korea

"International experience suggests that China's credit growth is on a dangerous trajectory, with increasing risks of a disruptive adjustment and/or a marked growth slowdown,” the IMF noted, sounding a tone that would provide comfort to hedge fund managers such as Kyle Bass who have bet against the Chinese economy. China's own central bank has been critical of Chinese leverage practices, as well.

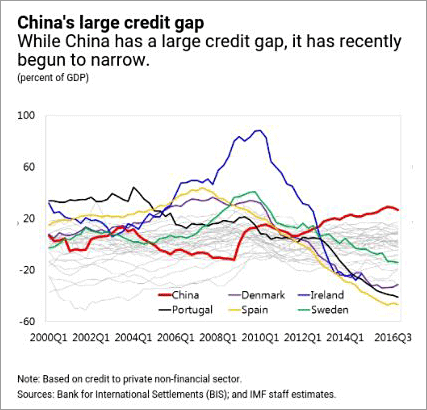

According to IMF projections, China’s debt to GDP, a measure of financial sustainability, is expected to reach 300% by 2022 as the nation sticks to an aggressive economic expansion plan. 2016 debt to GDP was estimated at 242%.

The IMF called on China to “intensify” its efforts to reduce leverage in their economic system, instructing the world’s second largest economy to “focus more on the quality and sustainability of growth, and less on quantitative targets.”

Don't let China's leverage get in the way of stock market investing, says Bernstein

While July lending data was down 32% month over month basis, a Reuters report, citing central bank data, noted that even with the decrease, July 2017 was nearly 49 billion yuan higher than July of 2014 and 2016.

China's leverage numbers in July represented a shift in many respects.

Medium- and long-term corporate loans were higher by 67.5% in the first half of 2017 compared with the same period last year, as efforts to dampen the hot corporate leverage arena appear to be falling short while, the report noted.

While household loans, primarily mortgages, fell to 561.6 from 738.4 on a month over month basis, the 31% drop was in line with the overall monthly decline and above expectations.

See also Reva Goujon: The Real Fight Is in Asia

Other monthly changes in the report included more loans provided through unregulated shadow banking appearing on official balance sheets at a time when the banking sector is growing in importance.

China’s banking sector is now “one of the largest banking sectors in the world,” the IMF noted, pointing to 310% of GDP, a number close to three times the emerging market average. “The sharp growth in recent years reflects both a rise in credit to the real economy and intra-financial sector claims. The increase in size, complexity, and interconnectedness of these exposures have resulted in sharply rising risks.”

China’s government pushed back, saying it was not debt that grew the economy in the first half of 2017, but efforts to rebalance the economy and it's own reform program that should be credited.

But don't let China's leverage report dampen investor appetite in the region. Bernstein thinks the leverage criticism is no reason to doubt China’s stock market. “There is nothing in the July data that – to us – would disturb the broadly positive mood around Chinese equities,” they wrote.

By Mark Melin