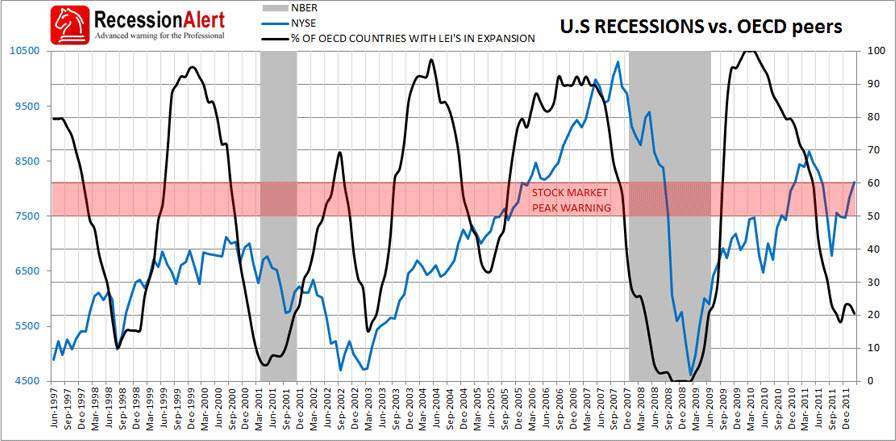

With many parts of the Euro-zone entering or already in recession, and the OECD recently putting Australia, Germany and Italy into recession, one has to wonder if the feeble U.S. recovery can skirt a global recession. Many mainstream pundits have been pointing to countries around the globe slipping into recession as a reason why a U.S. recession in the near future is a done deal. But this is not necessarily the case. The chart below shows which percentage of the 39 OECD countries across the world have their Leading Economic Indicators (LEI’s) in expansion. We used the 12-month rate of change of the amplitude adjusted LEI’s to determine expansion or recession. (Click image for larger view)

It is clear that there can be some severe stress in the 39 OECD countries without the US falling into a NBER classified recession. In July 1998, only 10% of the OECD country group was in “expansion”. There was a sympathy sell-off from the U.S. stock market, but no U.S. recession. In March 2003, just 15% of the OECD group was in expansion – again, a U.S. stock market sympathy sell-off but no official recession. In June 2005, just 32% of the OECD group was in expansion – there was a tiny U.S. stock market sell-off but no recession.

With less than 50% of countries in expansion, one could argue this would be a good definition of a “global recession.” In fact it would appear when the index of percentage of OECD countries in expansion falls below the 50-60% mark it is a good warning for a U.S. stock market peak, but there is no threshold above 10% which guarantees U.S recession.

You can see that from June 2011 the index dropped below the red warning zone and a stock market correction ensued in sympathy. In October 2011 the index bottomed with just 18% of OECD countries in expansion (according to the 12-month growth rates of their OECD LEI’s). The stock market bottomed slightly before this.

We only went back to June 1996 as this is the farthest back we could go for which we have OECD LEI data for all 39 countries, but we plan to repeat this research going back 3 or 4 more business cycles with a smaller set of OECD countries to see if the theories hold, and publish the research for our subscribers.

The next few months behavior of this index will be interesting to watch but we can make one observation about the current levels and that is it is not indicative of a pending stock market correction or peak. If anything, if the index starts pointing upwards, this will signal continued U.S. stock market gains.

Source: Recession Alert