Standing at the Crossroads

There are decisive moments in an individual's life. These epiphanies become turning points or doorways into the future. They are the fork in the road—a crossroad where decisions become life-altering experiences. We can probably count these moments on one hand, but they likely determine our life's successes or failures. In my fifty-plus years, I have faced five of them.

The first crossroad I faced was during the Vietnam War. I made a decision after leaving the army to go to college and pursue a degree rather than pursue a trade. The second fork in the road came when I met Mary. As a recent college graduate, I had two full scholarships to graduate school: one to Patterson School of Diplomacy in Kentucky and the other to Thunderbird (American Graduate School of International Management) close to home. I chose Thunderbird (accounting and business) over Patterson (politics and diplomacy) to be closer to my future wife—a decision I've never regretted.

The other forks in the road were along my career path. In 1979, I left the corporate world and decided to enter into the new field of financial planning. In 1985, I made another crucial decision to move into money management. Also at this time, I made a personal decision to return to my faith. The last turning point came when I made a decision to publish a newsletter for my clients on the Internet. I had no idea at the time that our website and my radio show would become what they are today. I started publishing my newsletter on the internet as a way to stay in touch with my clients. Since then, I've made numerous, faceless connections around the world. They have become not only good friends but also resources for information that I can tap into when I need answers to questions I have about the financial markets. I've also taken on clients from different states and foreign countries through their exposure to my site. Internet technology still amazes me to this day.

In 1992, a friend of mine had a keen interest in the Internet. We experimented with a site and produced a stock market report on the web back in 1993. But I doubt anyone was listening. Hardly anyone owned a personal computer at the time. It was a bit cumbersome, and I decided to concentrate on other things. I abandoned the Internet for television and daily radio. Back in 1992, I thought that the Internet was too technical and would never amount to much. Was I ever wrong! But my friend persisted. When he developed software for template websites, he asked me to be a beta test site in 1997. His software program became the original genesis of Financial Sense Online. From that point forward, our site has grown as a result of thought-filled days on my sailboat and my wife's imagination and creativity. My Storm Series was the product of an actual storm that scared the living daylights out me. As we were trying to make it back safely into port, I had a lot to think about—my life being one of them. Although my life was probably never in any real danger, it seemed so at the time. It was, however, an experience that gave me pause for reflection, especially on what was going to happen to the financial markets. The result was my Perfect Financial Storm Series that became widely read around the world. What happened to my friend and his software company? He sold his business for millions at the peak of the dot-com craze and now resides on a quiet island off the coast of Florida.

Investment Crossroads

You may wonder why I'm telling you all of this. Perhaps you too have found yourself in similar situations—crossroads in your life—where a decision you made altered the course of your life. There are similar crucial intersections in the investment markets. This similarity caught my attention when I recently read Marc Faber's The Gloom, Boom & Doom Report. In his February 28th newsletter, Marc wrote,

...an investor could have done very well over the last 30 years with just a handful of investment decisions. In 1970, a long-term investor should have bought gold, silver, and oil (commodities); in 1980, he should have sold his gold and oil and bought Japanese stocks; then, in 1989, he should have switched out of Japanese stocks into the S&P 500 or, ideally, into the Nasdaq, which he should have sold at the beginning of 2000.[1]

Faber succinctly expressed what I have found to be true: market leadership changes over time. As wise King Solomon wrote, there is a time and season for everything. Once a long-term trend is broken, another trend replaces it. Faber continues,

At such milestones in financial history, the rules of the investment game are altered; but alas, the vast majority of investors continue to play by the old rules and therefore either lose money or miss out on the substantial capital gains which the new opportunity or leadership brings about! I suppose that one reason the road to ruin is broad is to accommodate the vast amount of travel in that direction! The key to successful investing is to understand that, with nearly 100% certainty, the bursting of a bubble leads to a permanent change in leadership.[2]

Faber believes that commodities may be the investment markets next leader, especially gold and silver. I concur.

A Review of the 50's Bull Market

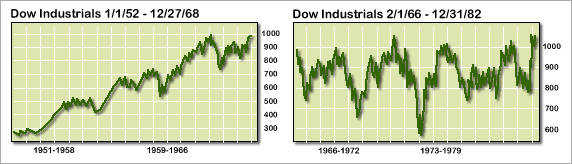

In my humble opinion, natural resources will become "The Next Big Thing." In a moment, I'll explain why. But first, it is important to look at the evidence of what Faber purports in his February newsletter. The first graph below depicts the bull market that began during the 1950's. Since the great stock market crash of 1929, it took the Dow Industrials 25 years to regain its former high reached in the fall of 1929. The 50's bull market reached its climax in the mid-60's. From that point forward, the stock market went through a series of highs and lows that culminated in the 1973-74 bear market. As the second graph of the Dow illustrates, the stock market would go virtually nowhere for 16 years. In fact, during the 1970-72 period, the only stocks that did well were the Nifty-Fifty stocks. These were the must-own stocks like Polaroid, Xerox, Disney, IBM, and McDonalds. The rest of the markets, other than a few individual blue chips, did poorly after the mid-60's.

The 70's Market

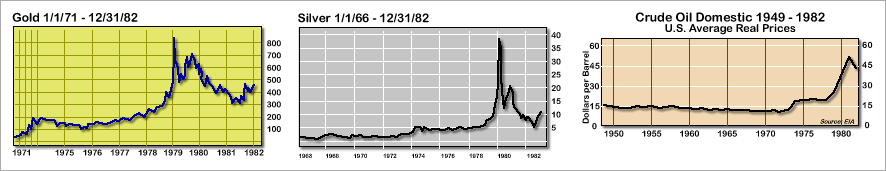

This next series of graphs depict what happened to the price of gold, silver, and oil during this period. The 1970's was an investment era dominated by the commodity markets. Investors had lost faith in paper assets. The Fed was inflating the money supply; gold no longer backed the dollar, and inflation was heading towards the double-digit level (a product of the debasement of the US currency). During the 1970's the price of gold was liberated from the control of governments. In the late 60's, governments were trying to curtail the price of gold as they are today. Back then the London Gold Pool kept gold prices suppressed. The US government began running a deficit. The Federal Reserve convinced the leading central banks of the world to form a selling consortium. They supplied gold to the pool. This pool was used to prevent gold prices from exceeding .20 an ounce. The manager of the pool was the Bank of England. The London Gold Pool collapsed in 1968. France withdrew from the consortium and began exchanging its dollars for gold. Eventually, as other foreign governments exchanged their dollars for gold, there was a run on US gold reserves. President Nixon was forced to sever the link between gold and the dollar in August 1971. From that point forward, the US government and other governments around the globe were free to inflate their currencies and run perpetual budget deficits. The era of deficit spending had begun, and it continues today.

During the 70's the US experienced a loss of confidence in government and financial paper. This period is now considered by many to be a series of policy failures that directly contributed to a rise in inflation. Investors preferred to put their money with tangibles rather than intangibles. These graphs of gold, silver, and oil show the tremendous price growth of essential commodities during this time. Other products such as grains, cotton, and base metals also rose in value. Everything tangible from gold, oil, real estate, and rare art to collectibles rose in value. The stock markets languished during this same period as reflected in the previous graphs of the Dow Industrials. If you made money in stocks, it was mainly in small cap companies or the commodity producers.

| S&P 500 Ten Biggest Stocks (Index Weight) | |

| 1970's | |

| IBM | 4.3% |

| AT&T | 3.8% |

| Exxon | 3.8% |

| Standard Oil Indiana | 2.5% |

| Schlumberger | 2.4% |

| Shell Oil | 1.9% |

| Mobil | 1.9% |

| Standard Oil California | 1.8% |

| Arco | 1.6% |

| GE | 1.5% |

| Source: WSJ 8/27/99 and Bloomberg | |

The table of the top 10 capitalized companies within the S&P 500 shows that seven out of the top companies were oil related.

The Bull Market's Return Beginning With Japan

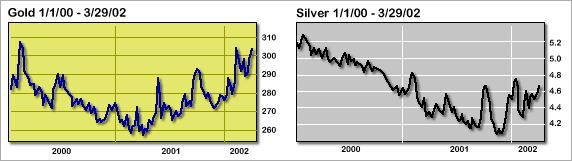

As the next graphs show, by the time the investment public began selling their silverware and jewelry, with silver at an ounce and gold over 0, the era was ending. The next big thing was about to begin. It wasn't gold, silver, or oil. It was Japan. The bull market in equities was about to begin again, and its epicenter was Japan. The Japanese stock market began a bull run that took the Nikkei from a low of 6475 in March of 1980 to a high of 38,274 in January of 1990 or a gain of 491%. The financial press eulogized the Japanese business model. Government officials talked about emulating the Japanese style of intervention, control of the economy, and industrial enterprise.

The era for investing in Japanese stocks came to an end when Japan's Central Bank decided to puncture the bubble by raising interest rates. The Nikkei has never recovered. As of today's Storm Update, it closed at 11,335—down over 70% from its peak. Since its zenith, Japan's economy has been mired in several recessions. Their once dominant banking institutions are now on the verge of bankruptcy. Prime ministers come and go with the people of Japan no longer having faith in their government or their financial institutions. They are now buying gold.

The US Market's Glory Days

Source: Federal Reserve

As Japan's stock market reached its pinnacle, the US equity markets were ready to take its place. The US stock market had risen steadily throughout the 80's, but not to the same degree as Japan's stock market. That would change the inflationary monetary policies of the Clinton Administration. A series of crises beginning with US banks and S&L's in the late 80's, and early 90's would enter a period of monetary and credit inflation, the likes of which we have never seen in history. The 90's were followed by one financial brush fire after another. It began with the bailout of the S&L's and continue to this day.

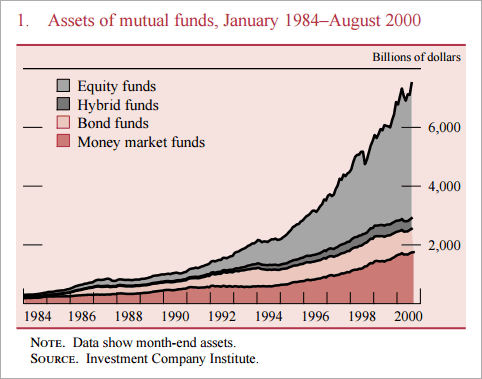

Throughout the decade, flooding the financial markets with money became the standard remedy for putting out fires in the financial system. It didn't matter whether it was Mexico and derivatives in 1994, Asia in 1997, Russia and Long-term Capital Management in 1998, Y2K in 1999, or the recession and Trade Center attack of 2001. The standard prescription for any crisis was and is to flood the system with money and credit. The result is that the outlet of much of that money creation moved into the financial markets beginning in 1995. From 1995 to 1999, the stock exchange experienced back-to-back years of double-digit returns not seen since the mid-1920's. It was also a period that the public came back to the stock exchange. Lured by double-digit returns and a quick way to wealth, the small investor bought into the stock market thereby contributing to the final stages of the bull market. You can see this rise in the graph of mutual fund assets, which grew disproportionately during the last years of the decade. Up until the mid 90's, most investors had their money in fixed income investments like GICs in their 401(k) plans, Treasury, and corporate bonds, or bank CDs. With fixed investments offering double-digit returns throughout the 80's and high single-digit returns in the early 90's, investor preference was for safety.

Investor preference changed with the monetary inflation and credit expansion that became the hallmark of the Clinton Presidency and the strong dollar policy of Robert Rubin's Treasury. Administration policy created the greatest monetary and credit expansion the world has ever seen. The outlet for much of this credit creation found its way into the stock market. As the graphs of M-3 and the Nasdaq show, the stock market—especially the Nasdaq and technology stocks—became the magnet for much of that money creation. The public received a constant diet of the new financial media and Wall Street about a new era of American companies. The endless hype, combined with the flow of easy money, created the market myths and shibboleths of the period. This period ended during the first quarter of 2000.

Trends are Never Permanent

The big question going forward is this: did the bubble-like conditions of the stock market finish in 2000 or was it simply a change in leadership within the stock market from technology to other sectors? Since the major markets hit their peak, only the Nasdaq has suffered significant losses. The Dow and the S&P 500 have both lost money, but not to the same extent as the Nasdaq. As Marc Faber makes clear in his February newsletter that if there were a complete stock market bubble, as had been the case in 1929 and Japan in 1989, then apparently a new leadership in an asset class other than the US stock market should be expected. He wrote, "If we can be sure that in 2000 a major US stock market mania reached a climatic peak, then it is futile for the average investor even to try to play bear market rallies."[3]

At this point, it can be safe to draw some conclusions from the above charts. Trends in financial markets are never permanent no matter the market. The 1990's bull market yielded oversized returns supported by easy money and credit. The new investment mania that produced these returns meant that lower profits would probably follow. The bust of the 30's followed the boom of the 20's. The 50's and 60's bull markets were developed by the commodity bull markets of the 70's. As commodity prices peaked, another bull market in financial assets replaced it beginning first in Japan and then in the US In the case of the US, the boom fed into an investment mania, which has only started to unravel. This unraveling is now working its way through the accounting scandals that are so prevalent in today's headlines. The earnings manipulations have shattered the "new era" earnings phenomenon. The earnings myth was a result of creative accounting more than it was a new era in earnings productivity.

Debt Fuel

Everything about the late 90's was a myth disguised to cover up the greatest monetary and credit expansion in US history. What made the 90's boom so unique is that government, private households, and businesses embarked on a spending and borrowing spree never before seen in history or any other nation. The government continued to borrow and spend as never before. The budget surpluses were the figment of the imagination of government bureaucrats and a powerful White House spin machine. The government debt ceiling was increased by half a trillion dollars back in 1997. Now, five years later, the US finds itself in a position of having to increase the national debt ceiling by another 0 billion. How can you have a balanced budget with annual surpluses and have the national debt growing by half a trillion dollars?

Everything about the late 90's was a myth disguised to cover up the greatest monetary and credit expansion in US history. What made the 90's boom so unique is that government, private households, and businesses embarked on a spending and borrowing spree never before seen in history or any other nation. The government continued to borrow and spend as never before. The budget surpluses were the figment of the imagination of government bureaucrats and a powerful White House spin machine. The government debt ceiling was increased by half a trillion dollars back in 1997. Now, five years later, the US finds itself in a position of having to increase the national debt ceiling by another 0 billion. How can you have a balanced budget with annual surpluses and have the national debt growing by half a trillion dollars?

During this same period, while government debt and spending were growing, debt was piled up at the consumer and business level. Consumers borrowed to pay for consumption and speculate in the financial markets. The escalation in consumption and debt accumulation resulted in the actual disappearance of personal savings. Private sector savings dropped dramatically and at one point turned negative.

Business debt also increased during this period, but not for reasons that would have higher productivity, profitability or increased economic activity. Instead, companies borrowed to buy back their shares and drive up earnings per share and consequently company stock prices. The debt also appeared in mergers and acquisitions of other businesses. Capital investment during this period fell to postwar lows. The much-heralded technology boom was another figment of the statisticians. Actual business spending on computers during the last half of the 90's increased by only .2 billion to .8 billion. The use of hedonistic pricing turned that small investment into an increase of 0 billion. The only problem with the 0 billion number was that those dollars were never spent or received by anyone.

What we know now is that the miracle productivity and investment boom of the last decade were more fiction than reality. A healthy economy grows on a sound basis with savings, investment, and profits that produce the income. An economy needs to grow to create enduring wealth. Just the opposite occurred. The capital consumed as savings fell with modest gains, and debt supplemented income. These are all the hallmarks of a bubble economy, not a miracle economy. It is one reason that the current economic recovery will be shallow and short-lived. In fact, the current recovery could also turn out to be nothing more than a recessionary rally. Just as bear markets occasionally rally, so do long lasting recessions and depressions. The US economy during the depression years of the 1930's and Japan in the 1990's and today are perfect examples of this phenomenon. Contrary to popular opinion, investment and not consumption leads and gives economic recoveries their real strength. It is one reason Mr. Greenspan hedges his speeches about economic recovery by saying, "growth of activity will be short-lived unless sustained increases in final demand kick in before the positive effects of the swing from inventory liquidation dissipates".

Where will this sustained final demand originate? Will it come from consumers going even deeper into debt or businesses leveraging up their balance sheets? In the case of business, just the opposite is true. Many major corporations are now in the process of shedding plant, equipment, and employees, and liquefying their balance sheet. From a macro sense, this reflects a contraction in the economy, not an expansion. The other aspect that makes a compelling argument against another stock market or economic boom is the self-cleansing process that typically takes place during recessionary periods. It hasn't happened this go-round. Just the opposite is true. Instead of debt liquidation, it increased by trillions of dollars. Savings fell as consumers continued to go deeper into debt to maintain living standards. According to The Wall Street Journal, unlike the last recession in 1990 where consumers cut debt by 0, this time, average household debt increased by ,420. Mortgage debt also increased as families extracted more equity out of their homes, which fed into consumption throughout the recession.

So if an economic recovery and another bull market take place, it will be entirely based on the continuation of debt accumulation by businesses and consumers and deficit spending by government. It will also take the willingness of foreigners to finance America's huge trade and investment deficits. It is for these reasons that I believe that the bull market ended during the first quarter of 2000. The stock market may rally, but I think these brief upward blips will be bear market rallies and nothing more. With government help, the markets could go through a similar period as shown by the late 60's and 70's, with short rallies punctuating a long bear market.

Basic Needs and Population

My observations lead me to believe the next big move will be in commodities. I think it will drive supply and demand factors and abet by a growing world population. Food, water, and energy are necessities. These items aren't optional but are considered necessities of life. Without them, civilization would perish. At the end of the last century, the world population was estimated to be 6 billion. By the year, 2020 global organizations from the World Bank to the UN estimate the human population on this earth will grow to 9 billion people, a fifty percent increase from where we are today. This population growth will become the primary driver of the demand for commodities of all kinds, will particular focus on clean water, energy, and food. This requirement for basics will take place regardless of the condition of the economy be it inflationary of deflationary.

Price Suppression

Another factor that will drive the next boom in commodities is the suppression of their price by financial instruments known as derivatives. Currently, the paper markets control the physical markets for essential commodities. Look at low prices for any valuable commodity. The chances are that significant short positions enhanced by leveraged derivative contracts have driven down their price. Once the world's monetary system became decoupled from gold, credit expansion took on a new dimension.

During the 1980's governments turned to central banks to help them out of an inflationary spiral. The answer was to expand credit and transfer it outside the primary banking system. In essence, the mechanism for creating credit was the financial system, and it became the central driving force behind monetary expansion. The inflationary impact of credit expansion manifested itself most directly through the financial system through debt instruments such as collateral mortgages and the securities markets. This enormous credit creating mechanism enabled the explosion of fixed plant and equipment on a global basis that has created the glut in manufacturing that we now see globally in just about every industry but essential commodities. The error in this policy was not to recognize the inflationary impact of these policies. Instead of showing up in the inflationary figures, they showed up in the financial markets and the excess capacity of all manufactured goods.

Resolving Crises Through Monetization

To maintain and keep this new system functioning, it became necessary for central banks to keep the financial system liquefied. That is why central bankers move expeditiously to contain any monetary fire whether it is Mexico, Asia, Russia, or LTCM. Since we now operate on a debt-based system, it is necessary to keep the system sufficiently liquid by additional injections to maintain the system from imploding or contracting. Since debt represents borrowed money, when it destroys or disappears through bankruptcy or default, it is replaced by additional infusions of money into the system.

By maintaining confidence, the system must continuously be fed with new funding to keep the system from contracting or imploding. For close to a decade, it has become necessary for central bankers and especially the US Fed to maintain the credit doors always open. If the bond market was to collapse from defaults or credit was to dry up, the system would fall from its weight. This support has become an absolute necessity to maintain the credit mechanism functioning. The stock market also plays a crucial role in keeping the household sector afloat. As collateral for a loan, rising housing, and equity prices provide the insurance and the cushion that allows for even more borrowing.

The Fed addressed the importance of monetizing the financial markets in its July 1999 discussion paper #641. In this article, Fed analysts Karen Johnson, David Small, and Ralph Tryon make the case for propping up the stock market should be monetary policy through money creation, and interest rate reductions fail to resuscitate the economy. If monetary policy should fail or if the stock market was to collapse, the Fed would be facing its worst nightmare deflation. They have been fighting the inflationary battle not recognizing its new form in the financial system. As generals who always want to fight the last war, the Fed has been fighting inflation without acknowledging that it is deflation that is knocking on its door. The deflation that is coming will affect those areas that were significantly impacted by credit. First among them is the financial system in both the stock and bond markets. Next it will be real estate.

Central Bankers' Two-Front War

For these reasons it has been necessary to maintain confidence in all things financial be it stocks, bonds or currencies. Central bankers are fighting a two-front war. One front is in the financial system that requires constant injections of liquidity to hold back the debt defaults and prevent the system from collapsing. The other battle is to avoid users inside the system from shifting their funds to an alternative medium such as gold, silver, oil or any other tangible good that would compete with paper and credit. It is a lot like a fork in the road. On one side is the credit and paper money system that makes up the world's financial system. On the other road are tangible goods such as base metals, oil, silver, and gold. The war is a constant battle where the public must corral on the one side of the road. Therefore, in a crisis, the only alternative is to shift from one paper asset to another rather than exit the system on the other side of the road.

Control by Derivatives

Battles continue to wage through the derivative markets. The use of leverage afforded by derivatives allows a relatively small amount of money (estimated to be approximate 0 billion) to control the world's commodity markets. You can see this very easily in the commitment of traders reports on any of the major commodity exchanges and zero in on the short positions. It is also apparent in the energy markets and in the silver and gold markets. In each of these markets, a small leveraged short position through derivatives has kept prices suppressed. It is the main reason despite growing worldwide demand for gold, silver, and oil, and their prices have declined for the last two decades.

HUI Index (Amex Gold Bugs Index) as of 2/4/02

This current system is very similar to the 1960's London Gold Pool, except that it is now on a much wider scale. The central bankers are aided and abetted in this task by the world's investment banks who have become allies in waging this two-front war. In my estimation, this is one reason for the explosive growth in the derivative markets over these last few years. The derivative book of our seven (in reality three) top banks have grown by double digits each year as the graph of derivatives by type above illustrates. There is a desperate battle waging in the precious metals markets. Gold has been the world's strongest currency over the last two years. While the yen, Euro, and the dollar have lost purchasing power, the price of gold has risen. In the financial markets, as shown by these graphs of the HUI, gold and silver mining shares have increased substantially. That is why central bank gold sales, gold leasing, and short sales of silver have grown to such magnitude. I believe the most subtle message here is in the rise of the price of gold and silver mining shares. They are growing as a hedge against the systemic failure of the credit-based financial system and as an alternative to a breakdown in the stock market. You can also throw in geopolitical tensions of the war against terrorism and the violence in the Middle East.

I will continue to elaborate on these issues in much greater detail in the forthcoming installments of Powershift. Reluctantly, I now believe that my Perfect Financial Storm thesis will become a reality. It will be the result of the central bankers' two-front war in the financial markets. Deflation will be the outcome of most of the economy because of the breakdown and contraction of credit. Concurrently, we will see inflation in the commodity markets because of their decade's long suppression. Study these charts of the financial markets, gold, silver, and oil again. I believe "The Next Big Thing" has already begun. Since 2000, energy, gold, silver, water, food, and most essential commodities have outperformed financial assets.

One final note. When I completed the Storm Series, I felt the need to continue to inform my visitors of potential storm clouds on our horizon. Since then, we have developed several resource pages of particular interest with the storm scenario. I would like to recommend that you occasionally visit Storm Watch, Precious Metals, and Energy resource pages. We include daily news stories, broadcasts, articles and commentary by experts in the investment fields. We even archive the stories as there are many. You will find these resource pages tell a compelling story. Remember the adage, "The trend is your friend." I hope that this site will help you discern the pattern.

Endnotes

- Faber, Marc, The Gloom, Boom & Doom Report, Marc Faber Limited, February 28, 2002, p. 5.

- Ibid., p.5.

- Ibid., p.5.