Fiat currencies have had nearly a 46 year run of success. But with cryptocurrencies “all the rage,” what Deutsche Bank Strategists Jim Reid and Craig Nicol call “inherently unstable” fiat currency system without any commodity backing might be coming to an end, they assert.

The end of a demographic trend will usher in another inflationary period, Deutsche Bank asserts

The idea of tying the supply of money to a commodity such as gold was that it kept government spending in check because money was in limited supply.

The US abandoned the gold standard in 1971, anchoring the currency’s value, not to a commodity but rather the faith in a government. This was followed by a sharp rise in inflation resulting in mortgage rates rising to near 20% annually by 1981. The resulting debasement of currency value and loss of buying power might have ended the fiat monetary system if it were not for the deflationary period that came along in the 1980s.

This gentle deflationary trend is about to come to an end, Reid and Nicol think.

Listen to Alejandra Grindal on Demographic Demise or Opportunity?

“The basic premise is that a fiat currency system - the likes of which we’ve had since 1971 - is inherently unstable and prone to high inflation all other things being equal,” they wrote in a November 1 report titled “The Start of the End of Fiat Money?”

The research duo believes that is evidence the deflationary forces are slowly reversing.

“If we’re correct, the fiat currency system may be seriously tested over the coming decade and ultimately we may need to find an alternative,” they wrote, pointing to a longer-term trend that might lead to cryptocurrencies.

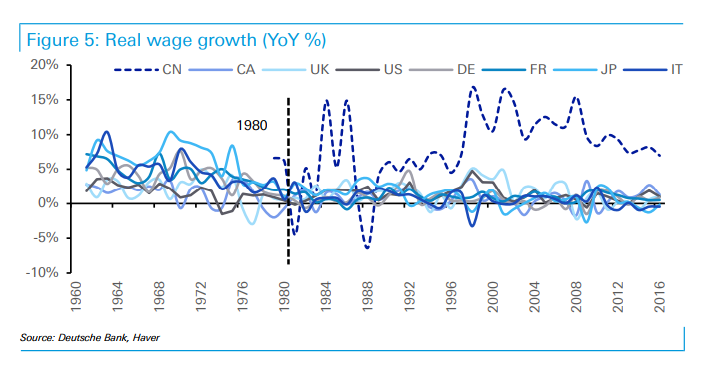

They think inflation has been tame due to demographics, China, and globalization. With younger workers keeping wages competitive along with China and jobs moving overseas, there was a 35 year period of growth that didn’t occur with significant wage inflation. This trend could now be reversing.

“Given we know that demographics are now slowly turning, it’s possible that a new era is slowly emerging towards higher wages, which will perhaps be encouraged by the rise in populism,” they write.

The political trend to address the rising tide of populism will lead to higher wages and inflation, which will be the end of fiat currencies, Deutsche Bank says

The trend towards populism, which is now being addressed by the "establishment" to various degrees, is based on several tenants, among them the relatively stagnant wages for the working class. If this starts to change, what could quickly result would be inflation. This is particularly true as the developed world and China engineer an economy built on significant levels of government, corporate and consumer debt.

The report notes that reversals in the “demographic supercycle” could lead to 1970s style inflation and ultimately a loss of faith in fiat currencies.

The counter-argument to this runaway inflation thesis is that technology and advances in artificial intelligence are likely to lead to significant job losses, which is deflationary as all worker’s value is lessened.

But in the era of battling populism with faith in the system, Deutsche Bank doesn’t see this happening. They say technology is likely to create more spending and newer jobs, as well as a political environment that likely will not be deflationary:

If technology destroys jobs and worsens the position of workers further we suspect populism would get a further push into the mainstream and force governments to pursue policies that specifically help the lower half of the income spectrum. This could be existing governments or new administrations swept into power under the power of populism. At the most extreme you could easily see moves towards Universal Basic Income. As a minimum you would expect more fiscal spending aimed at this cohort. Both would be inflationary all other things being equal. So in an era of bubbling populism we don’t think you can destroy the power of labor any more without seeing a major policy response and one that is likely to be inflationary.

They see that with demographics slowly turning, an era of higher wages for the middle and working class is on the horizon. “As such, will fiat currencies survive the policy dilemma that the authorities will experience as they try to balance higher yields with record levels of debt? That’s the multi-trillion dollar question for the years ahead.”