"This comment usually gets a hearty laugh, which merely goes to show how little most people have determined it actually to be a problem. But consider how many times has the following sequence of events occurred? For a full year, you trade futures contracts, making $1000 here, losing $1500 there, making $3000 here and losing $2000 there. Once again, you enter a trade because your (trading) method told you to do so. Within a week, you’re up $4000.

Your friend/partner/acquaintance/broker/advisor calls you and, looking out only for your welfare, tells you to take your profit. You have guts, though, and you wait. The following week, your position is up $8000, the best gain you have ever experienced. “Get out!” says your friend. You sweat, still hoping for further gains. The next Monday, your contract opens limit (down) against you. Your friend calls and says, “I told you so.” You got greedy. But hey, you’re still way up on the trade. “Get out tomorrow.” The next day, on the opening, you exit the trade, taking a $5000 profit. It’s your biggest profit of the year, and you click your heels, smiling gratefully, proud of yourself. Then, day after day for the next six months, you watch the market continue to go in the direction of your original trade. You try to find another entry point and continue to miss. At the end of six months, your method finally, quietly, calmly says, “Get out.” You check the figures and realize that your initial entry if held, would have netted $450,000.

So what was your problem? Simply that you had allowed yourself, unconsciously, to define your “normal” range of profit and loss. When the big trade finally came along, you lacked the self-esteem to take all it promised—who were you to shoot for such huge gains? Why should you deserve more than your best trade of the year? Then you abandoned both (trading) method and discipline. To win the game, make sure that you understand why you’re in it. The big moves in markets only come once or twice a year. Those are the ones which will pay you for all the work, fear, sweat, and aggravation of the previous years. Don’t miss them for reasons other than those required by your objectively defined method. The IRS categorizes capital gains as “unearned income,” that’s baloney. It’s hard to make money in the market. Every time you make, you richly deserve. Don’t ever forget that."

... Robert Prechter – the Elliott Wave Theorist (1992)

“Do you sincerely want to be rich?!”

What a great question! I recently reread the above quote from Bob Prechter. It’s an excellent quip and virtually everybody can identify with it. On the surface the question seems laughable; who can’t accept huge gains? But in order to set yourself up for such gains, you have to possess the courage to take an oversize position and maybe even leverage it. That kind of risk takes stomach and fortitude. Many times I have waited for the right moment, the big move, and decided against it. Maybe it was because I chickened out. While I often rationalized the hesitation away, the real reason I did not act was the emotional strain. Yet, I know myself and have learned that emotional actions are failures most of the time. What one has to do is be able to step outside of themselves in an objective fashion. When you do that, it’s kind of like seeing things in slow motion. You are calm, objective, and can see ahead, perceiving the proper sequence of events. You just know you’re right and you act.

We first scribed the preceding prose in 2009 when we were telling investors a new secular bull market had begun. Like our long-departed friend Stan Salvigsen (Comstock Partners) wrote at the start of the great secular bull market in 1982 in a reference to surfing, “If you want to catch a wave you need to grab a board and get into the water!” The same can be said given the recent stock market gyrations. As often stated in these missives, the bottoming sequence was “textbook.” The decline arrived almost perfectly on schedule. So did the “selling climax low” of Tuesday (2-6-18). We said that the subsequent “throwback rally” would fail to lead to either a retest of the selling-climax lows, or if perfect, an undercut of those selling-climax lows, which we would buy. BINGO, the undercut lows came on 2-9-18 and what followed was roughly a 220-point rally by the S&P 500 (SPX/2747.30) carrying it into the overhead resistance zone between 2750 and 2760. That occurred on Friday, February 16, when on CNBC we said, “We doubt that the SPX can traverse the 2750 – 2760 resistance zone on the first attempt and we would be cautious on a very short-term trading basis.” To be sure, a pullback to the 2680 – 2700 support zone would be picture-perfect; and, that is precisely what happened. So what now?

Well, we are now involved in the SPX’s second attempt to surmount the 2750 – 2760 overhead resistance level. Of interest is that last Friday’s Fling stopped exactly where last Wednesday’s attempt petered-out at 2747.76. Also worth mentioning is that on the SPX’s first attempt, which was on Friday 2-16-18, the stock market’s internal energy was totally used up, which is not the case now. So the equity markets have given participants three chances to buy stocks on the downside. The first was at the selling climax lows of 2-6-18. Then again on the undercut lows of 2-9-18 and once again on the pullback to the 2680 – 2700 level that occurred on 2-20-18 and 2-23-18. Keep in mind that many stocks bottomed before the indices did. So, “Do you have the mental fortitude to accept huge gains?” then you have to grab a board and get into the water! As Bob Prechter states:

The big moves in markets only come once or twice a year. Those are the ones which will pay you for all the work, fear, sweat, and aggravation of the previous years. Don’t miss them for reasons other than those required by your objectively defined method. The IRS categorizes capital gains as “unearned income,” that’s baloney. It’s hard to make money in the market. Every time you make, you richly deserve. Don’t ever forget that.

Then you have to have the mental fortitude to stay the course and allow yourself to accept larger gains than you think you are entitled to. Again as Bob Prechter states:

So what was your problem? Simply that you had allowed yourself, unconsciously, to define your “normal” range of profit and loss. When the big trade finally came along, you lacked the self-esteem to take all it promised—who were you to shoot for such huge gains?

Two years ago the best idea we heard at the March Raymond James Annual Institutional conference, which was covered by our fundamental research analysts with a favorable rating, was Shopify (SHOP/$137.00/Outperform). At the time the shares were changing hands around $23. They now trade at $137, talk about huge gains! Over the two year period ending 2-23-18, the S&P returned 17%. Last year the best idea we heard at the conference was Flexion Therapeutics (FLXN/$25.26/Strong Buy) with the shares trading around $20 per share (the S&P 500 returned 18% over the 12 month period ending 2-23-2018). Obviously, FLXN has not done nearly as well as Shopify, but we remain hopeful. This year’s Raymond James 39th Annual Institutional Investors conference begins on March 4 and we will once again mention the best ideas we hear there in these missives.

The call for this week: Like Bob Prechter, Warren Buffett says, “One or two good ideas a year are all you need.” At this year’s shareholders meeting Buffett had this quip in Berkshire’s shareholder letter (The Letter):

The bet illuminated another important investment lesson: Though markets are generally rational, they occasionally do crazy things. Seizing the opportunities then offered does not require great intelligence, a degree in economics or a familiarity with Wall Street jargon such as alpha and beta. What investors then need instead is an ability to both disregard mob fears or enthusiasms and to focus on a few simple fundamentals. A willingness to look unimaginative for a sustained period – or even to look foolish – is also essential.

And then there was this from SentimenTrader’s Jason Goepfert:

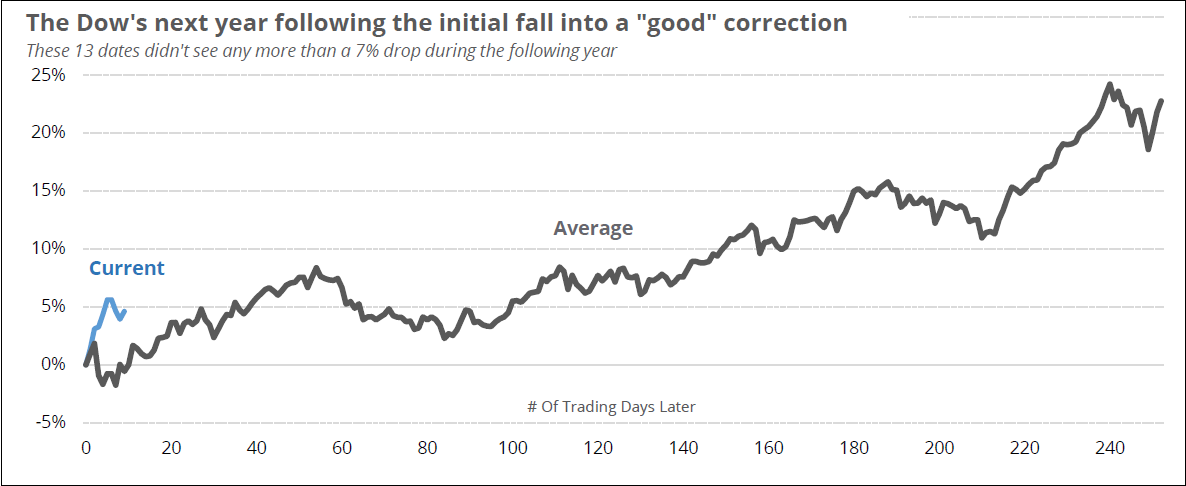

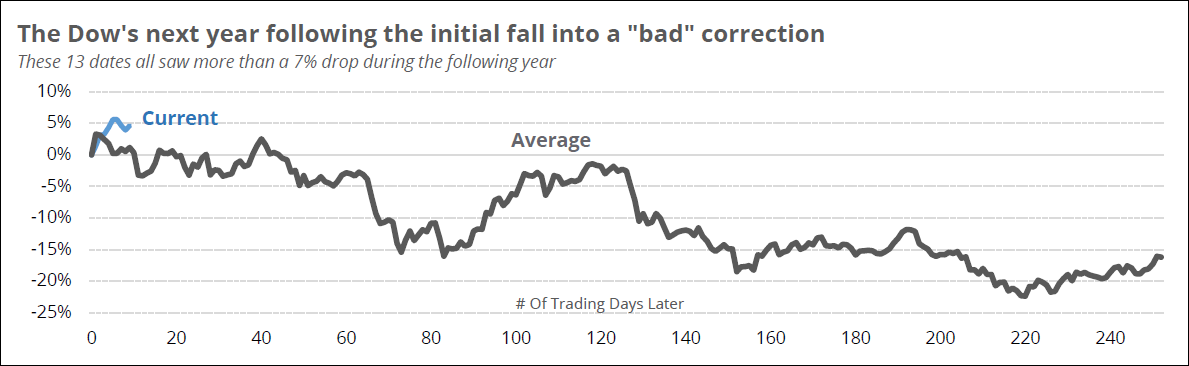

Good versus bad correction. In these first two weeks following the Dow’s drop into a correction, it has followed the path of many “good” corrections. Those are times when the Dow fell 10% from a high, then no more than a further 7% during the next year. “Bad” corrections usually saw immediate further selling pressure and lost an average of another -16% at some point (see Charts 1 and 2).

This morning the S&P 500 preopening futures are better by some 10-points as we write at 5:13 a.m. with participants giddy with Friday’s Fling believing that Fed head Powell’s speech tomorrow will be Street friendly.

The returns quoted for SHOP and FLXN do not include transaction costs and tax considerations. If included these costs would reduce an investor’s return. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the securities in this list. A complete record of our stock recommendations for the trailing 12 months is available upon request.